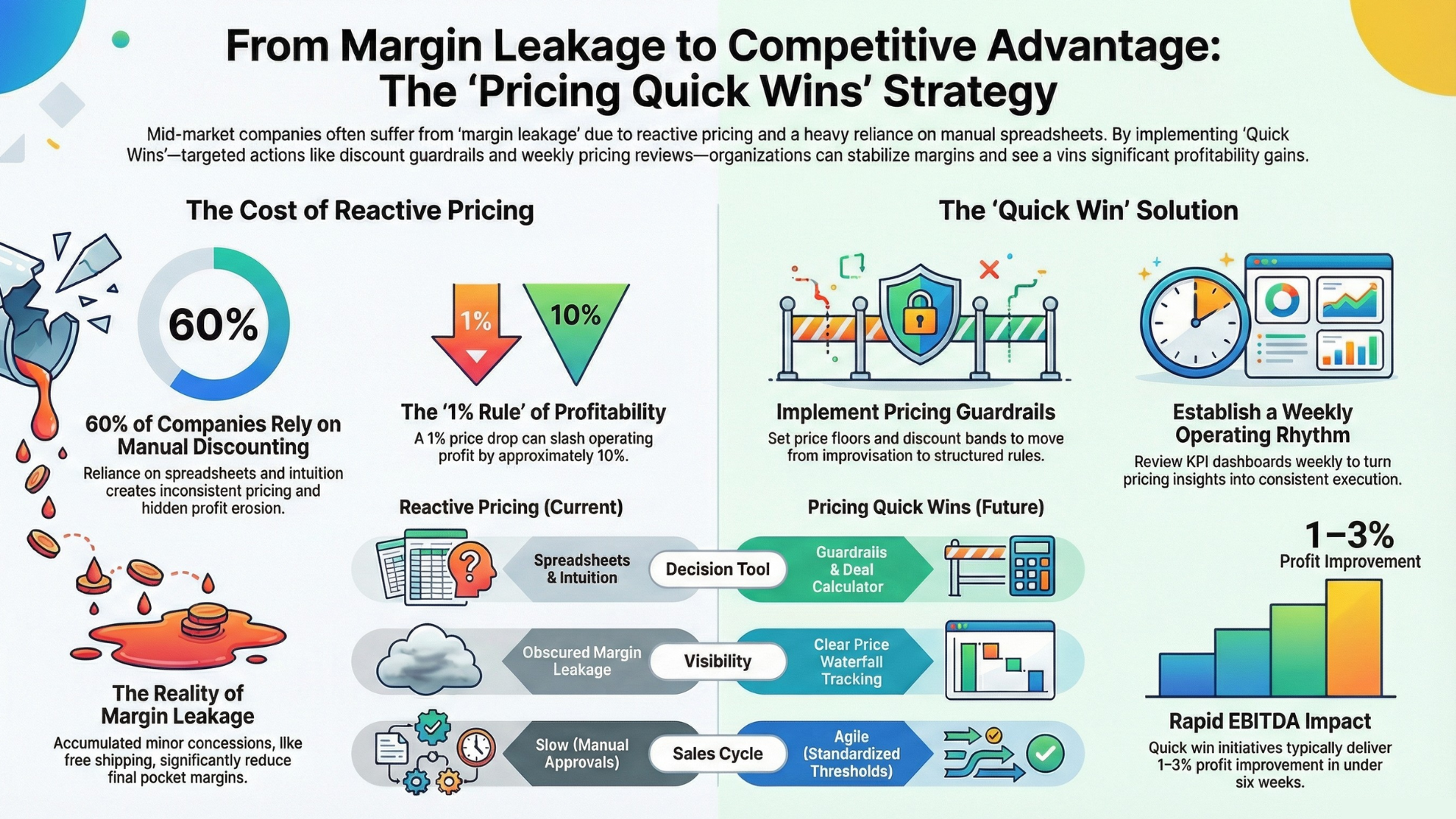

Pricing quick wins are targeted actions you can implement within days or weeks, using existing data and straightforward governance, to prevent margin leakage and improve net price realization without a full-scale transformation. Effective quick wins focus on tightening discounting, addressing price waterfall leaks, and enforcing pricing discipline for high-impact customers, SKUs, and quotes.

How “Pricing Quick Wins” Turns Issues into Competitive Advantage

Mid-market manufacturers and distributors often rely on reactive pricing and spreadsheet-based decisions. Ad-hoc processes and manual tools create inconsistency and hidden profit loss. Over 60% of companies still use manual, inconsistent discounting, which leads to ongoing margin erosion. Sales teams grant discounts individually, while finance reconciles the results, typically in Excel. This fragmented approach obscures the true impact of pricing decisions. As a result, margin leakage becomes difficult to detect, and small concessions accumulate until profits are significantly reduced.

Common Symptoms: Reactive Pricing & Spreadsheet Decisions

Are these challenges familiar? Pricing often underperforms in subtle ways. Discounts become the default tool to win sales, conditioning customers to expect concessions. Departments lack a unified pricing strategy, leading to reactive, inconsistent approaches. Teams rely on spreadsheets and intuition for quoting, causing slow turnarounds and frequent overrides. This leads to list prices that are rarely achieved, with no single source of truth for net margins. Many organizations do not track the price waterfall, making it difficult to identify profit leaks. Without this visibility, companies make ad hoc pricing decisions that may seem justified but ultimately undermine long-term profitability.

What It Costs You: Margin Leakage & Slow Decisions

These issues have high costs. Margin leakage, or the loss of potential profit from unmanaged pricing concessions, becomes widespread. Each unapproved discount, rebate, or special term reduces your pocket price. While individual concessions may seem minor, together they create a pattern of profit erosion. For example, free shipping or extended credit terms may build goodwill but directly reduce margins. Over time, average realized prices fall well below targets, and pocket margins decline. Research shows that a 1% price drop can reduce operating profit by about 10%; likewise, a 1% increase in realized price can raise profit by the same extent. Failing to address margin leakage means missing these potential gains.

Additionally, slow and inconsistent pricing decisions reduce business agility. When each quote requires manual review or executive approval due to unclear rules, the sales cycle slows. Customers notice the hesitation, causing deals to stall. Internally, sales and finance often conflict: sales seeks speed and flexibility, while finance prioritizes margin discipline. Without a clear framework, this friction leads to rushed approvals and last-minute discounts that may secure deals but erode margins. Ultimately, the absence of quick-win pricing discipline results in missed profit goals and slow responses to market opportunities.

What Changes When You Build Pricing Capability

Implementing pricing quick wins is the first step toward establishing a robust pricing capability. Rather than treating pricing as a one-time project, you begin to view it as a repeatable business process and strategic lever. This approach brings three key changes: disciplined guardrails, a consistent insight-to-execution operating rhythm, and cross-functional governance that aligns sales and finance on shared objectives.

