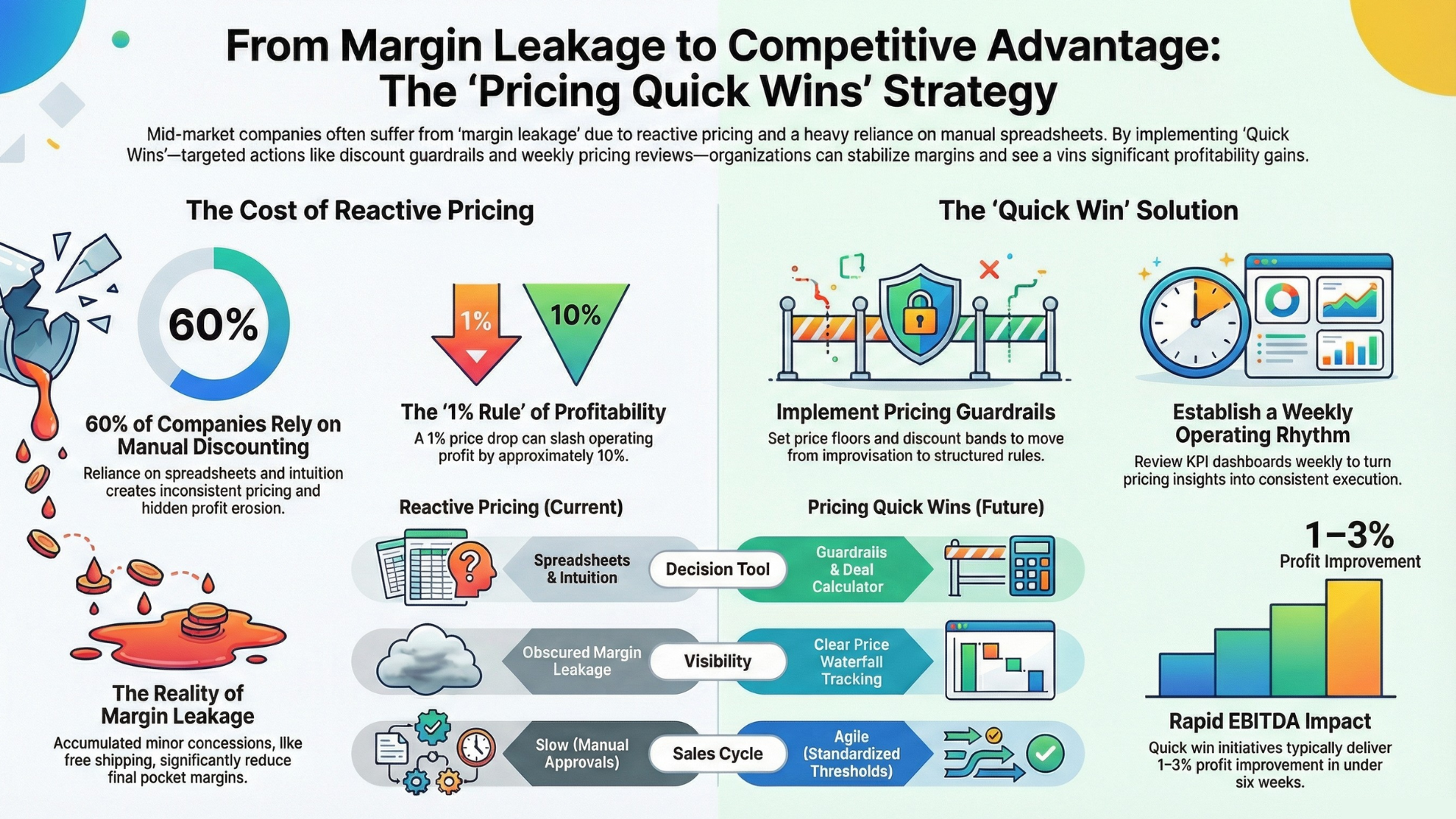

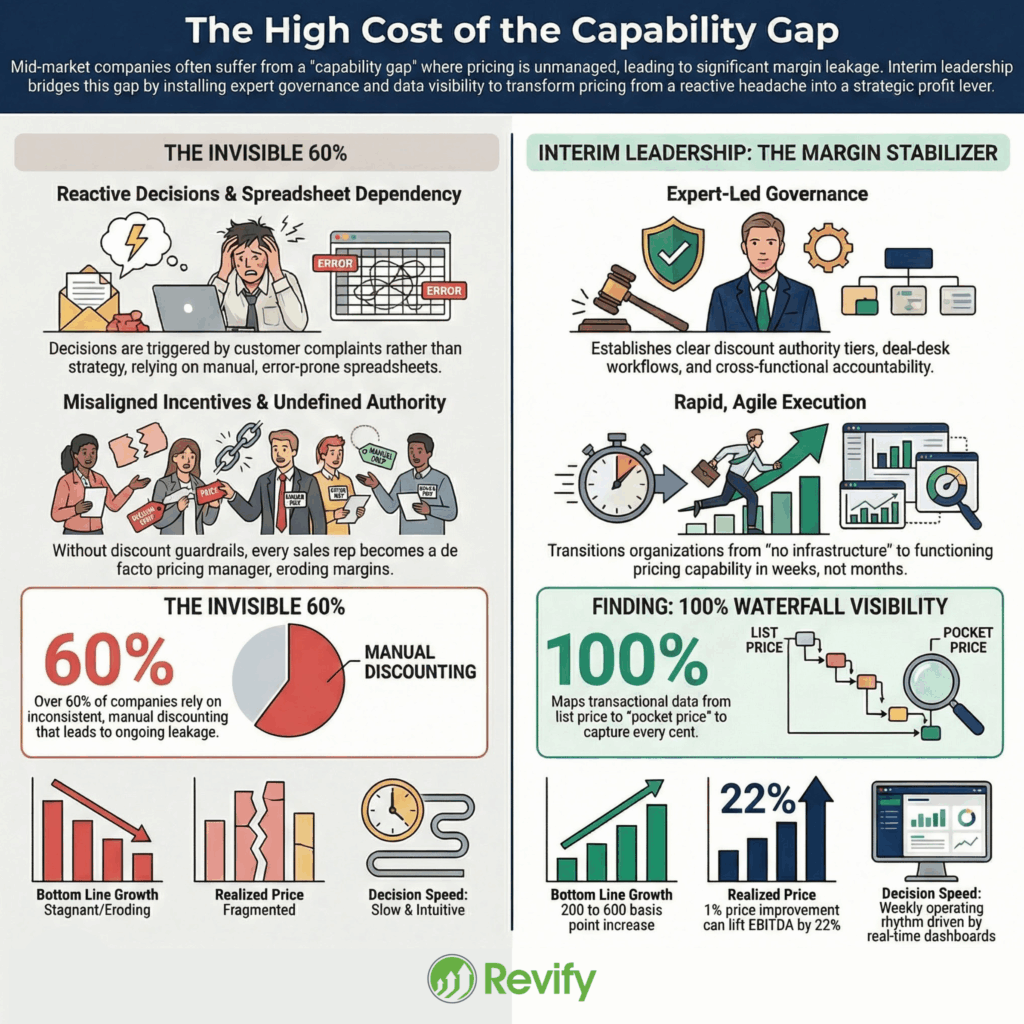

There are a large number of mid-market manufacturers and distributors caught between no pricing infrastructure and a fully effective one. They know there is a missed opportunity, while margins erode, discounts accumulate without clear rationale, and price increases are announced but not realized. Although data exists in ERP exports and spreadsheets, it is not being used to inform decisions.

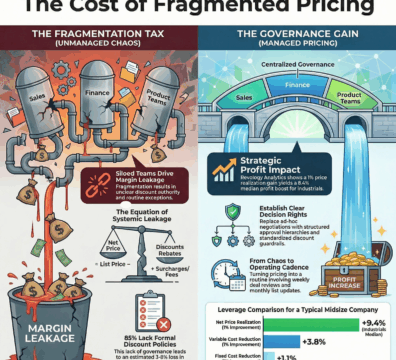

The main challenge is a capability gap, not a lack of data or intent. Many organizations lack pricing infrastructure—governance, waterfall visibility, and systematic price management. In some cases, infrastructure exists only on paper and delivers minimal results.

Interim pricing leadership bridges this gap by providing experienced practitioners on a defined, time-bound basis. They quantify the pricing opportunity, identify gaps in people, process, and technology, and accelerate the shift to effective price management. This is an expert-led engagement focused on building lasting capability, not a staffing service.

The Capability Gap: No Owner, No Process, No Visibility

More than 75 percent of industrial firms lack a dedicated pricing team, formal process, or clear decision rights. Pricing often falls between Sales, Finance, and Operations—nominally owned by all, but managed by none. The consequences are predictable:

• Pricing decisions are reactive, triggered by customer complaints or competitor moves rather than by data and strategy.

• Spreadsheets serve as the primary pricing tool—manual, error-prone, and incapable of delivering a real-time view of net price realization by customer, product, or region.

• Discount authority is undefined. Without guardrails, every sales rep becomes a de facto pricing manager—and discounting becomes the path of least resistance.

• Price increases are infrequent and blunt: applied as flat-rate adjustments regardless of product value or customer willingness to pay.

• No one tracks the full price waterfall. Revify’s 2025 Revenue Growth Analytics Maturity research found that roughly 50 percent of organizations do not use a price waterfall at all.

Interim pricing leadership closes the gap between recognizing a pricing problem and having the expertise and infrastructure to address it.

