From Top-Line Growth to Bottom-Line Profit

Your Revenue Growth is Masking a Problem

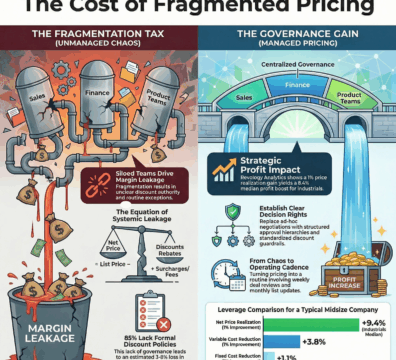

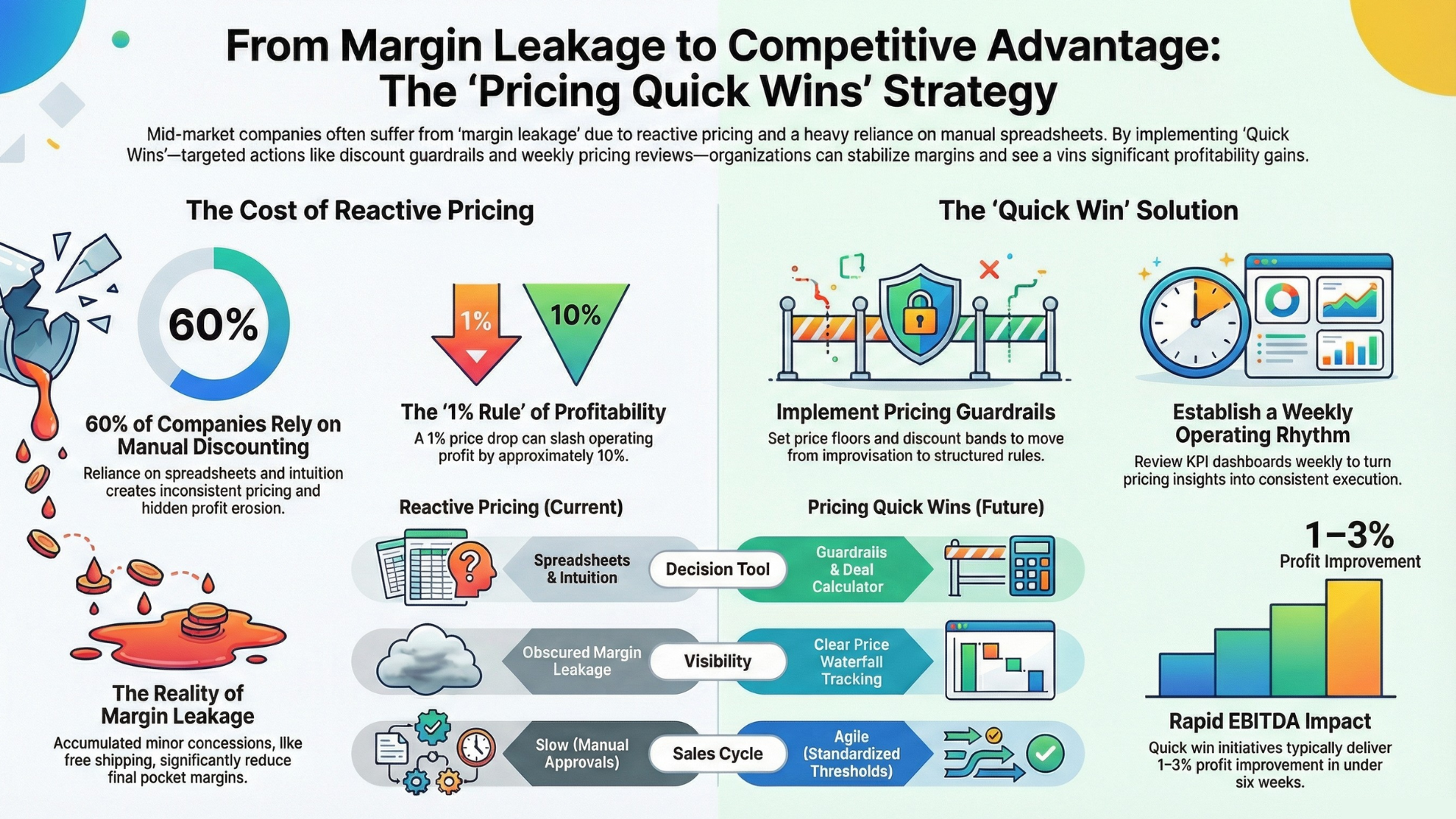

In most organizations, revenue commands the spotlight while profit languishes in the wings. This focus creates an illusion of health: impressive top-line growth can mask severe underlying issues in pricing discipline and cost management. The discrepancy between the revenue you invoice and the profit you actually retain is the result of Margin Leakage—the incremental and often invisible erosion of profitability across your entire commercial process.

This leakage is not a sudden breach but a slow, persistent drain. It’s a cascade of seemingly minor concessions that compound over time: the unmanaged “goodwill” discount your top salesperson uses to secure a key account, the escalating freight charges you absorb for a long-standing partner, a complex rebate program that doesn’t align with strategic goals, or the high-volume product whose true cost-to-serve renders it a marginal performer. These are the unearned volume discounts, uncollected service fees, and ad-hoc promotional allowances that create a significant gap between list price and pocket price.

While each of these decisions may be rationalized in isolation, their cumulative effect is a significant and unquantified drain on financial performance. Rectifying this requires a fundamental shift from reactive intervention to proactive governance. The solution lies in implementing a robust analytics framework capable of tracing every dollar from the initial quote to the final payment. This provides the clarity needed to identify the sources of leakage and, more importantly, to build the commercial policies that prevent it once and for all.

Why Traditional Profitability Analysis Fails

