Why the Best Companies Treat Price Sensitivity as a Core Capability

Price elasticity is not a metric. It is a discipline.

For companies that master it, price elasticity becomes a lasting strategic advantage.

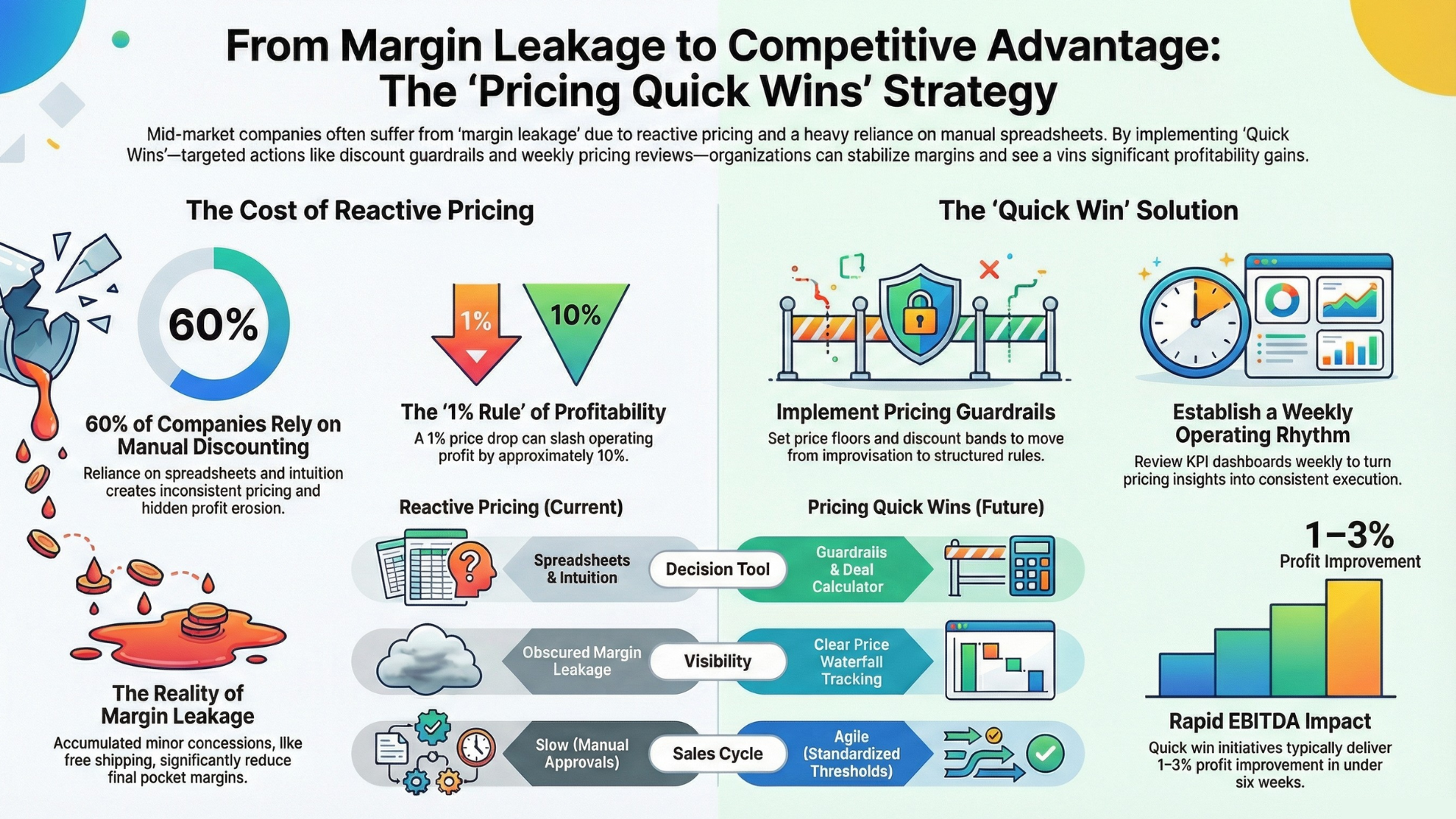

Most organizations adjust prices regularly, but few do so confidently. Price increases often aim to recover costs, discounts secure deals, and promotions are repeated based on past outcomes or minimal negative effects.

Behind every one of these actions sits the same unresolved question:

How will customers actually respond to this price change?

Price elasticity answers this question by providing a structured approach to pricing, replacing instinct and anecdote with evidence from real customer behavior.

