You think you know who your best customers are. They’re likely the names that top your monthly sales reports, the accounts that command the most attention. But what about all the other customers? Is your internal reporting providing you enough information about those customers as well? Blind spots, gut-feel (i.e. “that customer is doing fine”) and legacy top line reporting is a well-worn path to margin erosion, wasted resources, and preventable customer churn. It’s a quiet but relentless drain on profitability, forcing teams into a constant state of reactive firefighting where they scramble to save accounts they didn’t even know were at risk.

The necessary shift is to move from this reactive guesswork to a proactive, data-driven strategy. The solution is RFM Analysis, a powerful yet pragmatic framework that goes beyond simple revenue rankings and instead provides insights based on spend, frequency of purchases and other factors, showing you precisely who to nurture, who to re-engage, and where your greatest profit opportunities lie. The stakes are high, as research by Harvard Business Review and Bain & Company consistently shows that a mere 5% increase in customer retention can boost profitability by anywhere from 25% to 95%. RFM is your first and best line of defense.

Beyond the Top-Line: Why Traditional Customer Analysis Fails

For leaders in industrial manufacturing, distribution, and CPG, the challenge is rarely a scarcity of data; rather, it’s that their vast digital ecosystems generate a deluge of information that obscures more than it illuminates, creating a frustrating gap between possessing data and possessing answers

They possess mountains of transactional data but struggle to extract actionable intelligence. The default is to rank customers by total sales, but this method is deeply flawed because it ignores the three foundational pillars of true customer value: Recency, Frequency, and Monetary value. When these pillars are ignored, painful symptoms manifest across the organization. These aren’t isolated incidents; they are the direct, cascading consequences of navigating a complex market with an incomplete map.

You are likely feeling these symptoms today:

- Reactive “Panic” Discounting: Your sales team offers deep discounts to a historically “large” customer who has gone quiet, bleeding margin to win back someone who may already have one foot out the door.

- Ineffective, One-Size-Fits-All Marketing: Generic email blasts are sent to the entire customer list. The message, untailored to specific behaviors, results in wasted marketing spend that vanishes into the ether.

- Surprise Customer Churn: You’re blindsided when a supposedly “loyal” customer defects to a competitor. The warning signs were in the data—a gradual decrease in purchase frequency or a drop in order size—but nobody was looking.

- Inability to Pinpoint True Profit Drivers: When the CEO asks, “Who are our most profitable customers?” the team can only point to the highest-revenue accounts, without knowing if those accounts are buying high-margin products or constantly demanding costly services.

While the power of RFM analysis is its universal applicability, its true value crystallizes when applied to the specific pressures of a given sector. Let’s be frank, the challenges are not the same for everyone.

So, if revenue alone is a flawed metric for identifying your best customers, what is the alternative? This is where the elegant, three-dimensional logic of RFM provides a more robust framework for understanding and action.