Discipline, Governance, and Guardrails

The first change is the introduction of discipline through governance and guardrails. Pricing decisions shift from improvisation to a structured, rule-based process. For example, you may establish price floors, discount bands, and approval thresholds. Price floors set minimum allowable prices or margins; discount bands define acceptable discount ranges by customer segment; approval thresholds require higher-level sign-off for exceptions. These guardrails prevent significant margin leaks while allowing sales some flexibility within defined limits. Sales can operate freely within these boundaries, but any outlier discounts are flagged for review.

Importantly, governance is designed to empower sales by establishing clear boundaries and providing effective tools. Leading B2B companies ensure sales teams operate within defined guardrails using standardized tools, eliminating the need to create pricing policies for each deal. For example, a deal calculator can display real-time pocket margins and use color-coded indicators to show if a quote meets targets. This immediate feedback helps sales structure deals more profitably before seeking approval. When a quote reaches management, it is either within guardrails or clearly identified as an exception. Companies that implement discount guardrails and approval workflows often see rapid improvements in realized prices and operating profit, without sacrificing sales volume.

This discipline also requires consistent enforcement. Pricing capability is embedded in your systems and daily practices, not just documented in policy. Configure your quoting or order entry system to prevent sales below the floor price without triggering an approval workflow. For example, Tier 1 deals above the target margin may be auto-approved by sales managers, while Tier 3 deals below the floor require senior leadership approval. These approval tiers ensure that high-risk deals receive proper scrutiny, while routine business proceeds efficiently. As a result, fewer margin-eroding deals occur, and your team gains a stronger negotiating position. Over time, customers recognize your pricing discipline, making ad-hoc exceptions rare and shifting conversations toward value.

From Insights to Execution: Weekly Operating Rhythm

Building pricing capability involves more than setting rules; it requires establishing an operating rhythm that translates insights into consistent execution. After implementing quick wins, leading companies adopt a regular cadence—often weekly—to review pricing performance and address exceptions. This may include a weekly pricing meeting or a KPI dashboard review, during which pricing or finance leads, sales managers, and product managers assess key metrics such as net price realization, product-level margins, discount override rates, and win-loss rates. The objective is to create feedback loops that enable rapid learning and adaptation.

For example, suppose you introduced a new price floor or approval rule as a quick win. In the weekly review, you check how many quotes triggered approval in the past week, what the outcomes were, and if any sales were lost due to the floor. If win rates in a segment dropped sharply after enforcing a floor price, that’s a signal to investigate – maybe that segment truly had thinner margins or strong competition, and you need a different strategy for them. On the other hand, if you see many deals getting approved below the floor anyway, it may indicate the floor was initially set too high (or that Sales needs retraining on value selling). This continuous monitoring prevents both undue revenue loss and erosion of the guardrails – you refine the rules as needed rather than set-and-forget. As one CFO advisor notes, introducing a regular pricing review cadence turns ad hoc discounting into evidence-based decision-making, ensuring pricing improvements stick.

These reviews turn exceptions into learning opportunities. For example, if a customer repeatedly requests special freight terms not covered by current policies, this may prompt a policy update, such as charging for expedited shipping or implementing a freight surcharge. If a region continues to heavily discount a product line, it may require targeted coaching or price adjustments. Pricing capability becomes a managed process with a regular operating rhythm, similar to pipeline or production meetings. This approach allows leaders to identify and address margin leaks in near real-time, reducing the need for broad, reactive measures. A unified view of pricing performance across finance, sales, and operations reduces internal friction and builds mutual trust based on shared data.

This insight-to-execution process builds organizational confidence and agility. Regular pricing reviews enable faster responses to market changes. For example, if costs increase, you can quickly identify the margin impact and adjust prices or add surcharges within weeks. If a competitor undercuts a product, ongoing analysis may reveal unusual discount requests, prompting timely investigation and response. In summary, pricing becomes a proactive capability, focused on continuous optimization rather than reactive fixes.

How Revify’s Maturity Journey Works

At Revify Analytics, we encapsulate this capability-building process into a three-phase maturity journey. It’s a roadmap for mid-market companies to move from ad hoc pricing to world-class pricing operations in manageable steps. The three phases are: Phase 1 – Profit Diagnostic & Blueprint, Phase 2 – Margin Stabilizer (Guardrails + Governance), and Phase 3 – Growth Commander (Optimization Science). Each phase builds on the previous, ensuring quick wins fund and pave the way for more advanced techniques. Importantly, Phase 1 is a mandatory foundation before moving to execution in Phase 2, and likewise, Phase 3 (the most advanced analytics) only delivers full value once the basics are in place.

Phase 1 – Profit Diagnostic & Blueprint

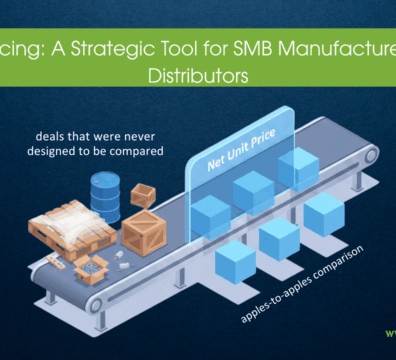

Every journey starts with a diagnosis. In Phase 1, Revify conducts a rapid Profit Diagnostic to identify where your margins are leaking and which quick-win actions will yield the fastest impact. Think of it as an X-ray of your pricing: we ingest a snapshot of your transactional data (quotes, orders, prices, costs) and build a price waterfall to visualize how your list prices cascade down to pocket prices after all discounts, rebates, credits, and costs-to-serve . This analysis often reveals eye-opening insights: for example, you might discover that 18% of your revenue last quarter was sold below a target floor margin due to unmanaged overrides or special discounts (a pattern we’ve seen in diagnostics). Or that a handful of SKUs or customer accounts for a disproportionate share of margin leakage because of aggressive pricing terms.

The Profit Diagnostic also benchmarks your pricing processes against best practices. We might find, for instance, that “pricing performance (net price realization) is only measured quarterly or not at all”, which is a red flag (indeed, ~20% of companies rarely measure price realization ). We survey your current tools and workflows: are you stuck in spreadsheets? Do you have any approval workflow in your ERP? Are customer-specific pricing overrides rampant? All these are assessed in a structured way. Within 7-10 business days, this diagnostic phase typically produces a blueprint of prioritized quick wins and longer-term opportunities . For example, the blueprint might highlight: (a) Tighten discounting on high-volume SKUs where margin is below target; (b) Implement price floors for products with extreme low-end prices; (c) Enforce approval on any quote with more than X% total discount; (d) Correct inconsistent pricing for similar customers (eliminate unnecessary price overrides); and (e) improve recovery of costs like freight or special handling via surcharges. These are concrete actions that can typically be implemented in a matter of weeks.

The diagnostic isn’t a theoretical report – it’s coupled with a live review workshop where we walk your team through the findings and collectively prioritize which quick wins to tackle first. We quantify the opportunity of each item using your data (for instance, “by raising customers below floor to the floor, you could gain $X in margin, with minimal volume risk”). This becomes the basis for alignment: finance, sales, and leadership see the numbers and agree on the plan. By focusing on low-hanging fruit first – the quick wins – you can drive 1–3% net price improvement almost immediately . Equally important, the diagnostic ensures everyone is on the same page about the root causes of margin leakage, so that the guardrails we implement are seen as solving a problem rather than arbitrary changes. In short, Phase 1 provides the “why” and “what” for your pricing improvement journey, with data-driven clarity.

