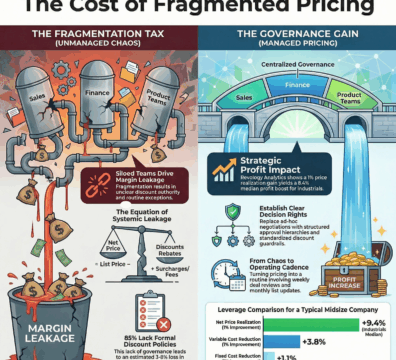

Most B2B manufacturers and distributors know that smarter pricing can yield significant profit gains – often boosting operating profit (EBITDA) by mid-single-digit to even double-digit percentages. In fact, a 1% improvement in realized price can drive an average ~6.4% increase in operating profit, with some sectors approaching ~10% or more improvement. Yet despite pricing’s outsized impact on the bottom line, many companies fail to adequately budget for pricing initiatives. Why would firms overlook such a high-ROI lever?

Why Pricing Initiatives Often Don’t Make the Budget

Several common reasons explain why companies miss the mark when it comes to budgeting for pricing programs:

· Unclear Pricing Potential: Organizations often lack clarity on how much profit uplift a pricing initiative could deliver. Without hard data or analytics, executives hesitate to budget for an unclear payoff.

· Fear of ROI and Customer Pushback: Requesting budget for a pricing initiative can trigger anxiety – what if the price changes don’t stick or upset customers? Many leaders are fearful of committing to a revenue or margin improvement in the budget without confidence in the ROI.

· No Owner or Cross-Functional Accountability: Pricing tends to fall into an organizational gray area – is it a Sales responsibility? Marketing? Finance? Without a clear executive owner or pricing leader, it’s easy for a pricing initiative to lack a champion during budgeting.

· Unapproachable initial investment: Very large investment requests often don’t make the cut, since they are deemed too large and risky, compared to other (more relatable) business investments.

“Too Good to Be True” Investments: Overstated ROI claims from specialized software vendors—especially when tied to significant upfront costs—breed skepticism and erode trust, effectively closing the door on genuine investment opportunities.

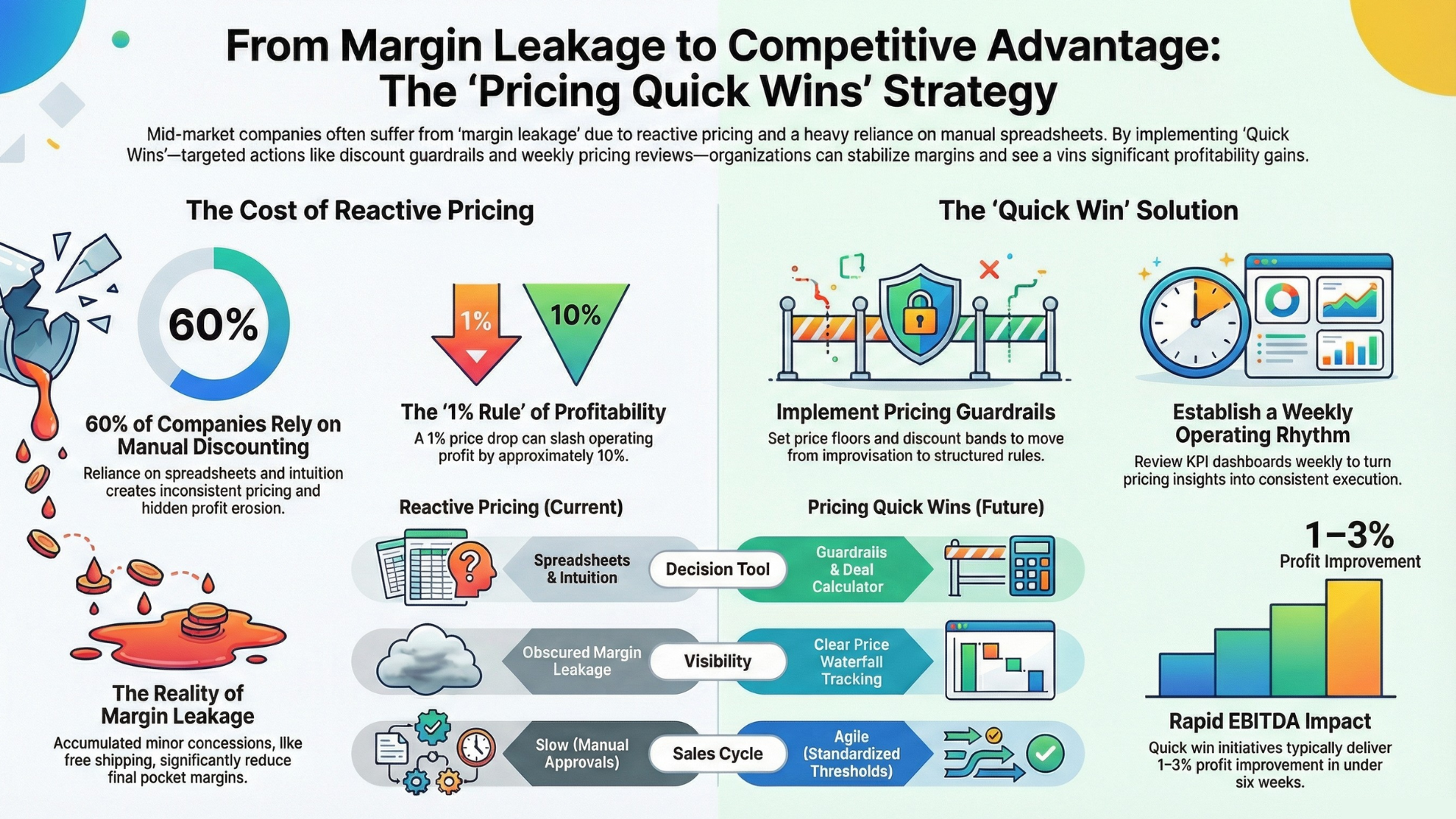

Companies that recognize these pitfalls can take proactive steps to overcome them. The first step is understanding that neglecting pricing comes at a high cost – and that cost is often hidden in plain sight.