Deconstructing the RFM Framework: The Three Pillars of Customer Value

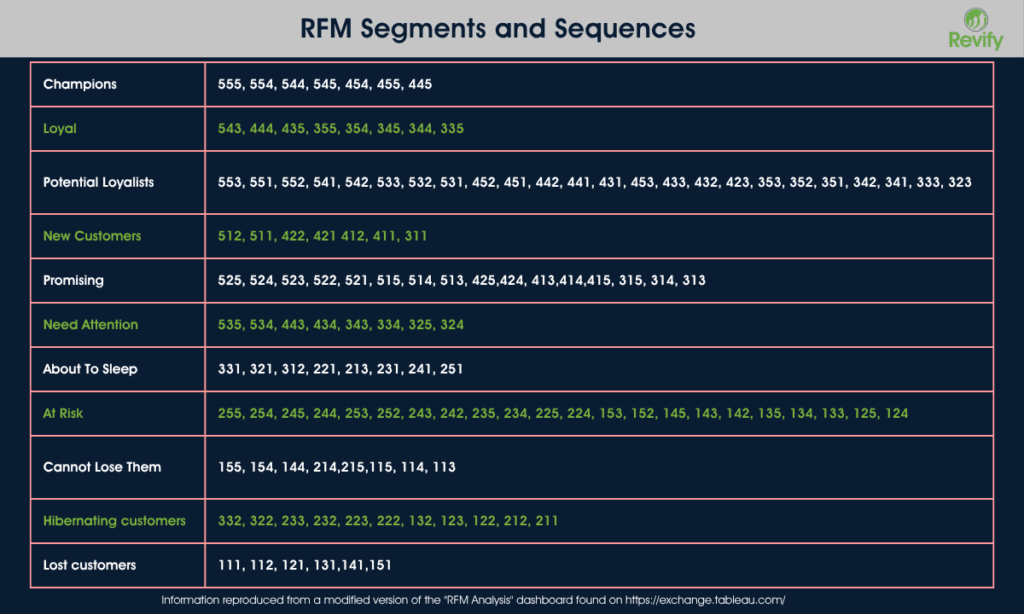

This table defines each customer segment by mapping descriptive names, such as “Champions” or “At Risk,” to the specific three-digit RFM score sequences used for their classification.

RFM stands for Recency, Frequency, and Monetary value. Instead of viewing customers through a single lens, it evaluates them across these three critical dimensions to create a holistic, behavioral profile. Understanding each pillar is the first step toward building a truly data-driven commercial strategy.

Recency (R): The Pulse of Engagement

Recency measures the amount of time since a customer’s last purchase. It is often the single most powerful predictor of future engagement and, conversely, churn. A customer who bought from you last week is far more likely to buy again than a customer who hasn’t purchased in six months, regardless of their past spending habits. A sudden drop in a customer’s Recency score is a major red flag, signaling that they may be testing a competitor or that their needs have changed. Some businesses have a large degree of seasonality in their sales, however when RFM is well implemented it will also account for these patterns.

- Example: A customer who historically placed an order every 30-45 days suddenly has a Recency of 90+ days. This is a critical churn signal that a simple revenue report, which still shows them as a large customer over the past year, would completely miss.

Frequency (F): The Cadence of Loyalty

Frequency indicates how often a customer makes a purchase within a specific time period. It separates your loyal, habitual buyers from occasional, transactional ones. A customer who buys from you 12 times a year in small amounts demonstrates a level of loyalty and reliance on your business that is fundamentally different from a customer who places one massive order every two years. Tracking disruptions in a customer’s established buying cadence is key to proactively managing relationships.

- Example: Customer A buys $1,000 worth of supplies every month like clockwork. Customer B buys one $12,000 piece of equipment once a year. While their annual revenue is the same, Customer A’s high frequency makes them a more stable and predictable part of your business, and any deviation from their monthly pattern warrants immediate attention.

Monetary (M): The Measure of True Value

Monetary value measures how much a customer has spent over a period. However, in a sophisticated RGM model, this goes beyond top-line revenue to consider profitability. True monetary value accounts for the Cost-to-Serve (CTS)—factoring in discounts, rebates, freight costs, and the level of sales and service support an account requires. This ensures you are measuring net contribution, not just gross sales.

- Example: A high-revenue “problem customer” consistently demands deep discounts, requires expedited shipping on every order, and has a high return rate. While their revenue is high, their monetary score based on profitability is actually lower than a mid-sized, self-sufficient customer who buys at list price and rarely requires support.

Understanding these pillars individually is powerful, but their true utility is revealed when applied to the specific pressures and nuances of your industry.

RFM in Action: Industry-Specific Scenarios

For Industrial Distributors: Tracking Wallet Share and Margin Mix

Distributors with massive SKU catalogs often struggle to see the whole picture. RFM helps track not just what customers are buying, but what they stop buying.

- Deeper Example: A distributor sees that a key account is still ordering their low-margin, commoditized bulk chemicals (high Frequency) but has stopped ordering their high-margin specialty fasteners and adhesives (a drop in Monetary value from profitable SKUs). This is a classic sign the customer is now dual-sourcing, giving the high-value business to a competitor while leaving you with the low-value scraps. RFM makes this shift immediately visible.

For CPG Companies: Optimizing Trade Spend and Brand Loyalty

In a market driven by promotions, RFM helps distinguish true brand loyalists from cherry-picking bargain hunters.

