Your business is growing, but the growth feels linear, hard-won, and expensive. You are fighting for every new logo while a vast, untapped reservoir of profit sits dormant within your existing customer base. This isn’t a symptom of market saturation or a weak sales team; it’s a strategic blind spot. The most sophisticated commercial leaders today are focused on a critical, often-overlooked metric: the Adjacency Gap. This is the measurable gulf between the products a customer currently buys and the full suite of solutions they inevitably need and are, in all likelihood, purchasing from your competitors.

Let’s be frank: what leaders often misdiagnose as a pricing or acquisition problem is fundamentally an analytics and intelligence failure. According to The 2025 Revology Analytics Maturity Report, a staggering 68% of B2B companies concede they have no formal, data-driven process for identifying cross-sell opportunities. They are effectively allowing their competitors to nurture their most valuable accounts. Closing this gap represents a paradigm shift—from a high-effort, hunter-gatherer sales model to a strategic, high-efficiency farming approach that systematically cultivates deeper, more profitable relationships.

The Compounding Cost of Commercial Inertia

Flying blind is no longer a viable strategy; leaving your cross-sell strategy to anecdotal “gut feelings” allows between 5-15% of your rightful revenue to evaporate annually. But the true cost transcends that top-line number, permeating every facet of your commercial operation.

This inertia creates a fertile ground for your competitors. Every unmet customer need is not just a lost sale—it’s a beachhead for a rival to land, establish trust, and begin a systematic campaign to capture a greater share of wallet. This dynamic is a leading indicator of future churn, transforming your most valuable asset—your customer list—into a competitor’s prospect list. It also forces your sales team into a reactive, defensive posture. Lacking the data to architect value-added solutions, they default to discounting as their primary growth lever, compressing margins and training customers to devalue your partnership. This isn’t a sales team failure; it is a systemic failure to equip them with the intelligence they need to win.

Industry Spotlight: Where the Adjacency Gap Is an Existential Threat

While this strategic gap is universal, its impact is uniquely acute and existential for asset-heavy B2B sectors.

- For Industrial Distributors: The core challenge extends beyond simply leaving money on the table; it’s about the misallocation of your greatest asset: your sales force. Distributors are masters of complexity, managing thousands of SKUs and intricate pricing agreements. Yet, without a clear view of adjacency opportunities, sales teams often invest disproportionate effort servicing low-margin, high-transaction accounts. They fulfill the orders for fasteners and basic supplies while completely missing the opportunity to sell high-margin, consultative products like specialized safety equipment or automation components. This is a critical failure to leverage their intrinsic product knowledge to climb the value chain within an account.

- For Manufacturers: The Adjacency Gap represents a failure to monetize the installed base. The initial sale of capital equipment is merely the opening act. The long-term, high-margin profit resides in the predictable stream of consumables, replacement parts, service contracts, and digital upgrades. The 2025 Revology Analytics Maturity Report found a damning statistic: 75% of manufacturers lack the analytical tools to accurately forecast and drive follow-on purchases. This transactional myopia makes them intensely vulnerable to third-party and offshore competitors who specialize in servicing that lucrative aftermarket, effectively stealing the most profitable part of the customer lifecycle.

Deconstructing the Gap: The Science of What’s Next

To architect a solution, leaders must first grasp the science behind the problem. The Adjacency Gap is closed by a fundamental shift in commercial perspective: from being product-centric to being customer-need-centric. This shift is powered by product affinity analysis, a data science discipline also known as market basket analysis. It moves beyond simplistic sales reporting to illuminate the complex, often non-obvious relationships between products based on immutable purchasing behaviors.

A sophisticated analysis doesn’t just tell you what was bought together. It reveals deeper patterns crucial for a proactive sales enablement strategy:

- Sequential Patterns: Customers who buy Product A have an 80% probability of buying Product B within the next 90 days. This insight transforms a sales call from a random check-in to a perfectly timed, needs-based consultation.

- Lead-In Products: The purchase of a specific, often low-cost item is a powerful leading indicator for a future major purchase, acting as a tripwire for strategic engagement.