Phase 2 – Margin Stabilizer (Guardrails + Governance)

Phase 2 is all about executing the quick wins and establishing governance to sustain them – hence the name Margin Stabilizer. In this phase, we implement the targeted fixes identified in the diagnostic, focusing on stopping margin leakage and “stabilizing” your net margins quickly. Practically, this means setting up the guardrails we’ve discussed: for example, configuring your systems so that no quote can go below the new floor prices without approval, uploading new price lists or revised discount matrices that tighten those leaks, and training the sales team on the new rules and how to work within them.

A key element of Margin Stabilizer is also introducing a basic pricing governance structure if one doesn’t exist. We often formalize a Pricing Steering Committee or at least define clear pricing ownership. Who is the point person for pricing decisions? Who reviews exception deals? In many mid-market firms, pricing was previously “owned” by everyone and no one – sales VPs, CFO, CEO all got involved sporadically. Now, we assign roles: perhaps a pricing manager or CFO chairs a weekly exceptions call (as mentioned earlier), sales ops or finance manages the KPI dashboard, and sales leaders are accountable for adhering to the guardrails. We help clients set up a simple weekly pricing dashboard that tracks the critical KPIs: net price realization vs. target, discount rate (% off list), override rate (# of deals needing approval), margin by segment/customer, and win rate by price band. This visibility is crucial to reinforce the changes. For example, if we set a discount band of 0–10% for tier-1 customers and 10–20% for tier-2 customers, the dashboard will show how many quotes fell outside those bands and why. By shining a light on behavior, you encourage compliance (nobody wants to be the outlier who frequently breaks the rules without good reason).

During Margin Stabilizer, companies typically see fast results. Because these quick wins don’t require new technology (we leverage your existing ERP/CRM capabilities), they can be rolled out in weeks. One industrial distributor, for instance, identified in Phase 1 that their long-tail SKUs (low-volume products) were heavily discounted by overeager reps. In Phase 2, they tightened discounts on those SKUs and set an approval requirement for any deal with a gross margin below 20%. Within the first month, their override rate dropped, and average margins on those SKUs improved by several points, contributing to an overall margin uptick. Another company, a manufacturer, found they had dozens of inconsistent customer-specific prices that didn’t reflect cost differences. The quick fix was to standardize those price lists, bringing low-priced customers up to par with peers. This eliminated an immediate source of revenue leakage (comparable customers paying different prices for the same product) . The result: more revenue from customers who had been underpriced, without losing them (since they were now simply in line with market and peer pricing).

Importantly, Phase 2 also builds momentum and buy-in. When salespeople see that margin-stabilizing actions lead to quick wins (and, in some cases, even bigger commissions, since prices are higher within acceptable ranges), they gain confidence in the pricing program. Leadership sees tangible EBITDA improvements. This sets the stage for the next phase. Before moving on, we ensure that the organization has operated for roughly 3–6 months under the new guardrails, with stable or improving margin trends (what we call “margin stabilized”). Typical quick-win KPI improvements by the end of Phase 2 might include: net price realization up several percentage points, discount variance narrowed (less price spread for similar deals), overall gross margin % up, and a boost to EBITDA of 1-2 percentage points, depending on the scope of changes.

Phase 3 – Growth Commander (Optimization Science)

With margins stabilized and a governance foundation in place, the company is ready for Phase 3, which we call Growth Commander. This phase moves into optimization science and advanced analytics to further enhance pricing and drive profitable growth. Essentially, once the “leaks” are plugged and basic discipline is in place, we can turn to optimization – finding the truly optimal prices and strategies to maximize revenue and profit, often using data science, AI, or more sophisticated pricing models.