Alignment: The Key to Successful Pricing Initiatives

Organizations that do succeed with high-impact pricing programs share one key trait: strong alignment between strategy and execution, with full organizational buy-in. Leadership treats pricing as a strategic priority and every function – from the C-suite to Sales to Finance – is on board with the pricing plan.

Successful pricing initiatives require treating pricing as a team sport. When everyone from the CEO down to the account managers understands the pricing strategy and their role in executing it, the initiative gains momentum and credibility.

Budgeting Tips for a High-Impact Pricing Initiative

For firms now entering their planning and budgeting cycle, here are some actionable tips:

- Allocate Resources Across Key Functions: Don’t silo your pricing initiative in one department’s budget. High-impact pricing optimization touches multiple functions – Sales, Finance, IT, and Marketing.

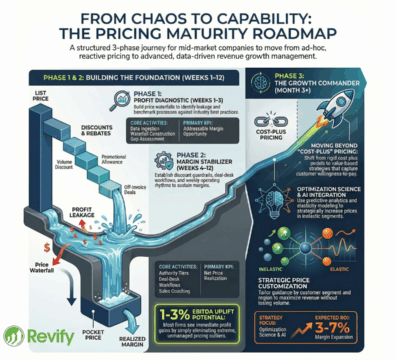

- Anticipate 1–2% of Sales in Value Creation: Companies new to systematic pricing optimization can often expect 1% to 2% of total sales in incremental profit improvement.

- Start with a Diagnostic to Quantify the Opportunity: If you haven’t done a formal pricing analysis recently, consider budgeting for a diagnostic phase. It can quantify the pricing opportunity in hard dollars and identify quick wins.

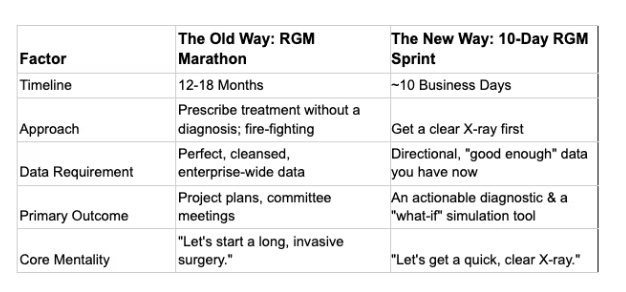

This diagnostic approach is designed to directly counter the “unapproachable initial investment” pitfall; instead of a high-risk 18-month marathon, a 10-day sprint can prove the ROI and build momentum.

Instead of budgeting for a high-cost, high-risk “RGM Marathon,” a low-risk “10-Day Sprint” acts as a powerful diagnostic to prove ROI and secure organizational buy-in before a major investment.

How Revify Analytics Helps Accelerate Pricing ROI

Revify Analytics supports companies through this journey – from identifying the profit potential in pricing to executing improvements in a low-risk, high-impact manner.

- Identify Pricing Lift Potential: Revify’s cloud-based analytics platform pinpoints where pricing improvements are possible and quantifies the dollar value of opportunities.

- Recommend First Levers to Unlock Improvement: Its dashboards and expert consultants highlight the highest-impact pricing levers specific to your business.

- Low-Barrier, Expert-Guided Execution: Revify delivers enterprise-grade pricing analytics at a fraction of the cost, combining intuitive tools with expert advisory support.

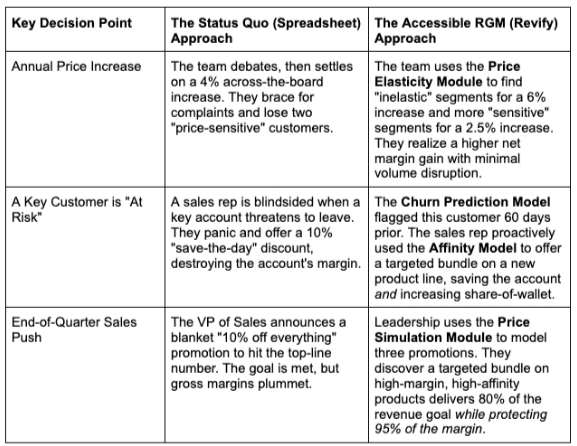

This combination of intuitive tools and expert support isn’t just theoretical. Here is a practical comparison of how an accessible RGM platform changes the outcome of common, high-stakes commercial scenarios.

See how budgeting for an accessible RGM platform moves your team from reactive, margin-destroying guesses to proactive, data-driven profit generation.

Ready to capture your hidden pricing opportunities?

Revify Analytics can help you quantify your pricing ROI and guide you step-by-step to realize it. Learn more about our approach and see pricing options on our Pricing & Details page.