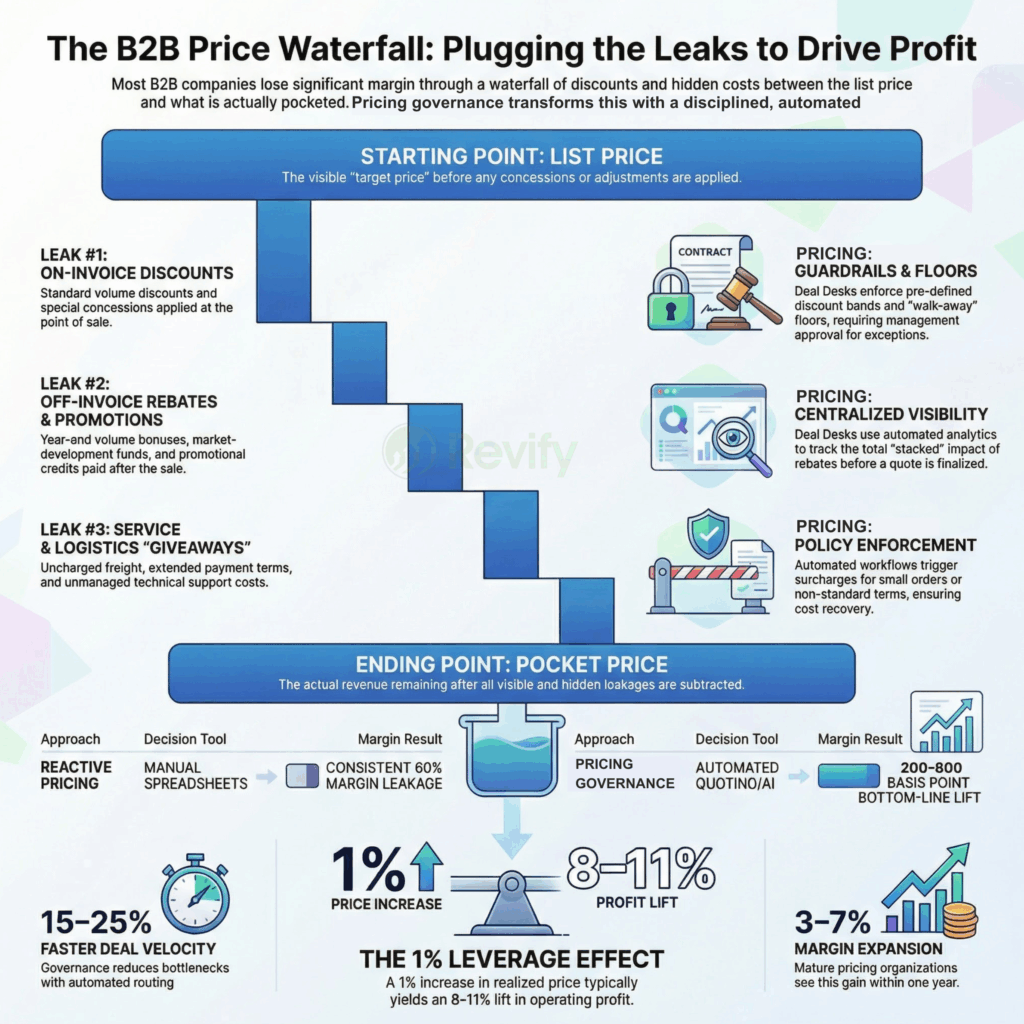

What the Pricing Capabilities Gap Costs You

McKinsey’s research on global distributors found that a 1 percent improvement in realized price yields as much as 22 percent increase in EBITDA margins. To achieve the same impact through volume alone, a distributor would need to grow nearly 6 percent. The classic McKinsey pocket-price-waterfall case studies show the scale of hidden leakage: in one lighting manufacturer, the pocket price was roughly half the list price after stacked discounts and off-invoice deductions. After implementing structured pricing management, operating profits grew 51 percent within one year.

Bain research across 1,700 B2B companies confirms that building pricing capabilities adds 200 to 600 basis points to the bottom line. KPMG found that pricing-mature firms enjoy EBITDA margins 3 to 8 percentage points higher than peers. The common thread: these gains require a dedicated pricing capability, not a one-time project or a better spreadsheet.

For a deeper look at margin erosion, see Making Better Pricing Decisions with Imperfect Data.

What Changes When You Build Pricing Capability

Interim pricing leadership addresses the root cause: missing capability. Effective pricing requires three interdependent layers, which most mid-market companies lack.