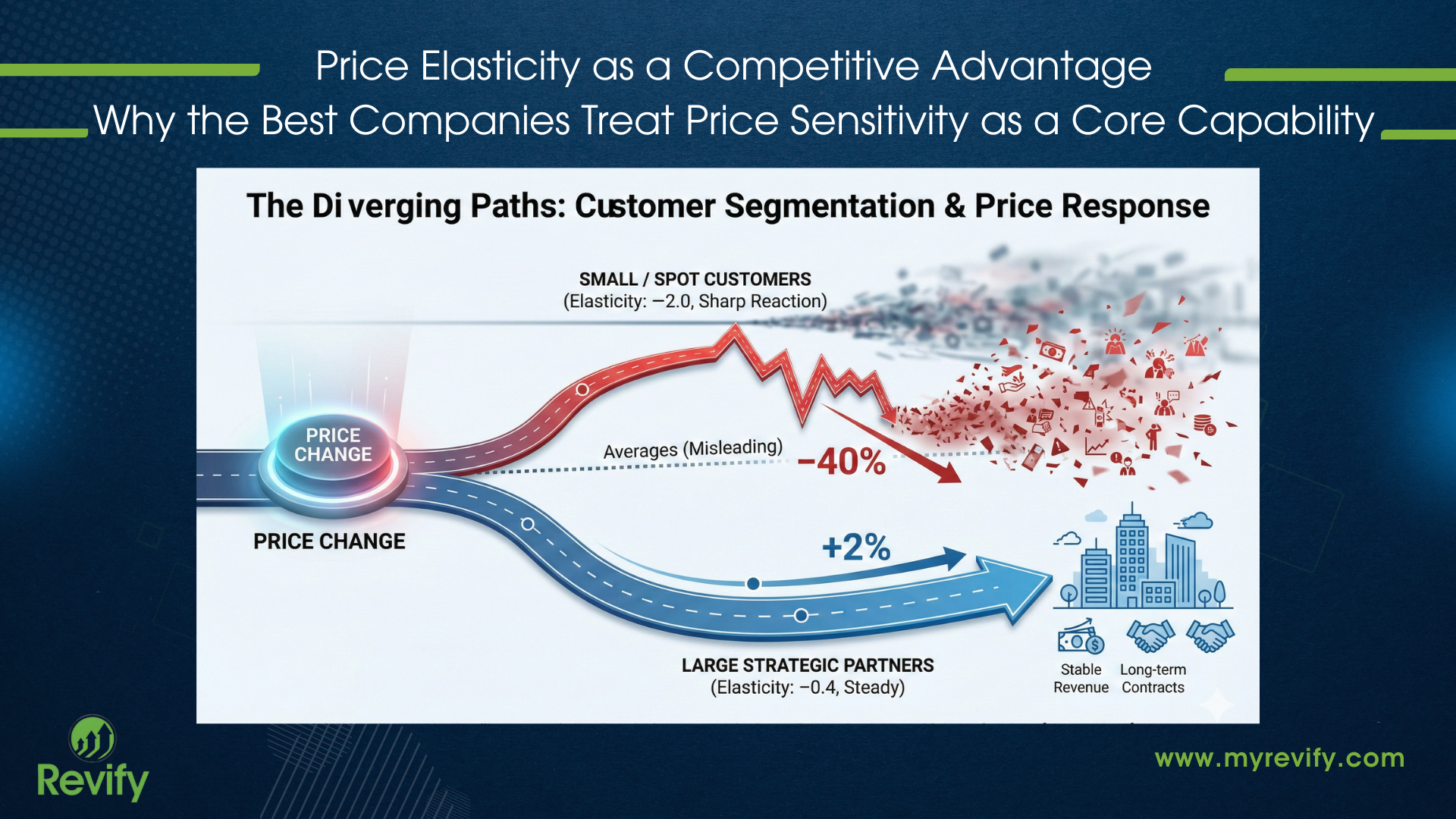

Growth Commander often involves deploying price optimization tools or AI-driven analytics that can analyze elasticity, customer willingness-to-pay, and competitive positioning. For instance, we might segment customers more granularly by price sensitivity and tailor price guidance to each segment (sometimes called strategic price customization or price differentiation). A classic output of Phase 3 could be an optimized price matrix: instead of cost-plus or one-size-fits-all pricing, you generate target prices by customer segment, region, and product, factoring in willingness-to-pay. If Phase 2 sets a floor and guardrails, Phase 3 might recommend where you can actually increase prices strategically – e.g., raising under-priced SKUs in inelastic segments, or introducing dynamic pricing that adjusts with market conditions.

We also look at more complex profit levers: customer profitability and cost-to-serve. Perhaps certain small customers are unprofitable when freight, service, and rebates are factored in. In Growth Commander, you might implement differentiated policies for those, like a small-order surcharge or moving them to a distributor model. We leverage optimization science to simulate these moves. Think of Phase 3 as bringing in the science of pricing once the art and discipline are handled. Techniques could include: price elasticity analysis, competitive price benchmark studies, AI-driven deal scoring (identifying which deals you could charge more on without losing), and even predictive analytics to anticipate where margin leakage might recur.

For example, one mid-market electronics manufacturer used advanced analytics in Phase 3 to analyze win rate versus the discount offered across thousands of quotes. The model found that for a given product line, a 5% price increase would reduce win probability by only ~1% (i.e., highly inelastic), suggesting an opportunity to raise prices safely. They implemented this targeted increase, which immediately improved margins on that line while the volume held steady – a pure profit win. In other cases, Growth Commander might involve refined quote-to-cash processes such as integrating a CPQ (Configure-Price-Quote) system that embeds all your pricing logic and guardrails, or introducing a “deal desk” for complex deals empowered with data-driven guidance on upsell/cross-sell, etc. The endgame is to transform pricing from a one-time cleanup into a continuous profit-optimization engine.

By Phase 3, companies often adopt tools or even lightweight software solutions (though mid-market firms can avoid the “7-figure enterprise tools” by using RGM-as-a-service models like Revify’s that provide analytics without massive IT projects ). The payoff is significant: organizations that reach this level of pricing maturity outperform their peers by 5 to 11 percentage points on average in profit margins. Pricing becomes a competitive advantage, not just an internal fix. You’re now in a position to implement dynamic strategies such as targeted value-based pricing (charging different segments based on value), promo optimization, and more, while maintaining the strong governance established in earlier phases.

To summarize the journey: Phase 1 (Diagnostic) gives you the insight and plan, Phase 2 (Quick Wins Execution) fixes the leaks and builds muscle memory, and Phase 3 (Advanced Optimization) accelerates you into best-in-class pricing performance. At each step, your team’s capability and confidence grow. Mid-market companies often find this phased approach much more practical than a big-bang pricing transformation. It delivers quick ROI (Phase 2 funds itself through margin gains) and establishes sustainable processes for long-term success, aligning with Revify’s philosophy of “actionable insights in days, not years.”

Quick Wins and Timeline to Impact

A key advantage of pricing quick wins is their rapid impact. Unlike large IT projects or strategic initiatives that require years, quick wins deliver measurable results within weeks. Below is an overview of improvements achievable in the next few weeks, along with the typical timeline and KPIs to expect.

What You Can Improve in Weeks (Not Months)

With focused effort, many pricing issues can be addressed within two to six weeks. Based on industry best practices and our experience, the following are some of the fastest quick-win opportunities for various business types:

- For Manufacturers: Standardize and tighten internal pricing policies. Manufacturers often have legacy price lists and custom deals that haven’t been updated in years. A quick win is to standardize discount structures and enforce price list consistency across regions or customers. For example, if two distributors are similar but one somehow negotiated a 15% lower base price, correct that inconsistency in the next round of orders or agreements. Also, implement surcharges or escalators for volatile costs (such as material or tariff surcharges) so you’re not absorbing cost increases. Many manufacturers can also reduce unprofitable deal exceptions by setting clear walk-away points – e.g., if a large special contract must be below a certain margin, it shouldn’t be pursued unless offset by volume guarantees. Quick wins in manufacturing often revolve around bringing discipline to a historically cost-plus environment, so actions like “no deal below X% margin without CFO sign-off” can be huge. One manufacturing company introduced a modest price floor on its top products (e.g., no units sold below $20) and immediately saw a 2.3% revenue increase in the first quarter, with no loss of volume – pure margin dollars gained by simply eliminating the most extreme underpriced deals.

- For Distributors: Streamline pricing on your broad SKU/customer matrix. Distributors often have thousands of SKUs and many small customers, which leads to pricing complexity and variability. Quick wins here include tightening discounting, especially on long-tail SKUs (low-volume items where sales tended to give bigger discounts to move inventory – set a policy to limit that). Also, fix outdated customer-specific price overrides: if customer A was given a special price last year that no longer makes sense, reset it to a more standard tier. Distributors can benefit greatly from reducing freight and credit leakage – e.g., enforce freight charges on small orders or automatically stop offering free shipping unless a threshold is met. If your analysis shows you gave away $100k in uncharged freight last quarter, that’s a quick win to start charging or adjusting terms. Another big win area is enforcing quote approval thresholds: for example, require any quote with a total discount of over, say, 30% or a margin below 5% to go through a deal desk. This catches the really margin-destroying deals before they go out the door. In one distribution case, implementing such thresholds and reviewing outlier quotes weekly led to a substantial drop in negative-margin sales. Additionally, distributors often find customer segmentation a quick win: perhaps small “C” customers are getting prices nearly as low as A customers due to one-size-fits-all pricing. Implementing segmented pricing (charging smaller customers a bit more to reflect their higher cost-to-serve) can boost margins within weeks on new orders. These changes don’t require new software; they just require better use of the current ERP pricing logic and clearer communication to the sales team.

- Universal Quick Wins: Regardless of industry, some quick wins are universally applicable:

- Build a simple price waterfall if you haven’t already. This is more of an analysis tool, but it’s a quick win in insight: map your list price -> invoice price -> net price (after rebates/credits) -> pocket margin. Doing this by segment or product will immediately highlight where the biggest leaks are . For example, you might find that most of the leakage is occurring in off-invoice rebates given to certain customers or in excessive free freight. That tells you where to act first.