Historically, profitability management has relied on a fragmented ecosystem of ERP data, institutional knowledge, and a series of intricate, disconnected spreadsheets. This legacy framework inherently limits leadership to a reactive posture, consuming valuable resources in analyzing past performance rather than proactively shaping future profitability. The organization remains focused on the rearview mirror, justifying historical results instead of steering toward desired financial outcomes.

This reactive footing is a primary driver of margin erosion, creating recurring friction points and strategic vulnerabilities within the organization:

- Inconsistent Pricing Decisions: Commercial teams advocate for pricing based on customer relationships, while finance scrutinizes margin impact using incomplete data. This structural conflict often results in protracted negotiations, inconsistent policy application, and ultimately, value being left on the table.

- Delayed Response to Market Volatility: When input costs fluctuate, the absence of clear, granular profitability data can paralyze decision-making. The critical process of implementing price adjustments becomes slow and uncertain, creating significant risk for manufacturers facing fierce competition and volatile material costs.

- Erosion of Internal Trust: When sales and finance operate from disparate data sets—such as CRM versus ERP—strategic discussions devolve into debates over whose data is correct. This fundamental misalignment hinders collaborative planning and erodes confidence. Industry data underscores this challenge: a surprising 51% of companies report lacking even a basic price waterfall, a foundational tool for tracking profitability.

- Price Realization Failure: In an inflationary environment, it is difficult to determine how much of a price increase will actually “stick.” Without integrated reporting to monitor compliance, small, unmanaged concessions systematically erode the intended benefit, often neutralizing the positive impact of the entire initiative.

A reliance on this hindsight-focused, spreadsheet-driven methodology represents more than a minor inefficiency. It functions as a core structural barrier to sustainable growth, quietly costing organizations millions in unrealized profit.