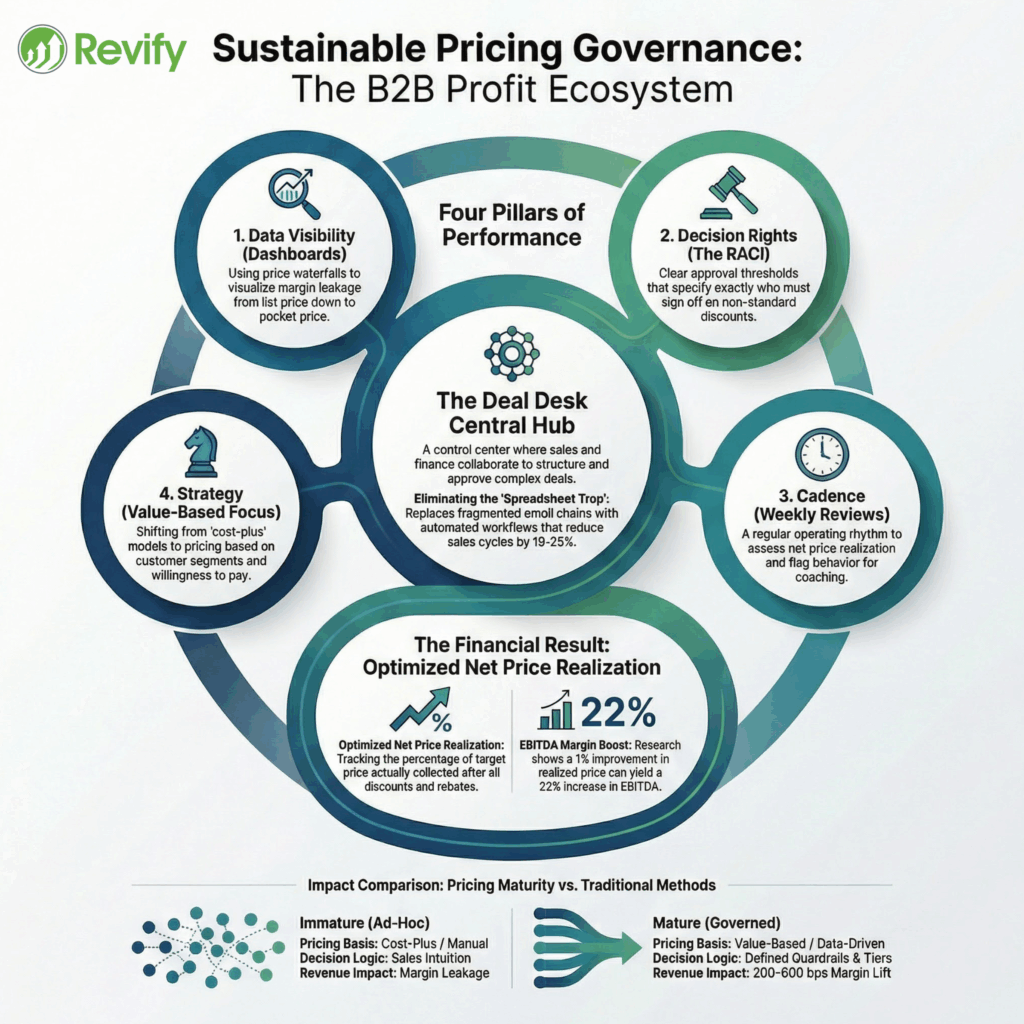

Governance: Decision Rights, Discount Policy, and Accountability

Pricing governance is the structured framework that determines who can make pricing decisions, under what rules, and with what oversight. It includes:

Decision rights. A clear RACI that specifies who approves what level of discount, when exceptions escalate, and who resolves disputes.

Discount policy. Defined discount bands, approval thresholds, and exception-handling rules. BCG research shows that companies with formal exception processes maintain 12 percent better price realization.

Deal desk and approval workflow. A mechanism that routes non-standard deals through pricing review before commitment—preventing the one-at-a-time margin erosion that compounds over thousands of transactions.

Visibility: The Price Waterfall and Margin Analytics

You cannot manage what you cannot see. A price waterfall maps the path from list price through on-invoice discounts, off-invoice deductions, rebates, and customer-specific costs down to the pocket price you actually collect. Most mid-market companies have never built one. Revify’s 2025 research found that 61 percent of organizations still manage deal pricing manually and over 75 percent rely on cost-plus or competitive benchmarks alone.

Waterfall visibility makes margin leakage measurable and actionable. Without it, pricing improvements are based on guesswork.

Operating Rhythm: Weekly governance and visibility are essential, but an effective operating rhythm is also required. Regular review and action on pricing decisions turn policy into practice. An effective cadence includes:

• Reviewing net price realization against targets by customer segment and product line

• Prioritizing the next wave of price actions (increases, renegotiations, contract renewals)

• Monitoring discount compliance and flagging exceptions for coaching or policy adjustment

• Coordinating with Sales on deal guidance and customer-facing pricing communications

• Reporting margin performance to leadership with actionable next steps

This cross-functional rhythm aligns Sales, Finance, and Operations around shared pricing KPIs. It moves organizations from simply measuring margin to actively improving it.