Why price elasticity belongs at the strategy level

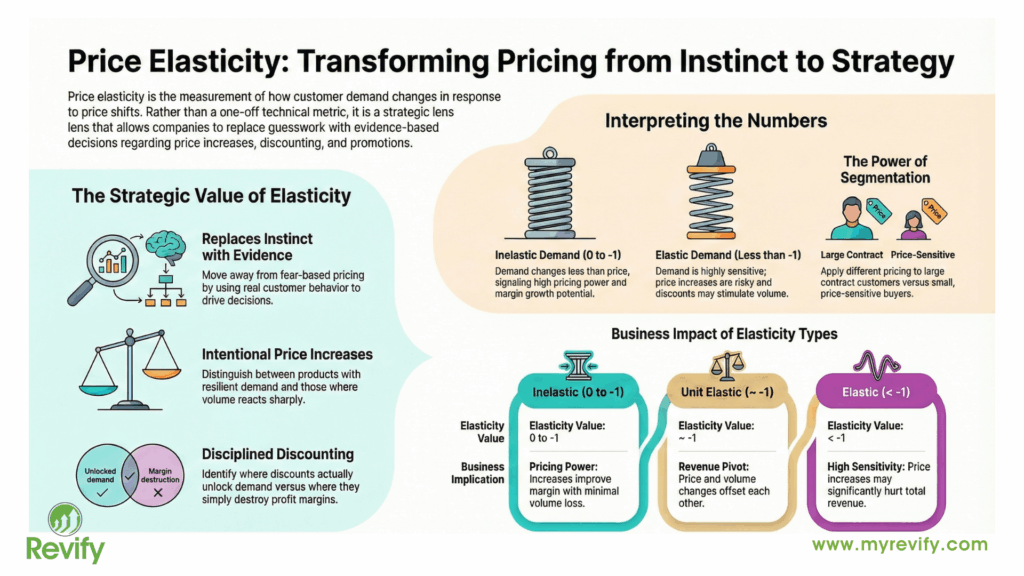

Elasticity is often seen as a technical concept, but it should be recognized as a strategic perspective.

Elasticity measures how sensitive demand is to price changes. When used effectively, it informs broader decisions, such as identifying where the business has true pricing power.

- Which products can absorb increases with limited risk?

- Which customers are driving margin volatility?

- When does discounting actually stimulate demand—and when does it simply destroy value?

Organizations without elasticity discipline rely on internal debate, while those with it use data-driven insights.

Elasticity creates discipline across the pricing lifecycle.

Treating price elasticity as an ongoing capability, rather than a one-time analysis, transforms pricing decisions across the organization.

Price increases become intentional

Instead of applying blanket increases or making overly cautious adjustments, elasticity enables companies to distinguish between:

- Products where demand is resilient

- Products where volume reacts sharply. This approach reduces internal resistance and improves execution quality.

Discounting becomes selective

Elasticity identifies where discounts generate incremental demand and where they only reduce margin without meaningful volume gains. Over time, this helps organizations avoid reflexive discounting.

Promotions become purposeful

Instead of repeating promotions out of habit, teams can assess whether their depth and frequency are justified by actual customer response. This approach makes promotions more credible.

Revenue plans that include price changes but ignore elasticity assume constant volume. Incorporating elasticity ensures forecasts reflect actual market behavior.

What price elasticity actually measures (in practical terms)

Price elasticity measures the percentage change in demand relative to a percentage change in price.

In plain business language:

- If prices move a little and demand barely changes, demand is inelastic.

- If prices move a little and demand changes a lot, demand is elastic.

Elasticity is usually expressed as a number, commonly negative because demand typically moves in the opposite direction of price.

The significance lies not in the calculation, but in what the elasticity value reveals.

Interpreting elasticity values: what the numbers really mean

Elasticity values are often quoted without context. Understanding their implications is essential.

Inelastic demand (elasticity between 0 and 1)

Demand changes proportionally less than price.

Example:

A 10% price increase leads to only a 2–3% volume decline.

Implication:

These products or customers typically have pricing power. Price increases improve margin and usually revenue. Discounting in these cases destroys value.

Elastic demand (elasticity less than –1)

Demand changes proportionally more than price.

Example:

A 5% price increase leads to an 8–10% volume decline.

Implication:

Pricing actions must be more selective. Price increases can hurt revenue if not carefully targeted. Discounts may stimulate demand if applied with discipline.

Unit elastic demand (elasticity around 1)

Price and volume move proportionally.

Example:

A 5% price increase leads to roughly a 5% decline in volume.

Implication:

Revenue remains stable at this point, often serving as a strategic reference for decision-making.