- Set discount guardrails (bands and floors as discussed). This is often the single fastest win most companies can implement: establishing discount bands and floor prices, with appropriate approvals, can often be done in a week of policy-making and another week of system setup. It’s fast and tends to yield immediate margin protection.

- Clean up “neglected” pricing elements: this might include expired promotional prices still in effect, outdated cost data (update your cost basis if costs rose so that cost-plus pricing isn’t underpricing), or inconsistent tier pricing. Simply auditing your price lists and discounts and removing anomalies can recover margin.

- Stop the bleeding on obvious losers: If there are SKUs or customer deals you know are unprofitable (e.g., below cost), address them now. Options include raising the price, packaging them differently, or even discontinuing if possible. Quick wins are not about across-the-board hikes; they are about targeted fixes. By focusing on the worst offenders, you gain margin with minimal risk to volume (since these were likely your least profitable sales anyway).

Companies can often implement several quick wins simultaneously. A typical initiative may follow this timeline: Week 1—build the price waterfall and identify key leaks; Week 2—design new guardrail policies and secure internal alignment; Week 3—configure systems and train sales on new rules; Weeks 4-5—pilot changes with a subset and monitor results; Week 6—roll out broadly. Many technical changes, such as updating price floors or discount settings, can be completed quickly. The primary lead time involves communication and securing buy-in. As a result, measurable impact is often seen within one month to one quarter.

Typical KPIs and Timeline to Impact

Once quick wins are in motion, what metrics should you track and what results can you expect? Here are typical KPIs and how they move as quick wins take effect:

- Net Price Realization – This is the percentage of your target or list price that you actually “realize” after all discounts. Formally, it can be defined as Actual Net Price ÷ List Price (or ÷ Target Price). If you had been realizing only 80% on average (meaning a 20% effective discount), you might see this creep up to 82-85% with guardrails in place. Improved net price realization is a primary success metric for quick wins . Even a few percentage points gain here is huge in profit terms. We’ve seen quick-win programs lift net price realization by ~2-4 points within a couple of months, depending on how leaky things were to start.

- Discount Rate / Variance – Measure the average discount given (as a % of list) and the standard deviation or variance. Quick wins should lower the average discount (by cutting extreme discounts) and shrink the variance (prices for similar deals become more consistent). For example, if discounts ranged from 0% to 50% at random, after guardrails, you might see most discounts fall into a tighter 0-20% band, with only rare exceptions beyond. A more consistent discount pattern indicates pricing is under control and not left to whims.

- Override Rate / Exception Count – This tracks how many deals needed special approval or fell outside standard pricing. Initially, when you introduce new rules, this might spike (as legacy behavior triggers approvals). But over a few weeks, as salespeople adjust, the override rate should trend down. If, say, 30% of quotes were being manually adjusted or overridden before, you could aim to cut that in half. A declining override rate (with stable sales) means the team is adhering to the pricing guardrails and fewer deals require management intervention. It’s a sign of efficiency and discipline.

- Gross Margin and EBITDA – Of course, the ultimate metric is profit. Quick wins often show up first in gross margin dollars (you capture more revenue per sale). Gross margin percentage might increase as well, but watch the dollars (total gross profit) to account for volume. A successful quick win program might, for example, increase gross margin from 30% to 33% on a product line, and when multiplied by revenue, that’s a significant EBITDA lift. Many mid-market firms see a 1-3% EBITDA uplift from initial pricing quick wins, as reported in case studies and benchmarks . These improvements often materialize within one pricing/buying cycle – for a business that quotes daily, you see it in weeks; for one on quarterly contracts, it might be a quarter or two.

- Win-Loss Rate / Volume – It’s important to monitor if your quick wins have any negative impact on sales volume or win rates. Ideally, a well-executed pricing improvement will hold volume steady (or even improve win rates in some cases, because a more confident pricing approach can build customer trust). For example, after eliminating extreme discounts, you might fear losing some price-sensitive customers. Monitoring win rate by segment will tell you if that’s happening. In many cases, companies find no significant loss of volume, because the quick wins target areas that were unnecessary giveaways. However, if you do see a dip in win rate in a certain segment, you can respond (perhaps that segment needs a different approach or more value communication). Generally, if quick wins are targeted (not across the board), they often reduce sales of unprofitable volume (which is okay to lose) while protecting or even enhancing profitable volume. One best practice is to segment your customers by strategic importance and price sensitivity: ensure that any price increases or tightened discounts avoid your truly strategic, price-sensitive accounts (for them, you might grandfather current terms initially), and focus on the tail or less sensitive group. That way, you avoid unwanted churn. As a rule of thumb, watch customer churn; if it stays normal while margin improves, you’ve hit the sweet spot.

Most companies will see some quick wins in the first month or two (for instance, an uptick in monthly margins). By 2-3 months in, the financial impact is clear and can be reported – e.g., “We added $500k to gross profit this quarter through pricing actions, with no volume loss.” Within 6 months, the new pricing discipline should be the “new normal,” reflected in improved quarterly earnings. Many public companies even comment on price realization or pricing actions that contribute to margins in their earnings calls, which shows how impactful this can be. The beauty of quick wins is not just the immediate profit bump, but the foundation they lay. Once leadership sees the tangible ROI – say, a 10x return on the effort spent – it builds support for continuing the pricing capability journey (moving into more optimization, investing in tools if needed, etc.).

Getting Started

Ready to pursue your pricing quick wins? While getting started may seem challenging, a systematic approach makes the process straightforward. The following steps outline how to launch a quick-win pricing initiative and begin building your pricing capability.

Start Your Profit Diagnostic

The best first step is to start with a Profit Diagnostic – essentially, measure and locate your margin leaks. You can do this internally if you have the talent, or engage experts like Revify. Gather a recent set of transaction data (last 6-12 months of sales is usually plenty). Make sure you have fields like list price, invoice price, any discounts or rebates applied, costs, customer ID, product ID, etc. With this data, build a basic price waterfall analysis. Even a simple chart or Excel analysis can work: for each major product or segment, calculate how you go from list price to net price . If you’re not sure how to visualize it, imagine a bar that starts at 100% (list price), then subtract a bar for average discount, another for rebates, and, if applicable, one for freight or payment terms, and see the remainder (pocket price). This will highlight, for example, “We give an average 15% off in discounts and another 5% in rebates, ending up with ~80% of list as the pocket price.” Compare this across segments: maybe small customers are actually getting 30% off, whereas large ones get 18%. These insights are gold – they directly point to where quick wins lie (e.g., tighten that 30% leak for small customers). If doing this analysis in-house is challenging, consider a quick pricing assessment engagement. Outside specialists can often complete a pricing X-ray in a couple of weeks and present you with the findings succinctly .