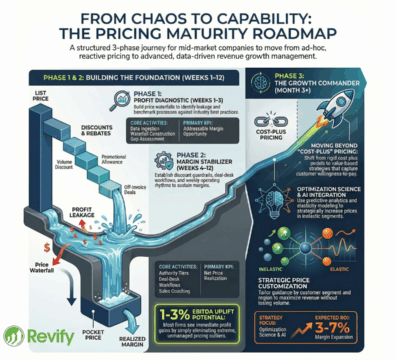

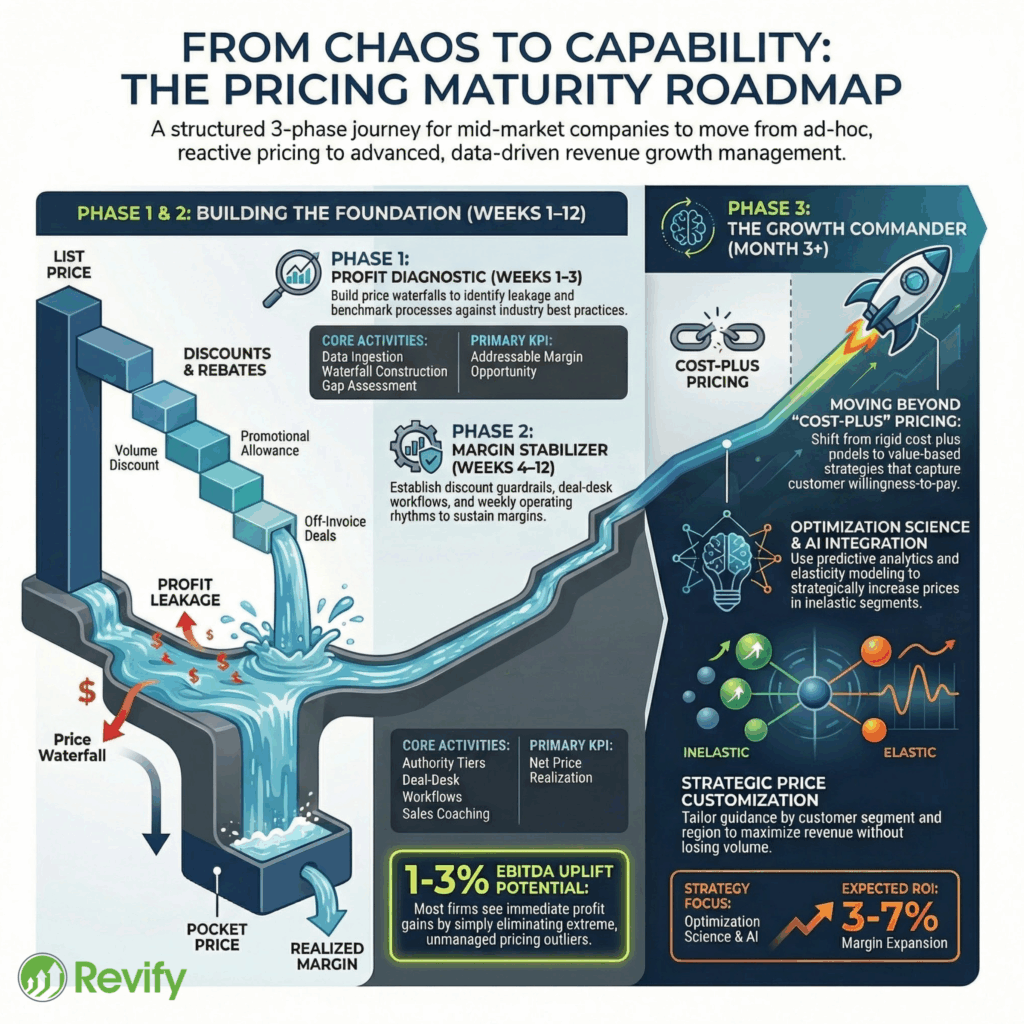

How Revify’s Pricing Maturity Journey Accelerates Capability

Revify Analytics helps mid-market organizations move from no pricing infrastructure—or an ineffective one—to a functioning pricing capability, faster than they could build it on their own. The approach follows a structured maturity journey with three phases, each building on the previous one.

Phase 1: Profit Diagnostic — (Quantify the Opportunity). Thorough diagnosis is essential before implementing solutions. The Profit Diagnostic is a rapid, data-driven assessment that determines the size of the pricing opportunity and identifies what is needed to capture it.

Using invoice-level transactional data—price, quantity, customer, product, cost, discounts, rebates—Revify constructs a price waterfall and maps where margin is leaking. The deliverable is a Pricing Blueprint: a prioritized view of your largest profit opportunities, the infrastructure gaps (governance, tools, process) standing in the way, and a recommended action sequence.

Typical Profit Diagnostic outputs:

• A full price waterfall from list price to pocket margin, with leakage quantified at each stage

• Segmented margin analysis by customer, product, channel, and region

• Discount outlier identification and pricing inconsistency mapping

• A “size of the prize” estimate: what margin improvement is realistically available

• A gap assessment: what governance, process, and technology the organization needs to capture it

The Profit Diagnostic is the mandatory entry point because it grounds every subsequent action in evidence. For more on budgeting for a high-impact pricing initiative, see the linked guide.

Phase 2: Margin Stabilizer — (Install the Missing Infrastructure). In the Margin Stabilizer phase, your organization begins to operate differently. Based on the Blueprint, Revify’s experts collaborate with your team to establish or improve pricing infrastructure.

Margin Stabilizer activities typically include:

• Designing and implementing discount authority tiers and deal-desk approval workflows

• Launching targeted price actions on the highest-opportunity segments identified in the Diagnostic

• Building price guidance for the sales team—replacing gut-based pricing with data-informed deal support

• Standing up compliance tracking: net price realization dashboards, discount variance reporting, and price-increase capture rates

• Establishing the weekly pricing governance cadence with Sales, Finance, and Operations

• Coaching commercial teams on pricing behaviors, value communication, and objection handling

The critical distinction: Revify does not hand off recommendations and leave. The team stays engaged through implementation and adoption—the phase where most pricing initiatives stall. Bain documented that when one manufacturer designated accountable pricing leadership, the company achieved EBITDA improvement of 7 percentage points. The pattern repeats: capability building, not strategy advice alone, is what moves the needle.