Real-world examples: elasticity in action

Example 1: Product-level insight

A distributor raises the price of Product A by 4%. Volume falls by 1%.

Elasticity is low (inelastic).

The price increase improves margin with minimal impact on demand.

For Product B, the same increase causes a 7% volume decline.

Elasticity is high.

The same pricing action yields a significantly different outcome.

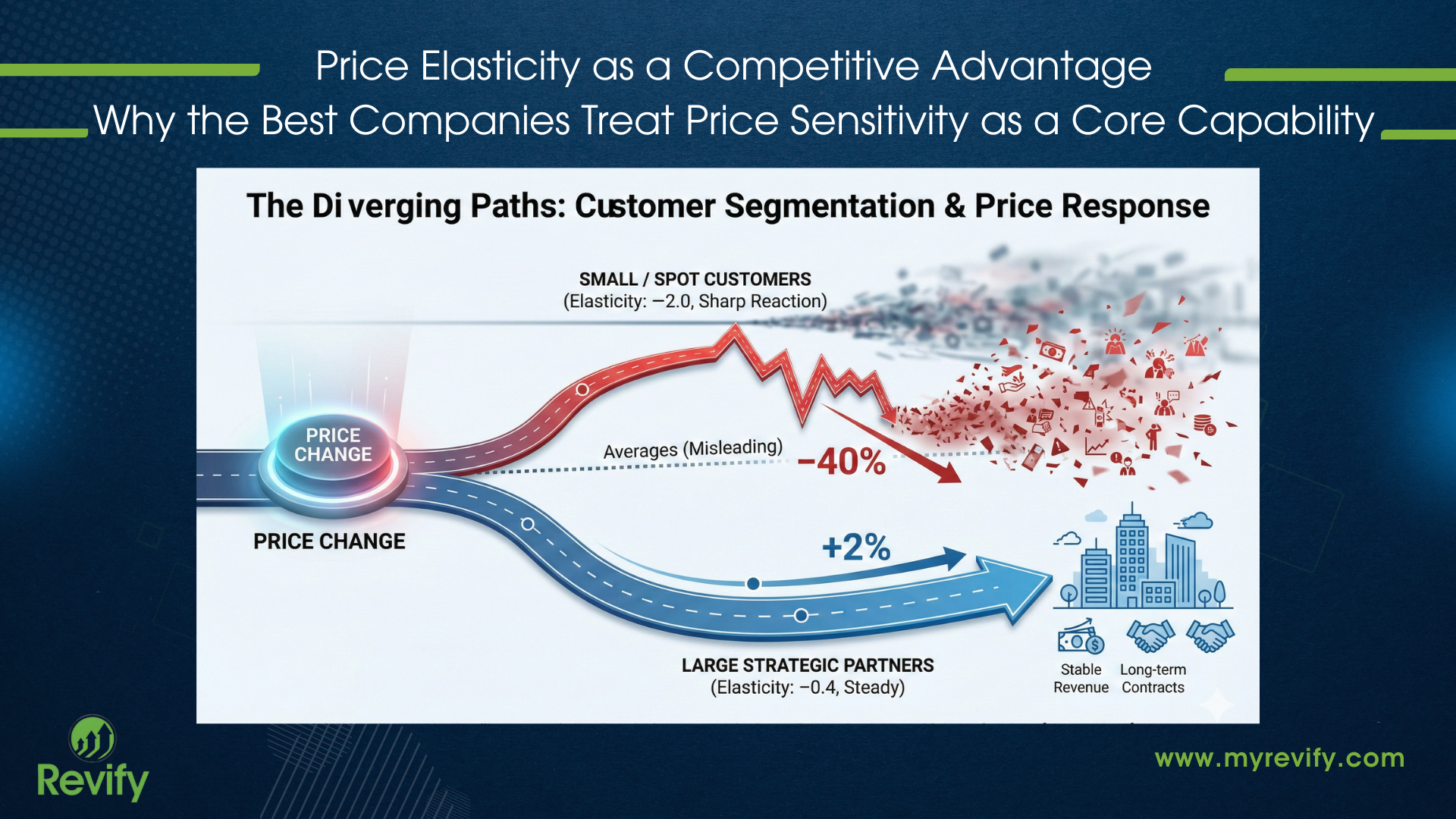

Example 2: Customer segmentation matters

Small customers show elasticity of –2.0.

Large contract customers show elasticity of –0.4.

A single price increase applied uniformly:

- Causes volume loss among smaller customers

- Barely affects enterprise demand.