- Category Affinities: Entire categories of products are linked. A customer buying heavily from your “industrial adhesives” category but never from “surface preparation” represents a clear, quantifiable opportunity and a competitive vulnerability.

Attempting to unearth these patterns in spreadsheets is an exercise in analytical archaeology—sifting through millions of transactional fossils with blunt tools, only to arrive at conclusions that are months out of date. To operate at the speed of the market, you require a living, intelligent system.

Revify: Your Engine for Predictive Commerce

A genuine commercial transformation requires more than a dashboard; it requires an engine. Revify’s RGM-as-a-Service (RGMaaS) platform is designed to be the central nervous system for your commercial operations, transforming raw data into predictive intelligence. Our Product Affinity & Elasticity module isn’t just a feature; it is a capability enabler that makes sophisticated data science accessible and actionable.

- Visualizing the Entire Purchase Journey: We move beyond isolated transactions to map the entire customer lifecycle. Our automated market basket analysis uncovers the non-obvious product relationships and sequential buying patterns that represent your most profitable growth corridors.

- Transforming Data into Prioritized Action: We don’t just show you that “buyers of SKU A also buy SKU B.” Our platform segments your customer base to identify precisely which high-value accounts are exhibiting this gap, creating a surgically precise, prioritized list of sales opportunities with the highest propensity to close.

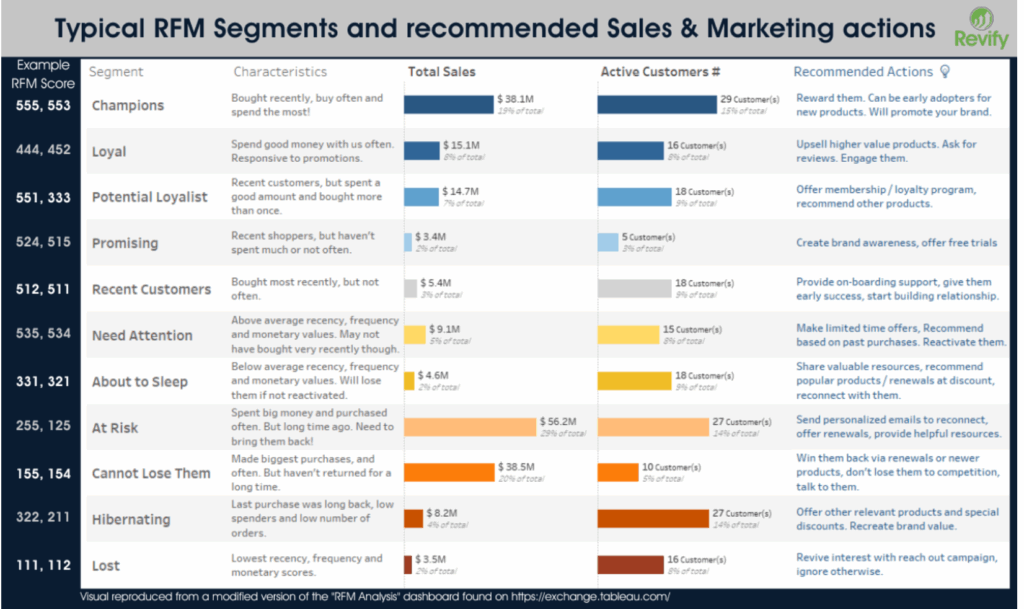

Before we can effectively close the ‘Adjacency Gap,’ we must first understand which customers offer the most profitable opportunity. This RFM (Recency, Frequency, Monetary) analysis table is a foundational tool that segments the entire customer base into actionable tiers.

It allows us to surgically distinguish our high-value ‘Champions’—who are prime candidates for new cross-sell initiatives—from our ‘At Risk’ customers who may require a different, more defensive strategy. By applying Product Affinity Analysis specifically to these ‘Champion’ segments, we focus our most powerful analytics where they will generate the highest return, ensuring our efforts are precise, targeted, and effective.