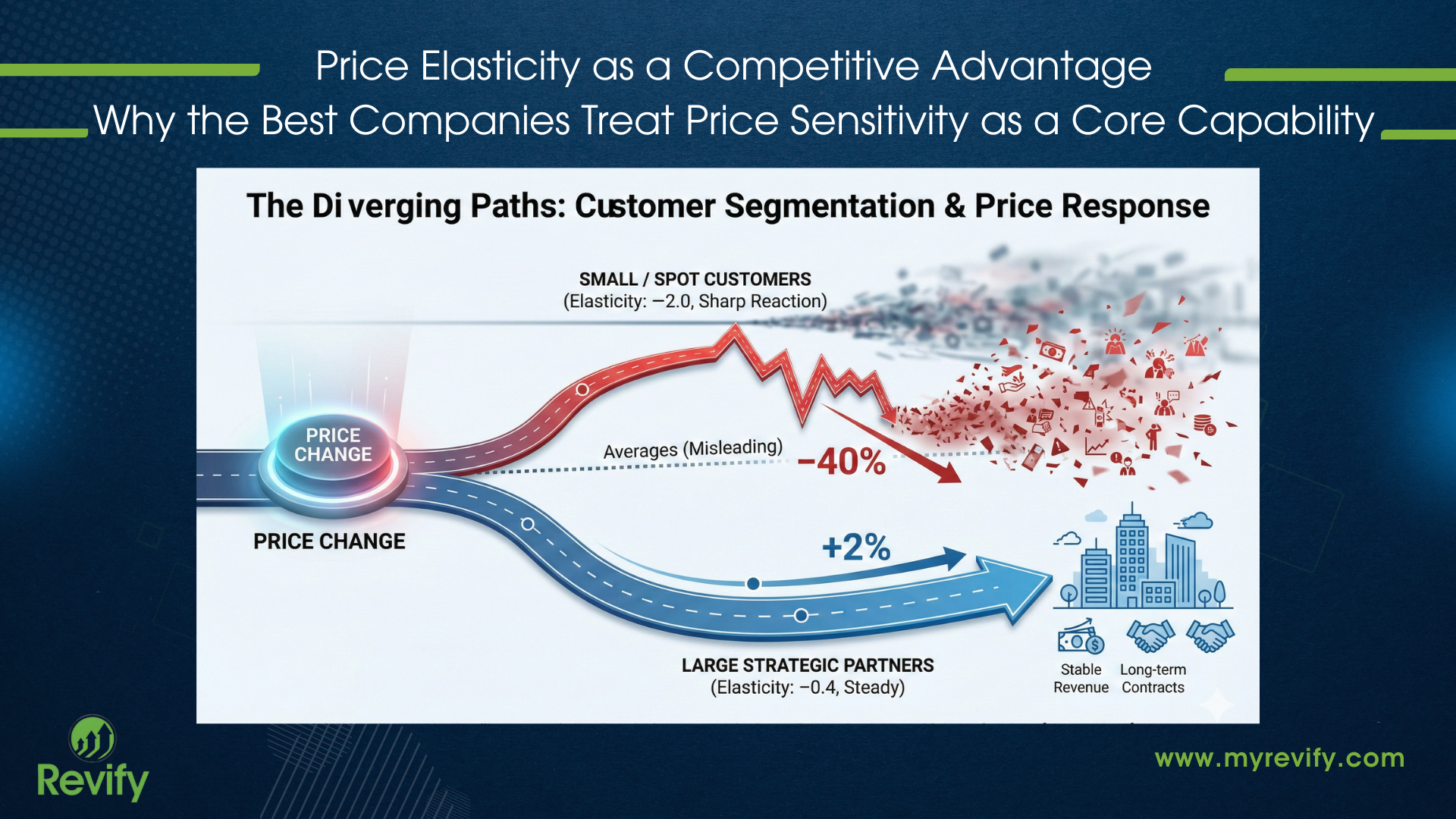

Phase 3: Growth Commander — Layer In Optimization Science. After stabilizing margins and embedding governance, the Growth Commander phase introduces advanced analytics such as price elasticity modeling, customer segmentation, predictive churn prevention, and scenario-based pricing simulations. This shifts the organization from reactive margin defense to proactive revenue growth management.

At this stage, AI-driven pricing becomes practical for mid-market companies, serving as an extension of the governance and operating rhythm established in earlier phases, rather than as a separate technology initiative.