The opportunity is to segment the price increase rather than avoid it.

Example 3: Discounting gone wrong

A 10% discount is applied to a product with elasticity of –0.3.

Volume increases by only 3%.

Revenue and margin decline sharply.

Although the discount seemed necessary, the elasticity analysis showed it was unwarranted.

How elasticity is typically measured

In practice, elasticity is estimated using historical transactional data:

- Net realized prices (not list prices)

- Quantities sold

- Time periods

- Customers and products

Statistical models analyze how demand changed when prices changed, while controlling for other factors such as:

- Seasonality

- Promotions

- Customer mix

- Product lifecycle effects

The goal is not theoretical perfection, but actionable insights that reflect real buying behavior.

Why is elasticity still rare among SMBs

Despite its value, most small and mid-sized companies still do not use elasticity in a structured way.

Historically:

- It required specialized analytics skills.

- Models were slow to build and hard to maintain.

- Outputs were static and disconnected from decisions.

- Results lived in spreadsheets instead of workflows.

As a result, pricing decisions often remain instinct-driven, even when extensive transactional data is available.

This creates a competitive gap. Larger organizations often use elasticity-informed pricing, while smaller companies typically do not.

This gap presents a significant opportunity.

Key watch-outs when using elasticity

Elasticity is powerful when applied correctly. Common pitfalls include:

Relying on averages

Average elasticity can hide significant differences across products, customers, or regions. What appears safe on average may be risky in specific segments or micro-segmentations.

Different customer types behave differently. Treating all customers as equally price sensitive leads to blunt pricing and missed opportunities.

Assuming elasticity is static

Elasticity changes over time in response to competition, substitutes, and market conditions. Old estimates should not be considered permanent.

Confusing acquisition with retention behavior

New customers are often more price-sensitive than existing customers. Mixing these groups can distort conclusions.

Using list prices instead of net prices

Elasticity based on list prices often misrepresents reality. Actual buying behavior reflects discounts, rebates, and negotiated prices.

Effective pricing discipline requires both measurement and interpretation.

From insight to execution: making elasticity usable

Conceptual A conceptual understanding of elasticity is insufficient. To become a true pricing discipline, it must be based on real transactional data.

- Updated as conditions change

- Accessible beyond analytics teams

- Embedded into pricing decisions

Modern analytics platforms make this level of pricing discipline achievable. Action Decision Matrix

Using the Degree of Price Elasticity on one axis (Inelastic vs. Elastic demand) and Data Reliability on the other (High vs. Low reliability of elasticity estimates), we can outline four quadrants. Each quadrant has a recommended pricing action based on how sensitively customers react to price and how confident we are in the data:

- Inelastic Demand / High Reliability – Aggressive price realization. These products have the “permission” to increase price and drive higher margins with minimal volume risk.

- Elastic Demand / High Reliability – Promotional optimization and volume defense. Price-sensitive products should use targeted discounts and value messaging to boost or maintain volume, defending market share against competitors’ pricing moves.

- Inelastic Demand / Low Reliability – Measured price adjustments. If demand seems inelastic but data confidence is low, avoid extreme price hikes. Instead, make moderate price moves aligned with category norms and focus on improving data quality for future decisions.

- Elastic Demand / Low Reliability – Cautious promotional testing. If demand appears elastic but data is uncertain, do not overcommit to deep discounts or assume extreme sensitivity. Test smaller price changes in controlled markets to validate elasticity assumptions and refine pricing based on better data.

Quadrant Insights and Recommended Steps

Inelastic Demand / High Reliability

Products in this quadrant have low price elasticity (demand changes little with price) and highly reliable data confirming this inelasticity. The key takeaway is that the company can raise prices confidently to improve profit margins. Customers are likely to keep buying despite higher prices (often because the product is a necessity or has few substitutes). The recommended steps for a company include systematically implementing price increases for these products and monitoring sales volumes. Since volume loss is expected to be minimal, the focus should be on capturing additional margin. For example, management might schedule incremental price upticks or reduce discounting on these items, knowing demand will hold steady. It’s also wise to watch competitor behavior – though these brands have pricing power, any competitive price changes should still be observed to ensure continued volume stability.