Embedding Intelligence into the Workflow: The ultimate goal is to arm your sales team with irrefutable, data-backed intelligence. The insights from Revify generate concrete “Sales Plays,” turning every CRM notification into a strategic directive and every customer conversation into a value-building opportunity.

The Proactive Growth Framework: From Signal to Strategic Action

This framework translates analytical signals into decisive, value-adding commercial plays. It is a blueprint for how a platform like Revify moves your team from reacting to customer requests to proactively architecting customer success.

| Affinity Signal | The Diagnosis (What This Really Means) | Strategic Goal | Key Metrics (KPIs) | The Executive-Level Sales Playbook |

|---|---|---|---|---|

| High-Propensity Pairing Detected | The customer has a confirmed need they are likely filling elsewhere. This is an active revenue leak. | Immediate Wallet Share Expansion |

|

|

| Category “Whitespace” identified | A strategically important customer has a critical gap in their purchasing, signaling a strong competitor presence. | Strategic Account Fortification & Competitive Displacement |

|

|

| Single Product Line Onboarding | A new customer is “testing the waters,” indicating they are actively multi-sourcing and hedging against incumbents. | Accelerate Trust & Establish Incumbency |

|

|

| Declining Purchase Breadth | An established customer is slowly and silently migrating their spend to a competitor. This is a quiet form of churn. | Proactive Churn Reversal & Root Cause Analysis |