Introducing the Profit Velocity Engine

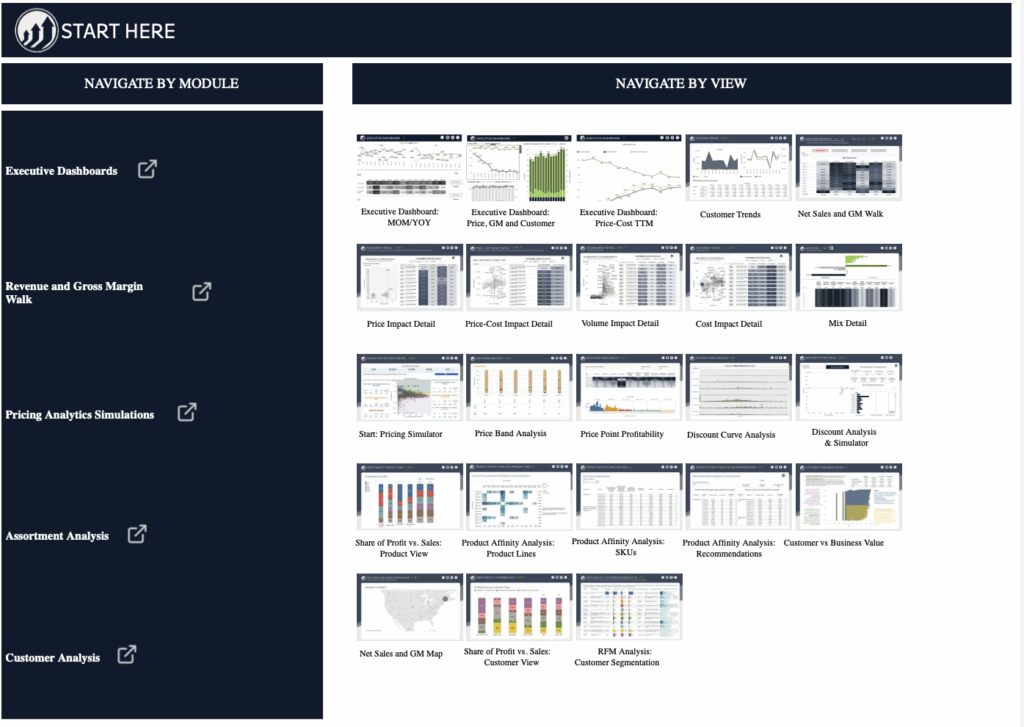

Revify provides a comprehensive suite of analytics modules—from executive dashboards to detailed pricing and assortment simulations—creating a single, unified view to navigate and manage business profitability.

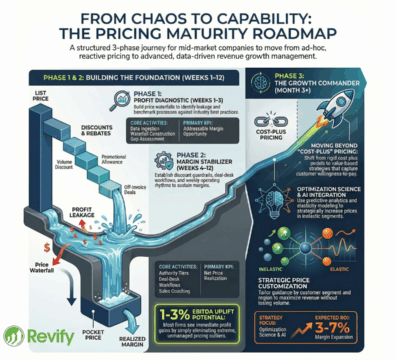

To permanently address the root causes of margin leakage, you need more than a better report; you need a new operating system for your entire commercial engine. The Profit Velocity Engine is a systematic methodology for making smarter, faster, and more profitable decisions. It is built on a unified, real-time view of your customers, products, and pricing, moving your organization from retrospective analysis to proactive profit optimization. This engine for growth is built on three foundational pillars.

Unify: Forge a Single Source of Profit Truth. Everything starts here. The most fundamental challenge is that critical data lives in disconnected silos. This pillar is about consolidating all transaction-level data from your ERP, CRM, and other systems into one trusted, accessible platform. This isn’t merely a technical exercise; it’s a cultural one. When the entire organization, from the C-suite to the front-line sales team, operates from the same set of facts, adversarial debates are replaced by collaborative, strategic conversations focused on the shared goal of profitable growth.