Once you have the diagnostic insights, secure leadership buy-in on tackling this. Explain the concept of pricing quick wins: that these are not massive price hikes or risky moves, but targeted improvements and governance changes that are proven to yield profit. It helps to share external evidence or case studies: for instance, cite that companies leading in pricing outperform peers by up to 11% in margin, or that tightening discount guardrails improved realized price with only small changes in volume. Emphasize this isn’t about gouging customers – it’s about stopping self-inflicted profit loss. With executive sponsorship (especially from the CEO or CFO), you’ll have the mandate needed to enforce changes.

Next, assemble a cross-functional team for the quick-win project. Include someone from finance/pricing (to lead analysis and rule-setting), someone from sales (to provide field perspective and champion it to the reps), and IT or operations if system changes are needed. Keep the team nimble – this is a sprint, not an endless committee. Define the specific quick wins you’re going after, and assign owners and timelines to each. For example: Finance to implement a new price floor in the ERP by X date; Sales Ops to update the discount guidelines document and roll out training by Y date; Sales Manager to monitor compliance and gather feedback for the first Z weeks. Having clear owners ensures things don’t slip through cracks.

Before flipping the switch on changes, communicate openly with your sales team. They need to understand why these quick wins are being done and how it helps the company (and even helps them earn better commissions on higher margins). Address their concerns – for instance, a common fear is “Will tighter pricing make us lose deals?” Explain the analysis that shows where we can win and where we were underpricing. Perhaps implement a short pilot or trial period to show the impact. Arm them with talking points for customers if needed (“Our company is standardizing pricing to ensure fairness and sustainability, which means you’re assured consistent terms and continued product investment from us.”). When sales teams are treated as partners in the change, not adversaries, the rollout will be much smoother .

Finally, use early quick-win successes to build momentum. When positive results are achieved, such as increased margins in the first month, communicate these outcomes to the team and leadership. Highlight the tangible benefits, such as additional profit available for reinvestment. This positive reinforcement encourages continued engagement and supports future pricing initiatives, allowing you to proceed from a position of demonstrated success.

Implementing pricing quick wins does not require a large budget or new software platforms. Success depends primarily on data, analysis, and decisive action. If you are unsure where to begin, Revify’s Profit Diagnostic service can help identify opportunities within a 10-day sprint. The most important step is to start promptly. Delaying action results in lost margin and competitive disadvantage. By initiating your profit diagnostic now, you can realize the benefits of quick wins within the current quarter.

(For a detailed step-by-step on running a pricing sprint and aligning your team, see our guide on Budgeting for a High-Impact Pricing Initiative, which covers how to avoid common pitfalls when planning pricing improvements.)

FAQs

Q: What are pricing quick wins in B2B manufacturing and distribution?

A: They are fast, practical pricing actions—like tightening discount rules, correcting inconsistent price lists, and enforcing approval thresholds—that improve your realized margins in a matter of weeks using data you already have. Instead of a long transformation, quick wins focus on immediately plugging profit leaks (e.g., unwarranted discounts, unchecked rebates, free freight giveaways) and instilling basic price discipline. For example, a manufacturer might quickly standardize its discount terms across all sales regions to stop ad-hoc deals, or a distributor might set a floor price on certain SKUs to prevent selling below cost. These changes don’t require new software or heavy infrastructure; they leverage your existing ERP/CRM with some added rules and governance. The result is you stop margin leakage fast and see higher net prices without waiting for a big project to finish.

Q: What is the fastest pricing quick win most companies can implement?

A: The single fastest quick win is usually to set and enforce discount guardrails. This means establishing clear discount bands, floor prices, and approval thresholds on quotes and orders, then tracking any exceptions. For instance, you might decide that sales reps can offer up to, say, 10% off freely, but anything beyond 10% up to 20% requires manager approval (and nothing over 20% is allowed without executive sign-off). By configuring this in your quoting system and communicating it to the team, you immediately eliminate extreme discounts and ensure oversight of deeper cuts. Companies can roll out such guardrails literally in days – it’s often a matter of updating pricing policies in the system. Once in place, monitor the exceptions in a weekly report. This quick win closes the door on “random acts of discounting” and typically yields a quick bump in margins, as deals that would’ve been given away cheaply are now sold at a more reasonable price or require justification .

Q: How do you find pricing quick wins quickly?

A: To find quick wins, start by building a simple price waterfall and segment analysis. Take your recent sales data and break down how your list price “leaks” into net price: identify discounts, rebates, free freight, credit terms, etc., that reduce your realized price. Then segment that data by key dimensions – for example, by customer type, by product family, by region, or channel. You will usually see patterns emerge: perhaps certain customer segments have much deeper average discounts, or one product line has many rebates that reduce its net price. These patterns point to quick wins. If Segment A consistently gets 25% total discounts versus Segment B’s 10%, ask why – if A isn’t strategically more important, you likely have an opportunity to tighten that up. Focus on the biggest, most controllable leaks first. If your waterfall shows rebates are a huge margin drain, but they’re contractually set for a year, you might instead focus on discretionary discounts, which you can control tomorrow. Also, talk to front-line folks: sales reps and customer service can often tell you where “we’re leaving money on the table.” Maybe they know customers who would have paid more if we’d asked, or frequent giveaways that no one questions. Those are quick wins too (stop doing that and capture the value). In short, use data to pinpoint the largest profit leaks and target those that can be fixed with a policy or price change right away .

Q: Do pricing quick wins require new pricing software?

A: No—most quick wins can be executed with the tools and systems you already have. Pricing quick wins is less about technology and more about rules and governance. For example, you can implement approval workflows for discounts in many standard ERP or CRM systems (or even via a manual sign-off process in email if needed). You likely have reporting capabilities to track sales and margin – use them to monitor the impact. New pricing software (such as price optimization or CPQ systems) can be great for advanced optimization (Phase 3 of the journey), but it is not a prerequisite for Phase 1 and 2 quick wins. In fact, one common misconception is “we need a fancy pricing tool to do better pricing.” The reality is you can start with simple changes: upload a new price list, adjust existing discount matrices, configure existing approval settings, etc. Many companies achieve significant margin improvement without any new software, just by better using their current ERP’s pricing module and by enforcing process discipline . The motto here is “process over platform” initially – fix the process and governance, prove the value, then consider tools to scale it further. This is good news for resource-strapped mid-market firms: quick wins are a low-cost, high-return endeavor.

Q: What metrics prove a pricing quick win is working?

A: Key metrics to watch include:

- Net Price Realization – the increase in net price realization (actual net price vs. target or list). If you start capturing, say, 85% of the list on average instead of 80%, that’s a clear win .

- Discount and Override Rate – a drop in the average discount percentage and a drop in the frequency of special approvals/overrides indicate the guardrails are holding, and fewer margin concessions are being made.

- Gross Margin Dollars – the increase in gross profit dollars (and margin percentage) attributable to pricing. You should see a higher gross margin on sales of the products/customers you targeted, without a big drop in volume.

- Win Rate and Volume Stability – maintaining a stable win rate (or only a very slight dip in some areas) while margins improved is evidence that the quick wins did not unduly harm sales. For example, if your win rate stays around 30% but now each win yields more profit, that’s a success.