Elastic Demand / High Reliability

This quadrant covers products with high price elasticity (demand is highly price-sensitive) and is backed by reliable data. The data gives confidence that raising prices could significantly hurt volume, so the emphasis is on defending volume and market share. The takeaway is to leverage promotions and value enhancements rather than hefty price increases. A company should optimize promotional strategy – for instance, use targeted discounts, bundle deals, or loyalty rewards – to boost sales volume and signal value to price-sensitive customers. Any necessary price increases should be modest and ideally paired with improvements in perceived value (e.g., better quality, features, or service) to justify the price. The recommended steps include closely monitoring competitor pricing and customer responses: if competitors cut prices, the company may need to respond with its own promotions or risk losing share. In essence, pricing tactics here are about volume defense – maintaining sales by keeping prices attractive or offering deals, because even small price hikes could lead to outsized drops in demand.

Inelastic Demand / Low Reliability

In this quadrant, products seem to have inelastic demand (initial analysis suggests customers aren’t very price-sensitive), but the elasticity data is not very reliable (perhaps due to limited data or high variability). The key takeaway is uncertainty – the product might not actually be as inelastic as it appears. Thus, the recommended action is tempering any aggressive pricing moves. Rather than immediately imposing large price increases, the company should take a measured approach. For example, management could implement a small price increment and observe the impact, or rely on broader category benchmarks as a guide (using industry or category-average elasticity as an anchor). By applying hierarchical shrinkage toward category medians (i.e., assuming the product’s true elasticity is closer to the category’s typical elasticity), the firm avoids overreacting to noisy data. Key steps include investing in better data collection – such as running controlled pricing experiments or gathering more sales history – to improve elasticity precision. Meanwhile, avoid extreme pricing decisions; maintain relatively stable pricing with slight adjustments. Over time, as more data becomes available and confidence in the elasticity measure grows, the company can revisit and potentially increase prices further. In short, patience and data-driven caution in this quadrant will prevent costly mistakes.

Elastic Demand / Low Reliability

This quadrant represents products that appear to have elastic demand (the analysis indicates high price sensitivity) but with low confidence in the data. The takeaway here is to proceed carefully, as the true elasticity might be lower (or higher) than the initial estimate. A company should not fully bank on the product being extremely price-sensitive without confirmation. Therefore, the recommended strategy is to conduct cautious testing and validation. For instance, rather than broadly cutting prices (which would sacrifice margin on the assumption of big volume gains), the firm could run small-scale price tests or regional promotions to see how demand actually responds. If the product is truly highly elastic, these tests will show significant volume increases from minor price cuts or special offers, confirming that a larger rollout of discounts could drive growth. However, if demand doesn’t respond as strongly, it indicates the elasticity was overestimated, and the company avoids needlessly eroding profits. Additional steps include analyzing customer feedback and market conditions closely – there may be external factors that caused the data to look uncertain (e.g., irregular buying patterns or one-time events affecting sales). In general, do not make drastic pricing changes in this quadrant until elasticity is validated. By refining the data (through A/B testing prices, gathering more observations, and improving the reliability of the elasticity model), the company can gradually develop a confident strategy. Once the elasticity is better understood, the firm can either implement targeted promotions to capitalize on true high elasticity or pivot to a different approach if it finds demand is less sensitive than thought.

Overall, applying this four-quadrant framework helps tailor pricing actions to product and market realities. High confidence in elasticity data allows for bolder moves (raising price when demand is inelastic, or using promotions when demand is elastic), while low confidence urges caution and further analysis. By following the recommended steps in each quadrant, a company can optimize pricing to improve margins or volumes as appropriate, all while managing risk. The key is to align pricing strategy with both the nature of customer demand and the quality of insights available, ensuring decisions are profitable and data-informed.

How Revify Analytics enables elasticity as a core capability

Revify Analytics is designed to help SMB manufacturers and distributors adopt elasticity as an operational discipline rather than an academic exercise.

Revify:

- Models elasticity directly from transactional data

- Estimates elasticity by product, customer, and segment

- Embeds elasticity directly into dashboards

- Enables “what-if” pricing scenarios before actions are taken

Teams can simulate price increases, assess the expected volume impact, and evaluate trade-offs before execution, rather than reacting afterward.

Elasticity as a sustainable advantage

When elasticity is integrated into decision-making, pricing shifts from a recurring challenge to a strategic tool.

Organizations gain:

- Confidence in price increases

- More disciplined discounting

- Better forecasting accuracy

- Stronger alignment between pricing, sales, and finance

For small and mid-sized companies, this capability remains uncommon, which makes it especially powerful.

Closing thought

Price elasticity is not about formulas.

It is about understanding actual customer behavior and using that insight to make better, more consistent decisions.

Revify Analytics enables companies to quickly build this discipline using their own data and apply it to everyday pricing decisions that influence revenue, margin, and long-term competitiveness. Please reach out to apply these best practices to your bsuiness.