Analyze: Activate Your Data with Accessible AI. Once your data is unified, the next step is to uncover the strategic opportunities hidden within it. This pillar involves using accessible AI and machine learning models as a “co-pilot” for your team, making sophisticated profitability analysis available to your commercial leaders. For instance, a price elasticity model can predict the volume impact of a price change, removing guesswork. Price-Cost-Volume-Mix (PCVM) analysis helps businesses understand the components driving changes in financial metrics from one period to another. A customer segmentation engine can automatically classify accounts into profitability quadrants (e.g., High Margin/High Growth vs. Low Margin/High Maintenance), showing your sales team exactly where to focus their time. This is how raw data is transformed into the actionable business insights that create a sustainable competitive advantage.

Act: Drive Decisions with Speed and Precision. An insight’s value diminishes if it arrives too late to be acted upon. This final pillar is about building the organizational capability for “speed-to-insight”. In the traditional model, it could take weeks for finance to manually assemble a profitability report, by which time the window for action has closed. This pillar focuses on an automated, cloud-based system that continuously refreshes data. This enables your team to spot a margin anomaly on Monday and deploy a corrective pricing action by Wednesday, capitalizing on opportunities and mitigating risks in near real-time.

The Framework Delivering Real-World Wins

Case Study #1: Reclaiming Profit for an Industrial Distributor

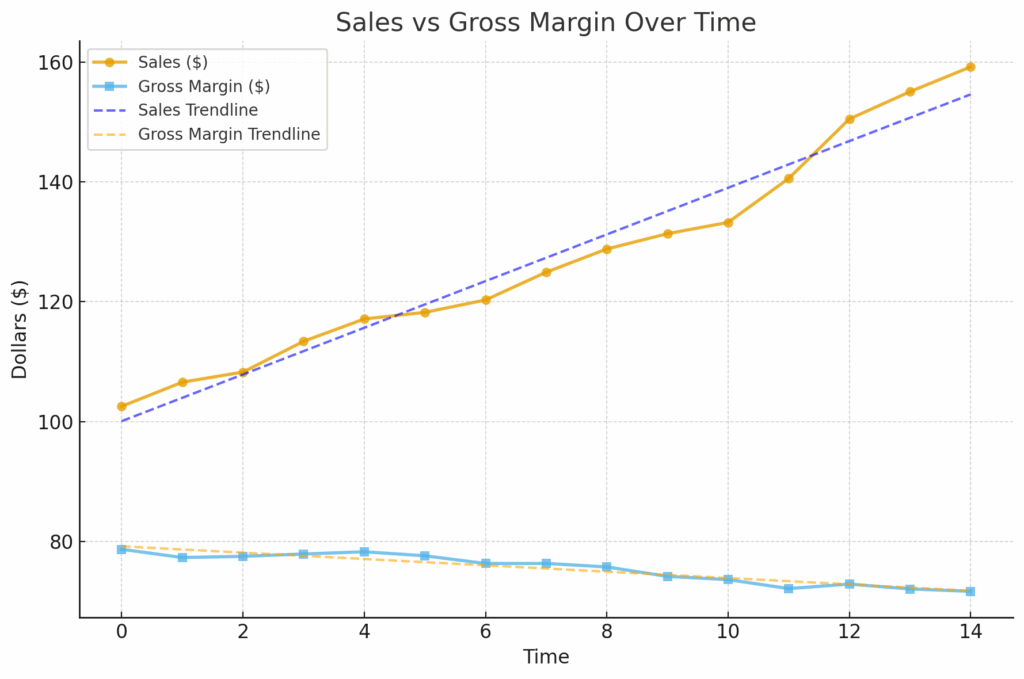

A common symptom of margin leakage is visualized here: while top-line sales show a healthy upward trend, the actual gross margin steadily erodes over time, creating a dangerous gap between perceived growth and actual profitability.

The Problem: A successful industrial distributor faced a common challenge: revenue was growing, but margins were shrinking. Their pricing strategy was inconsistent and heavily reliant on discounting, which was accepted as “the cost of doing business”.