- Deeper Example: A CPG company sees two households with the same high purchase volume for their flagship snack brand. RFM analysis, however, reveals one household buys the product consistently week-to-week at various price points. The other household buys four times the quantity, but only when there is a “Buy One, Get One Free” promotion. The first is a loyal customer to be nurtured; the second is loyal only to the deal, and trade spend directed at them may not be building long-term brand equity.

For Private Equity: Accelerating Value Creation

For PE firms, speed to insight is critical. RFM is a powerful diagnostic tool for the post-acquisition 100-day plan.

- Deeper Example: An operating partner uses RFM to triage a newly acquired company’s customer base. They immediately identify the “Champions” to protect, but also find a large group of “Hibernating” customers with high past Monetary value. This segment becomes the target of a quick-win reactivation campaign, providing an immediate lift to the top line while the firm develops longer-term strategies.

The strategic insights are clear, but for many mid-market firms, the practical barrier remains: how do you actually implement this without derailing your team with complex, manual processes?

From Manual Complexity to Automated Clarity: The Revify Approach

For years, the main barrier to effective RFM analysis for the mid-market has been complexity. The “Old Way” involved wrestling with cumbersome spreadsheets—a manual, error-prone, and painfully slow process. The alternative, enterprise-grade software, was often a non-starter due to cost and complexity. This is precisely the gap Revify was built to fill. We are not just a software vendor; consider us your Revenue Growth Management as a Service (RGMaaS) partner. Our platform translates complex data into clear, actionable insights by focusing on tangible outcomes.

- Automated RFM Scoring & Segmentation: Revify securely ingests your transactional data and automatically assigns Recency, Frequency, and Monetary scores to every single customer. This eliminates the manual, error-prone work that plagues so many teams and provides a living, breathing view of your customers, refreshed automatically.

- Visual Segment Analysis: We transform spreadsheets into strategy. Our dashboards allow you to see the size, value, and characteristics of each RFM segment at a glance, making it easy for sales, marketing, and leadership to align on a single source of truth.

- From Insight to Action: Revify doesn’t just show you a problem; we equip you to solve it. Our expert consultants—a core part of every subscription—help you architect the right re-engagement playbook, ensuring insights translate directly into ROI.

Once the platform provides this clarity, the next step is to translate these segments into a concrete plan of action. This is where a strategic playbook becomes indispensable.

The RFM Playbook: From Segmentation to Strategy

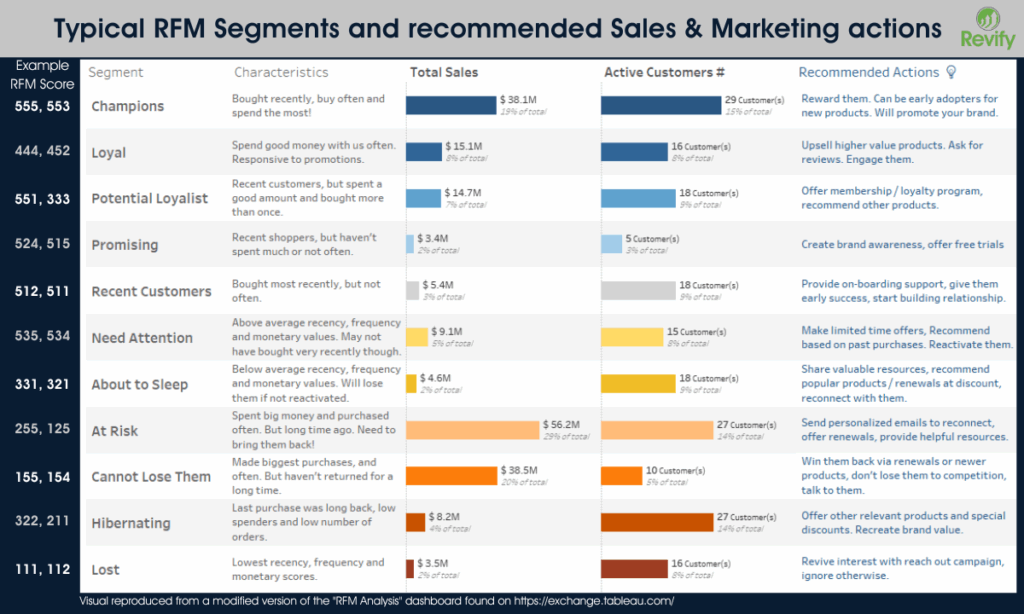

This chart details typical RFM customer segments, illustrating each group’s sales value, characteristics, and the recommended marketing actions to engage them effectively.