- Fewer Unapproved Exceptions – if you had many “rogue” deals before, a successful quick win program will show fewer and fewer deals outside the approved guidelines. Salespeople adapt to the new rules and still close deals, meaning the quick wins were absorbed smoothly.

- EBITDA or Contribution Margin – ultimately, improved EBITDA is the goal. If your pricing changes add, say, $1M to the bottom line on an annualized basis, that’s a very concrete proof point. CFOs often validate pricing initiatives by isolating margin improvement in financial results.

- In practice, within a month or two of implementing quick wins, you might report, for example, “Net price realization improved from 78% to 82%, our average discount fell by 3 points, and gross margin grew by $200k versus last quarter while volume held steady.” Those kinds of numbers prove the quick wins are working.

Q: How long do pricing quick wins take to show results?

A: Many quick wins show measurable impact within 2–6 weeks, depending on your sales cycle. Some changes can literally have an overnight impact – for instance, if you raise the price on a set of SKUs effective Monday, you’ll start seeing higher margins on those SKU sales immediately. However, to be safe, consider the typical quote or order cycle. In businesses with daily transactions (e.g., distribution with frequent orders), you’ll notice results in a month or less. In businesses that work on long-term contracts or quarterly buying cycles, it might be a full quarter before the change cycle goes through. Another factor is adoption: the first week of enforcing new rules may lead to some confusion or pushback, so results might be modest until everyone gets on board. By week 4-6, things normalize, and you can clearly measure the effect. For example, one company piloted new discount rules on a subset of customers and saw override requests drop within 2 weeks as reps learned the new limits, and by week 6 their pocket margins on those customers had improved noticeably. If you have any contracts that lock prices, full realization may wait until those contracts renew – but you often have plenty of non-contract business where quick wins apply immediately. So in summary, many quick wins start contributing within the first month, and nearly all will show up by the end of the second month at the latest. Just be sure to track it closely; seeing the early wins will help reinforce the changes internally.

Q: What are common pricing quick wins for distributors?

A: For distributors, some high-impact quick wins include:

- Tightening discounting on long-tail SKUs: Distributors often carry a vast array of products, and it’s common for lesser-known or low-volume items to be heavily discounted for no strategic reason. Curb this by setting minimum margins or smaller discount caps on those long-tail items.

- Correcting customer-specific price exceptions: Over time, distributors give certain customers special pricing that can become outdated or overly generous. Review these and align them with your standard tiers unless there’s a compelling reason. One approach is to create a “pricing exception cleanup” list and address a batch of them each week.

- Reducing freight and credit leakage: Distribution businesses frequently offer free freight on orders, extended credit terms, or generous return policies, which eat into profits. A quick win is to enforce freight charges on orders below a certain size, or to pass through carrier cost increases rather than absorb them. Also, if you’re not charging late fees or financing costs for long credit terms, consider implementing them or at least tightening eligibility for extended terms.

- Enforcing quote approval thresholds: Given the volume of quotes in distribution, you want to prevent bad deals at the quote stage. Set up rules like “any quote with gross margin below 15% must go to the pricing manager for review” or “discounts above X% require VP approval.” This catches margin killers before they become orders. It also sends a message to the sales team about where the boundaries are.

- Segmenting service levels by customer size: Not every customer should get the same pricing and service. A quick win could be introducing a small order fee or removing free delivery for small customers, as these often cost you money to serve. Alternatively, use a tiered pricing where smaller customers simply pay a bit more per unit (which they often expect in B2B).

- These actions are typically feasible with a combination of policy changes and existing system settings. By focusing on the distribution-specific pain points (like freight, vast SKU lists, and small customer economics), you can see a healthy margin uptick quickly. As a note, when implementing these, communicate changes to customers as needed (e.g., “Due to rising logistics costs, orders under $500 will incur a delivery fee”) – many will accept it, and those that don’t are often unprofitable to serve under old terms.

Q: What are common pricing quick wins for manufacturers?

A: Manufacturers usually benefit from quick wins that impose structure on pricing and patch up inconsistent past practices. Common ones include:

- Standardizing discount structures: If different salespeople or regions have been using their own judgment, implement a uniform discount policy (e.g., standard volume break levels, a global discount authority matrix). This ensures, for instance, your product line A isn’t discounted 5% by one rep and 20% by another for similar deals.

- Fixing price list inconsistencies: Manufacturers often maintain price lists across multiple channels or geographies. Quick win: audit your price lists for any anomalies (two plants selling the same item at different list prices without reason, outdated prices that don’t reflect cost changes) and align them. Even adjusting price lists by a few percent where underpriced can add up, especially if those were legacy prices that no one updated.

- Improving surcharge pass-through: In industries where raw material costs or tariffs fluctuate, manufacturers may implement surcharges (e.g., steel or fuel surcharges). A quick win is to enforce those surcharges systematically – ensure all new orders have the surcharge line item applied and that sales aren’t waiving it. If you haven’t had surcharges, consider adding them when appropriate (customers often accept a transparent surcharge tied to an index rather than an embedded price hike).

- Reducing unprofitable deal exceptions: This includes one-off deals in which a big customer negotiated very low margins or special terms. Quick win approach: review any contracts or customer agreements up for renewal soon – plan to remove or mitigate terms that cause margin loss (e.g., exchange them for less costly alternatives). Even before contracts expire, you can start saying no to new requests that would repeat those concessions.

- Clear governance for special pricing approvals: Many manufacturers have “price desks” or sales management teams approving special prices, but the criteria are often loose. A quick win is implementing strict approval criteria: e.g., any price below a certain margin must include a documented rationale (e.g., competitive pricing proof or volume commitment) before approval. Deals that don’t meet the criteria get adjusted. This prevents the infamous “strategic discount that becomes permanent” scenario .

- Manufacturers also benefit from doing a SKU profitability analysis – often a small percentage of SKUs generate the most profit, while a bunch of SKUs might be sold at a loss. Identifying and addressing those unprofitable SKUs (raise prices or consider discontinuing if non-strategic) is a quick win that can boost overall margin. It’s about enforcing the notion that not all products or customers should be treated equally – you apply discipline to align price with value and cost-to-serve. These quick wins for manufacturers ensure you’re covering costs, capturing value for differentiated products, and not inadvertently subsidizing customers or products that drag down your profitability.

Q: How do you avoid losing volume when raising prices as a quick win?

A: The key is targeted segmentation and thoughtful execution. Quick wins are not blunt, across-the-board price hikes; they are precise adjustments with high confidence of minimal volume impact. To avoid losing volume, do the following:

- Use segmentation and price bands to Identify which customers or products are most price-sensitive versus those with greater flexibility. For example, protect your strategic accounts or highest-volume customers from any significant increase – you might even leave their pricing as is initially (or grandfather them for a period) while you raise prices or tighten discounts on less sensitive segments. By segmenting, you avoid alienating your most important customers.

- Focus on high-discount/low-value transactions first: If a subset of deals is deeply discounted and barely profitable, those are often not your core volume drivers. Tightening up pricing there may reduce some volume, but by definition, those sales weren’t contributing much profit. It can actually improve your business by freeing capacity for more profitable work. Monitor whether the lost volume is mainly the unprofitable kind (which can be a good thing in the long run).