The Action: By implementing the framework, they conducted a comprehensive price waterfall analysis. The system revealed that one sales territory was consistently applying 5-7% more in off-invoice discounts than any other, with no corresponding increase in volume or strategic advantage. A visual dashboard tracking discount variance provided a new level of transparency.

The Result: The conversation shifted from opinion-based arguments to data-driven coaching. The territory closed the discount gap, adding over $500,000 in pure profit directly to their bottom line in just six months.

Case Study #2: Correcting the Unprofitable Mix for a Manufacturing Company The Problem: A mid-sized manufacturer offered a portfolio of both highly innovative tools and more commoditized “me-too” products. They discovered that both categories were being discounted at nearly identical rates.

The Action: A deep-dive profitability analysis using a unified data model revealed a critical insight. The sales team’s standard discounting tactics failed to differentiate between their premium, high-R&D products and their commodity lines. This simplified the sale but cost the company millions in margin that their innovation had earned. By showing sellers how they could successfully defend the value of high-performance products, the analysis confirmed customers were willing to pay a premium for superior quality.

The Result: Armed with this undeniable data, the company executed a strategic pivot. They restructured sales incentives and reallocated marketing spend to champion their high-margin products. This fundamentally improved their profit mix, dramatically increasing overall company profitability without a major disruption to top-line revenue.

Your 5-Step Margin Recovery Strategy

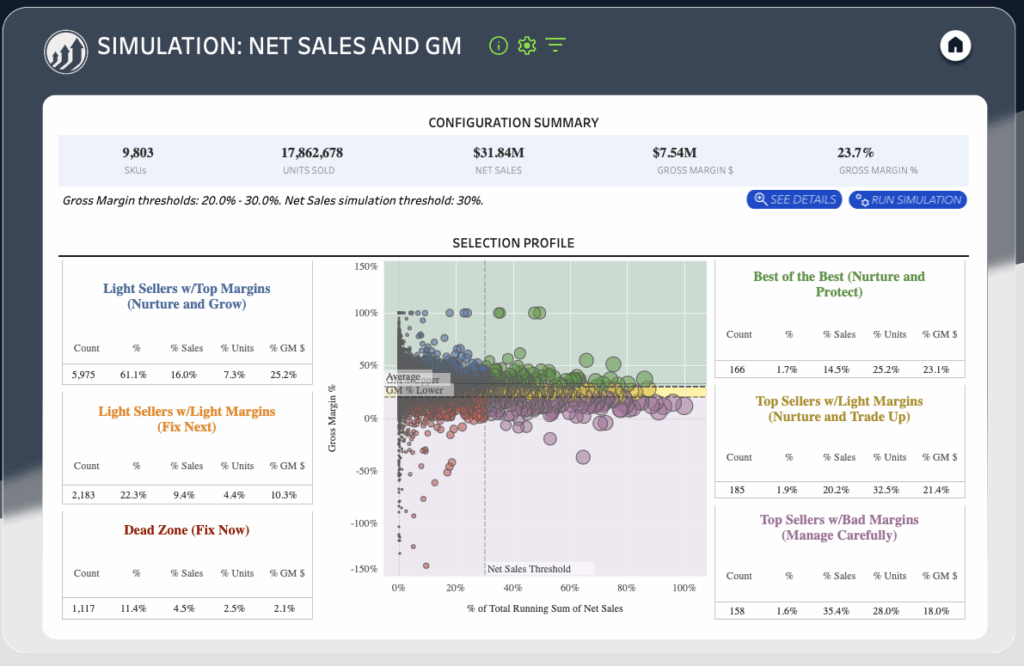

Conduct a Comprehensive Margin Leakage Audit. Before you can build a solution, you must diagnose the problem. Take stock of where you are most vulnerable. Is it unmanaged discounting? Unprofitable customer segments? High cost-to-serve products? Use a guided process to identify the single biggest leak and target it for a quick, high-impact win that will build momentum and secure organizational buy-in.