|

|

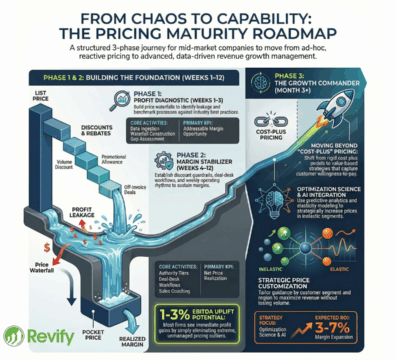

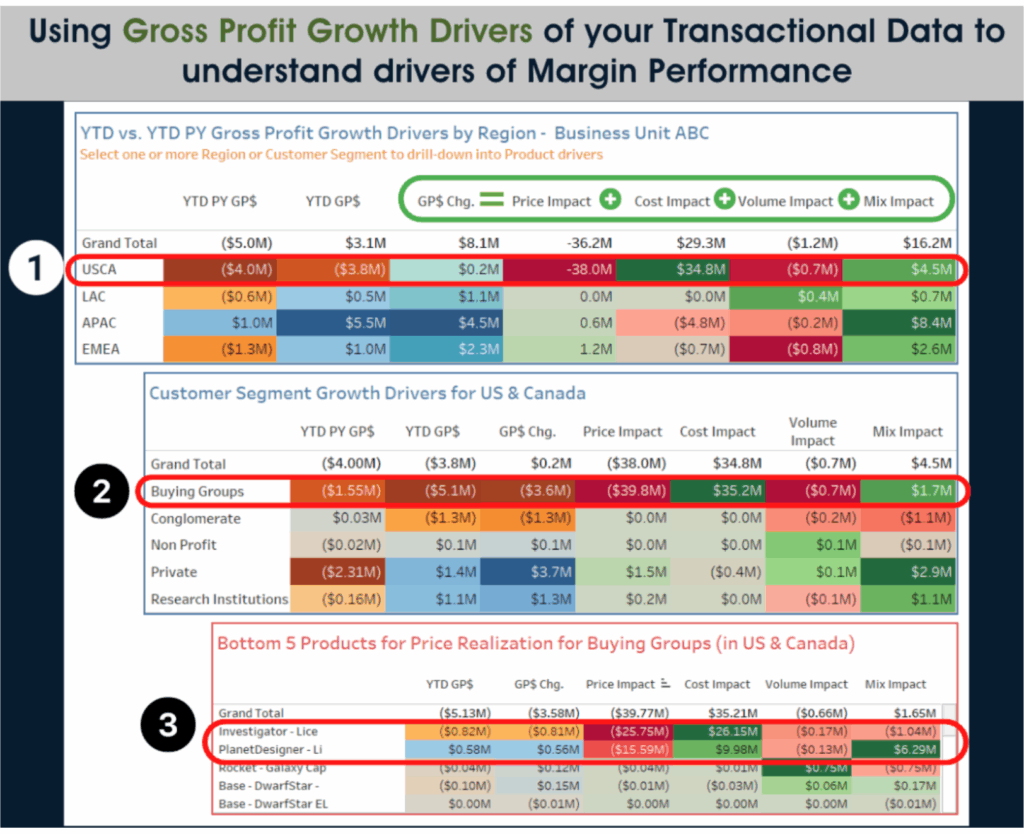

This profitability waterfall chart visualizes the core drivers that bridge last year’s revenue to this year’s. While product affinity analysis tells us what to cross-sell, this framework shows why it’s so profitable. The final and most critical driver, labeled ‘Mix,’ represents the financial impact of selling a more strategic combination of products.

By using affinity analysis to close a ‘Category Whitespace’ with a higher-margin item, you are actively improving your profit mix. This visual proves that a successful cross-sell strategy isn’t just about increasing top-line sales; it’s a deliberate method to engineer a more profitable business.

The Leader’s Roadmap to Predictive Commerce

Adopting a predictive analytics culture is a strategic initiative, not an IT project. Revify’s rapid onboarding (typically 1-2 weeks) is designed to accelerate time-to-value, but long-term success hinges on leadership. Our experience in the trenches has revealed a clear blueprint for success:

- Mandate a Unified Data Foundation: The first act of leadership is to break down the data silos. Integrating transactional, operational, and CRM data into a single source of truth is the non-negotiable foundation for all meaningful analysis.

- Champion Data Governance as a Cultural Value: “Garbage in, garbage out” is an understatement. Flawed data creates flawed insights, which erodes the sales team’s trust in the system. Championing data integrity is how you ensure the insights are trusted and, therefore, acted upon.

- Pilot with Your Champions, Scale with Their Success: Validate the models with a small group of your most forward-thinking sales professionals. Their success stories and feedback will become your most powerful internal tool for driving broader adoption and silencing skeptics.

- Embed Intelligence, Don’t Just Display It: The goal is to make insight unavoidable. The most effective deployments embed prioritized action lists, opportunity scores, and affinity alerts directly into the daily CRM workflow, making intelligence a natural part of the process, not a separate destination.

- Re-Skill, Don’t Just Re-Tool: Your team needs to evolve from presenting products to diagnosing needs with data. Invest in training that explains the “why” behind the recommendations, transforming your salespeople into credible, data-fluent consultants.

- Commit to a Continuous Improvement Loop: Predictive models are not static. Markets shift, customers evolve, and your models must learn. Establish a formal feedback loop to continuously refine your analytics, ensuring your commercial engine remains perfectly tuned.

The Choice: Incremental Effort or Exponential Growth?

The Adjacency Gap is more than a metric; it’s a strategic choice. You can continue to pursue linear growth through sheer force of effort—hiring more reps to hunt for more logos in an increasingly crowded market. Or, you can unlock the exponential growth that comes from systematically and intelligently cultivating the profitable potential already sitting within your business.

Continuing to operate with an incomplete view of your customer is no longer a viable strategy. It is an explicit decision to leave your most profitable revenue on the table for others to claim. The strategic imperative is to move from guesswork to guidance, from reaction to prediction. The tools and the data are here. The only remaining question is one of leadership.

This is what decisive, data-driven leadership looks like in action. It’s the pivotal moment when the strategic imperative to act is met with the tools to see clearly—transforming abstract potential into a tangible, high-value ‘Cross-Sell Opportunity’ on the screen. This is a preview of what seeing your own business through the Revify lens can reveal, providing the guidance needed to unlock the exponential growth hidden in your accounts.

Understanding the full scope of your Adjacency Gap is the foundational first step toward building a more resilient and profitable commercial engine. If this analysis has raised critical questions about your own business, we encourage you to schedule a complimentary, confidential strategic review. Our primary goal is to help you see your own data through a new lens and identify the most immediate and impactful path to securing the growth currently hidden within your accounts.