Once the platform provides this clarity, the next step is to translate these segments into a concrete plan of action. A visual dashboard provides an immediate, high-level overview of segment characteristics, their value, and the recommended strategic focus for each.

A playbook provides a starting framework for sales, marketing, and leadership to align on a consistent, data-driven response for each type of customer behavior.

Customer Segment Analysis

| RFM Segment | Who They Are (Characteristics) | The Hidden Risk or Opportunity | The Strategic Playbook (Action) |

|---|---|---|---|

| Champions | Your best customers. High R, F, & M scores. They buy your most profitable products and are true partners. | Complacency. Assuming their loyalty is unconditional. Their feedback is a goldmine you might be ignoring. | Reward & Recognize: Don’t just discount. Add value via exclusive access, co-innovation, and use them as a beta group for new products. Publicly celebrate the partnership. |

| Loyal Customers | The bedrock of your business. High Frequency, solid Recency. They may not be your biggest spenders, but their consistency is invaluable. | Being overlooked. Their steady business can be taken for granted while sales chases “shiny objects.” | Nurture & Cross-Sell: Actively solicit their feedback. Systematically introduce them to higher-margin products or adjacent categories. Fortify the relationship to increase wallet share. |

| Potential Loyalists | Newcomers showing promise. They’ve bought recently and have a decent Frequency or Monetary score. This is a critical window. | Early attrition. A poor initial experience—a fulfillment error, a billing issue—could cause them to leave before their full potential is realized. | Onboard & Impress: Flawless execution is key. Provide exceptional post-purchase support. Offer a strategic, personalized incentive to solidify the relationship and train their buying behavior. |

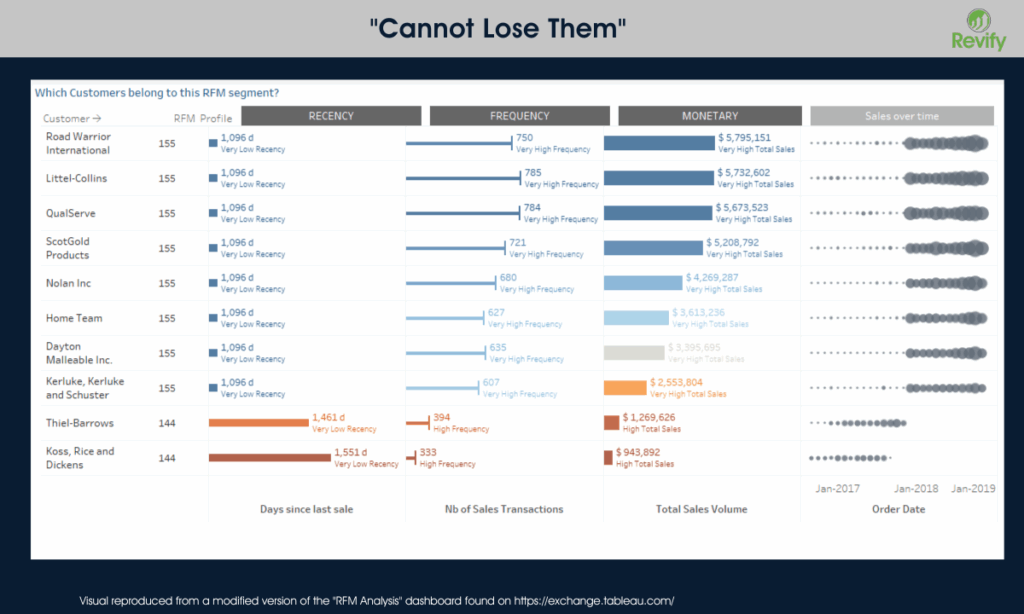

| Cannot Lose Them | High Frequency and Monetary value, but low Recency. They were Champions or Loyalists, but have gone quiet. A red flag. | Silent Churn. They are actively being courted by a competitor, are deeply dissatisfied, or their needs have changed. Their loss would be a major financial and strategic blow. | High-Priority Re-Engagement: Trigger immediate, personal outreach from a senior sales rep. Conduct a root cause analysis: was it a service failure, a competitive price play, or a personnel change? |