Diagnosing Profit Leaks: A powerful margin leakage audit tool visually segments every product based on its contribution to net sales versus its gross margin, immediately identifying high-performers to nurture and unprofitable “Dead Zone” items that are silently draining the bottom line.

- Establish Your Single Source of Truth. This is the non-negotiable foundation for everything that follows. Partner across departments to centralize core transaction-level data. While this sounds daunting, a dedicated partner like Revify can accelerate this critical process, using pre-built connectors to get you live in 7-14 days, not the typical 6-12 months.

- Deploy a “Quick Win” Dashboard. Based on your audit, deploy a simple, intuitive dashboard that is hyper-focused on solving that one specific problem. Our solution already has views to address the typical challenges companies face. Leverage the ones that help create your baseline performance and then track improvements from that point forward. The goal is to deliver an immediate “aha!” moment and prove the immense value of accessible, visual data.

- Empower Your Commercial Teams with Insights. This intelligence should not be siloed within the finance department. The transformative impact occurs when you push intelligence out to the edge of the organization. Give your sales team direct access to analytics that help them sell smarter—showing them which customers are most profitable and which products are prime for a high-margin cross-sell.

- Launch a Monthly Profitability Cadence. Create a recurring, data-driven meeting that brings sales, finance, marketing, and leadership to the same table. Use your new dashboards as the undisputed source of truth to review performance against profit-centric goals, diagnose root causes, and assign specific, time-bound actions for the upcoming month.

Overcoming the Hurdles to Transformation

Adopting a data-driven approach is a significant change, and it’s natural to have concerns. Here’s how this modern methodology addresses the most common obstacles:

The “We’re Too Busy” Hurdle. This framework is designed to reduce complexity, not add to it. It achieves this by automating the time-consuming, manual work of gathering data and building reports. A modern Revenue Management as a Service (RMaaS) platform does the heavy lifting, freeing your most valuable talent to focus on high-level strategic decisions, not data wrangling.

The “This Feels Too Expensive” Hurdle. You’re right to be cautious of massive, multi-year software projects. This is an entirely different model, distinct from the monolithic enterprise software projects of the past. RMaaS is a subscription-based service specifically designed for mid-market budgets. It delivers rapid and demonstrable ROI at a fraction of the enterprise cost, with implementation in days, not years.

The “Sales Won’t Like This” Hurdle. The key to adoption is framing this as empowerment, not oversight. This framework isn’t just a tool to flag inconsistent discounts; it’s a co-pilot that helps salespeople win more profitably by highlighting their best opportunities and providing the hard data they need to confidently justify value over price in tough negotiations. It helps elevate them from an order-taker to a strategic partner.

Building a Culture of Profitable Growth

The journey from chronic margin erosion to sustainable, predictable profit is not about working harder—it’s about working with clarity and intelligence. For too long, mid-market leaders have been forced to make high-stakes decisions with incomplete data and lagging indicators. The Profit Velocity Engine offers a new, pragmatic methodology designed to replace guesswork with data-driven confidence.

By establishing a single source of truth and empowering your entire commercial team with actionable insights, you can do more than just plug leaks—you can transform your operations and build a resilient culture of profitable growth. This begins with a single, targeted win that proves the ROI and builds sustainable momentum.

Delaying action means another month of leaving money on the table. If you’re ready to stop reacting to last month’s numbers and start proactively shaping next month’s bottom line, it’s time for a conversation.

Ready to Find and Fix Your Most Costly Profit Leak?

Schedule a complimentary, no-obligation Margin Health Audit with a Revify expert today. In 30 minutes, you will walk away with a clear diagnosis of your primary source of margin leakage and a data-backed estimate of the financial opportunity you can capture in the next 90 days.