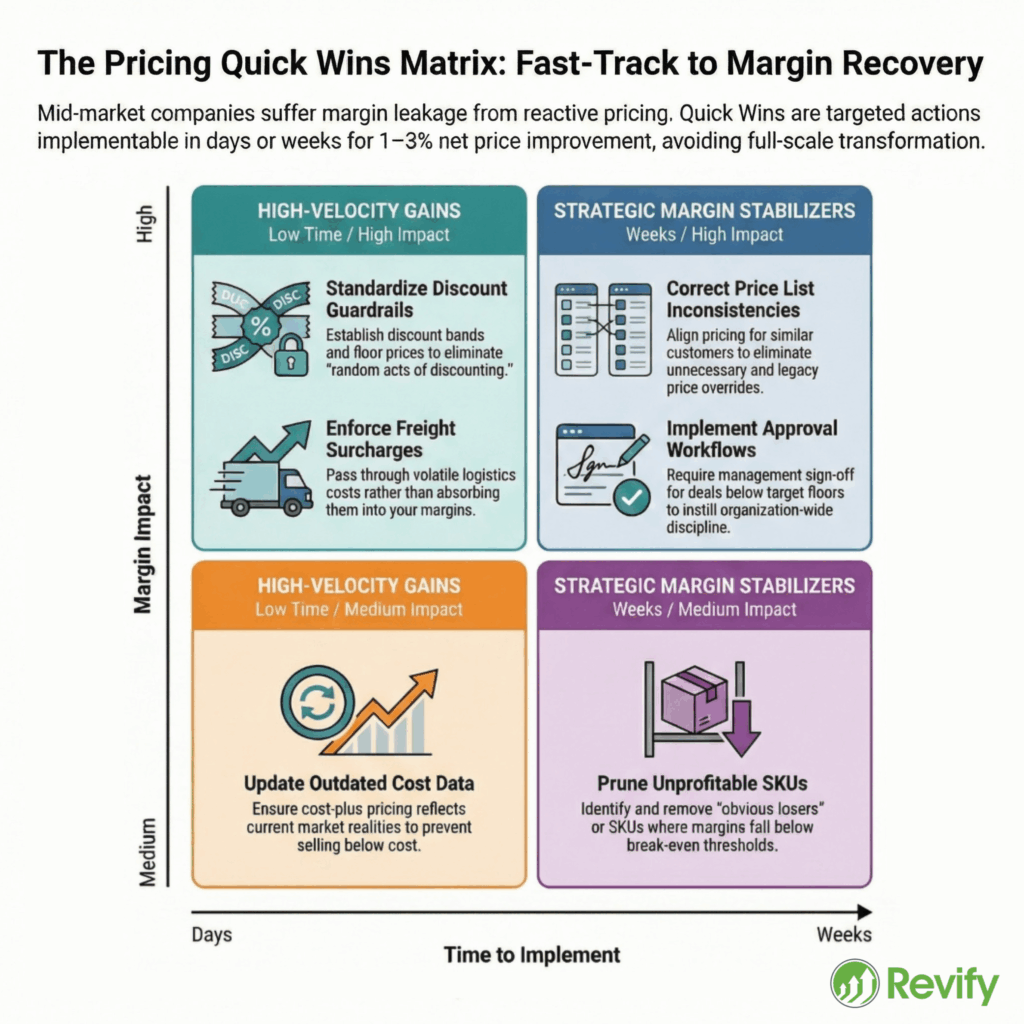

Quick Wins and Timeline to Impact

What You Can Improve in Weeks, Not Months

Many believe pricing results take six to twelve months. With thorough diagnostics and the right expertise, significant improvements can be achieved in weeks:

• Weeks 1–2: Data ingestion, price waterfall construction, identification of the largest margin leakage points, and discount anomalies.

• Weeks 3–4: First governance structures defined. Targeted price actions launched on the highest-opportunity segments.

• Weeks 5–8: Price guidance deployed to Sales. Compliance tracking is live. First measurable improvement in net price realization.

• Months 3–6: Governance cadence embedded. Price-increase capture tracked. EBITDA impact quantified and reported to leadership.

McKinsey confirms that pricing transformations deliver initial benefits within 3 to 6 months. Blue Ridge Partners reports that correcting mispriced accounts yields a 1–2 percent revenue increase within a single quarter.

Typical KPIs: Price Realization, Discount Compliance, EBITDA Lift

Net Price Realization (%). Calculated as (Actual Net Price ÷ Target Net Price) × 100. The single most important pricing health metric—it measures how much of your intended price you actually collect.

Discount Compliance (%). Share of revenue transacted within approved discount policy. Rising compliance signals that governance is working.

Price Increase Capture (%). (Realized Increase $ ÷ Expected Increase $) × 100. Industry research found that only 7 percent of industrial companies achieve 80 percent or more realization on intended increases.

Gross Margin ($ and %). The lagging indicators that confirm whether pricing actions translate to bottom-line improvement.

EBITDA Lift. For mid-market manufacturers and distributors, a 1 percent improvement in net price realization commonly translates to an 8–11 percent lift in operating profit.

For context on how tariff environments affect pricing strategy, see the linked article.

Worked Example: A Distributor Builds Pricing Capability in 90 Days

Scenario: A $200 MM industrial distributor with no dedicated pricing function. Margin has eroded for three consecutive years. Sales reps discount freely. Price increases are applied annually as a flat percentage and poorly tracked.