- Communicate value, not just price: When implementing a quick win that raises price (or removes a discount), arm your sales team to communicate the why to customers. Maybe your service levels have increased, or your product has improved, or simply market conditions (input costs, etc.) dictate the change. Customers are less likely to leave if they understand the value they’re getting. Also, highlight any investments or benefits you provide that competitors might not.

- Monitor win-rate and churn indicators closely by segment: As you enact changes, keep a very close eye on whether certain customer groups start buying less or if you’re losing more quotes than before. If you see a worrying trend in a segment, you can course-correct quickly (perhaps you pushed a segment too hard and need to adjust). Often, though, companies find negligible change in win rate when quick wins are well-targeted, because customers either barely notice or are willing to accept the new terms.

- Gradualism for sensitive areas: If you do need to adjust prices for a sensitive group, consider phasing them in (small increments rather than a single big jump) or pairing them with added value. Also, you can trial changes with a small subset to gauge reaction before wider rollout.

- A classic finding is that sales teams often overestimate volume loss from price increases – the fear is greater than reality, especially if done smartly. One technique is to present the changes as benefiting the customer in the long run, e.g. “We’re doing this to ensure we can continue to supply you reliably and invest in quality.” Moreover, by focusing quick wins on margin leaks (which are usually things customers haven’t been explicitly paying for anyway, like free services or excessive discounts), you’re not taking away something they originally demanded – you’re correcting internal inefficiencies. So, with thoughtful segmentation and monitoring, you can raise prices or tighten discounts and actually drop unprofitable volume while keeping your good business intact .

Q: What should a pricing quick-win plan include?

A: A good quick-win plan should include:

- A prioritized backlog of actions: List out all identified quick wins (from your diagnostic) and rank them by impact and ease. For example: 1) Implement discount floor for Product Line X (high impact, easy), 2) Review top 20 customer special prices (medium impact, medium effort), 3) Enforce freight charge policy (medium impact, easy), etc. This acts as your roadmap.

- Assign clear owners to each action: assign a person or team responsible for each quick win. Who will update the price list? Who will adjust the ERP settings? Who will draft the communication to sales/customers? Ownership ensures accountability.

- Defined rule changes: Document the specific rule changes (e.g., “Floor price = 15% above cost for all products,” or “Discount bands: Tier 1 customers max 5%, Tier 2 max 10% without approval”). These should be simple and unambiguous. Also define the approval workflow: e.g., “Deals below floor require CFO approval” – make a flowchart if needed, so everyone understands the new process.

- A weekly (or regular) KPI dashboard: Set up a simple dashboard or report that tracks the metrics we discussed (price realization, margin, override count, etc.). This should be reviewed in a recurring meeting or circulated to stakeholders. It keeps everyone informed on progress and flags issues early.

- An exception review cadence: Plan how you’ll handle exceptions and learn from them. For instance, schedule a meeting or add an “exception review” section to an existing sales meeting. In that, discuss any deals that asked for exceptions: Did we approve or deny? Why? What does that tell us? This is where you refine rules and also coach sales on how to handle similar future cases.

- Communication and training materials: The plan should include how you’ll communicate the changes internally (a sales kickoff call, an FAQ document for salespeople, and maybe cheat sheets on new pricing rules) and, if needed, what you’ll communicate to customers (for instance, a letter about a policy change like freight terms). Ensuring everyone is on the same page prevents confusion that could derail the effort.

- Timeline (2–6-week milestones): Lay out the timeline, e.g., Week 1: data analysis done; Week 2: policy design; Week 3: system changes; Week 4: pilot; Week 6: full rollout, etc. Quick-win plans are fast, so a tight timeline with milestones helps maintain urgency.

- Executive sponsor sign-off: Include a step where the plan (backlog and rules) is approved by an executive sponsor. This way, when enforcement time comes, there’s top-level backing. It’s also wise to decide up front how you’ll handle any pushback – knowing that the CEO or GM supports it gives the project lead the mandate to push through resistance.

- In essence, the plan is part project plan and part governance charter. It aligns people on what we’re doing, who’s doing it, and how we’ll operate going forward. A well-crafted plan becomes the weekly playbook you execute: you tick off quick wins one by one, measure results, and adjust course as needed. It’s also living documentation that can later be used to onboard new team members into “how we manage pricing now.” Many companies treat it as their interim pricing policy manual, clearly outlining guardrails and roles to eliminate ambiguity. Keep it concise, though – the beauty of quick wins is agility, so we want just enough process to be effective without slowing things down.

By focusing on pricing quick wins, mid-market companies can rapidly improve profitability. This approach stops margin leaks, instills discipline, and builds a data-driven pricing capability. The result is both immediate margin improvement and a foundation for scalable growth. Expensive systems or lengthy studies are not required; small, targeted actions using current data can deliver significant results. Begin with a diagnostic, implement guardrails, measure progress, and refine your approach to transform pricing into a competitive advantage.

(For more insights on taking your pricing to the next level, check out our webinar “Taking Pricing Next Level”, and learn how Strategic Price Customization Recaptures Value once you’ve handled the basics. Also, explore Mid-Market AI Pricing: Accessible RGM for Real Results to see how even mid-sized firms can leverage AI after quick wins. And if you’re dealing with imperfect data, our piece on Competitive Intelligence Analytics for Better Pricing Decisions offers practical tips.)

Example: A simplified price waterfall chart helps visualize where margin is leaking – from list price down to net “pocket” price after discounts, rebates, and other concessions. Quick wins often target the largest drops in this waterfall to stop profit leakage.

Key Takeaways:

- Start with visibility: Build a net price waterfall to see where profit is leaking (discounts, rebates, free freight, etc.). More than half of companies don’t take this basic step, but it’s crucial for identifying quick wins.

- Prioritize by impact & control: Tackle the leaks that are both high-impact and within your control – e.g., tightening discounts for certain customers or SKUs, enforcing existing terms, or plugging obvious loopholes. Often, a small subset of customers or deals causes disproportionate margin loss. Focus there first (80/20 principle).

- Implement simple guardrails: Establish price floors, discount bands, and approval thresholds to impose discipline. This creates guardrails for sales without needing new software. Automate these rules in your quoting process, if possible, so compliance is baked in.

- Fix execution before optimization: Address execution issues (inconsistent quoting, unmanaged overrides) before diving into advanced price optimization. Quick wins shore up your foundation – they often fund the deeper pricing initiative and ensure that more sophisticated strategies later (segmentation, dynamic pricing, etc.) aren’t sabotaged by poor discipline. In other words, stabilize margins now to enable growth later.

- Measure and iterate: Use a weekly or monthly cadence to measure net price realization, discount rates, override frequency, margin by segment, and win rates. This ongoing monitoring allows you to fine-tune your approach and sustain the gains . Pricing improvement is not a one-shot deal; it’s a continuous process of learning and enforcement. With each quick win, you’re not only boosting profit but also building the internal capability and confidence to tackle the next level of pricing sophistication.