Step 1: Profit Diagnostic (Weeks 1–3). Revify ingests 24 months of invoice-level data and builds a price waterfall. The analysis reveals on-invoice discounts averaging 28 percent off list, with off-invoice deductions adding another 9 points. Three product categories account for 60 percent of total margin leakage. The Pricing Blueprint identifies $3.2 MM in addressable margin opportunity and maps the governance, process, and tool gaps standing in the way.

Step 2: Infrastructure Installation (Weeks 3–6). Working with the distributor’s Sales and Finance leaders, Revify designs three discount authority tiers, implements a deal-desk workflow for exceptions, and creates a price-action backlog prioritized by margin impact.

Step 3: Price Actions and Guidance (Weeks 4–8). Targeted increases launch on underpriced segments. Price guidance is deployed to Sales with floor prices and recommended ranges. Commercial teams receive coaching on value communication.

Step 4: Cadence and Measurement (Ongoing). Net price realization and discount compliance dashboards go live. A weekly governance meeting tracks realization against targets. Within 90 days, the distributor has a functioning pricing capability where none existed—and measurable margin improvement to show for it.

Getting Started

Start Your Profit Diagnostic

Revify Analytics delivers interim pricing leadership as a People + Process + Platform partnership for mid-market manufacturers and distributors. The engagement begins with a Profit Diagnostic: a rapid assessment that quantifies your pricing opportunity and identifies the infrastructure, governance, and capabilities your organization needs to capture it.

The Profit Diagnostic covers:

• Full price waterfall construction with leakage quantified at each stage

• Segmented margin analysis across customers, products, channels, and regions

• Discount and rebate analysis with outlier identification

• A prioritized pricing action backlog with estimated margin impact

• Governance, process, and technology gap assessment with recommendations

From there, Revify’s experts stay engaged through the Margin Stabilizer phase (governance installation and execution) and Growth Commander (optimization science)—accelerating your organization’s shift toward effective, self-sustaining price management.

Revify’s platform aims for go-live within one to two weeks, compared to six to twelve months for enterprise competitors. Each engagement includes expert RGM consulting, providing both analytical infrastructure and practitioner expertise.

For transparent pricing and engagement details, visit the Pricing & Details page.

Frequently Asked Questions

What is interim pricing leadership?

Interim pricing leadership is a time-bound, expert-led engagement that bridges the gap between having no pricing capability (or an ineffective one) and operating with the governance, analytics, and discipline needed to manage price effectively. It is not a staffing service—it is a structured partnership that quantifies the opportunity, installs missing infrastructure, and accelerates the organization’s shift to effective price management.

Who typically needs interim pricing leadership?

Mid-market manufacturers and distributors ($10 MM–$1 B revenue) with margin leakage, no dedicated pricing function, inconsistent discounting, or a gap between having data and acting on it. It also fits companies with an immature or underperforming pricing process that needs expert-led acceleration.

How is interim pricing leadership different from pricing consulting?

Traditional consulting delivers recommendations—the strategy deck. Interim pricing leadership stays engaged through implementation and adoption: governance design, price-action execution, sales enablement, compliance tracking, and capability transfer. The goal is a functioning pricing capability, not a report.

How quickly can interim pricing leadership make an impact?

The Profit Diagnostic typically surfaces pricing outliers and the first targeted opportunities within weeks. Measurable net price realization improvement follows within two to three months once governance and price actions are in place.

What does the engagement look like week to week?

It depends on the phase. During the Diagnostic, the focus is data analysis and waterfall construction. During Margin Stabilizer, the work shifts to governance installation, price-action execution, compliance monitoring, sales coaching, and weekly performance reviews with your leadership team.

What deliverables should we expect?

A Pricing Blueprint (opportunity map and gap assessment), price waterfall with margin visibility, discount and governance policies, a price-action backlog, compliance dashboards, and a defined operating cadence. The specifics depend on what your organization needs most.

How long does an interim pricing leadership engagement last?

Long enough to build real capability. The Profit Diagnostic takes a few weeks (typically less than three). Margin stabilization and governance installation typically take a few months. Companies that want continued support for optimization and advanced analytics extend into the Growth Commander phase. The right duration depends on where you start and how self-sufficient you want to become.

Does this replace hiring a pricing manager?

It can bridge the gap while you recruit, or it can provide the expert guidance your team needs without the overhead of a full-time senior pricing hire. BCG recommends that even companies under $500 MM maintain at least five full-time pricing staff—a benchmark most mid-market firms do not meet. Revify fills this expertise gap.

What data is required to start?

At minimum: invoice-level sales data (price, quantity, customer, item), costs, discounts, rebates, and customer/item attributes. Imperfect data is expected and workable—the Profit Diagnostic is designed to identify gaps and prioritize actions even with incomplete information.

How do we measure success?

Net price realization, margin dollars, discount compliance, price-increase capture rate, and adoption metrics (exception rates, adherence to guidance). These KPIs are reviewed weekly in the governance cadence and reported monthly to leadership.