| Hibernating | Low scores across the board. They may have been valuable long ago but haven’t engaged in a meaningful way for a long time. | Wasted resources. Continuing to invest significant sales and marketing effort here is a classic misstep that drains resources from higher-potential segments. | Automated Reactivation & Pruning: Target them with a compelling, automated promotion via a low-cost channel. If they don’t re-engage, strategically prune them to focus resources where they will have an impact. |

A playbook provides the tactics, but sustainable growth comes from integrating this process into a continuous business rhythm, creating a self-reinforcing cycle of improvement.

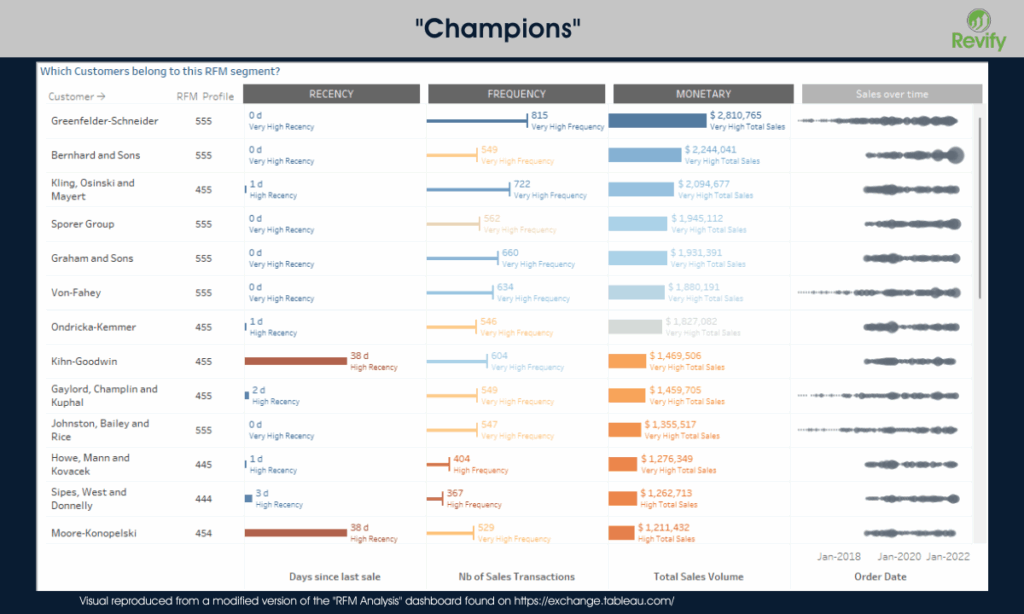

This detailed dashboard showcases individual customers within the “Champions” segment, illustrating their top-tier value with very recent purchases, high transaction frequency, and significant total sales.

This is where RFM analysis delivers its most urgent value—the early warning signal for churn.

The view below shows the stark reality of the “Cannot Lose Them” segment: these were once great customers who are now on the verge of being lost forever, a fact that is invisible in standard sales reports.

Building the Commercial Flywheel: Your Blueprint for Success

RFM analysis is not a one-off project; it is the engine of a commercial flywheel that builds momentum over time. The insights from your RFM segments don’t live in a vacuum. They become the targeting criteria for your pricing actions, the justification for your trade spend, and the priority list for your sales team. This is how you build a true commercial flywheel, where customer insight directly fuels profitable action, which in turn generates more data. But this strategic vision is only achievable through a pragmatic and structured implementation—a journey that many fear is fraught with complexity.

Our approach is designed specifically to mitigate the common pitfalls of analytics projects—dirty data, lack of buy-in, and IT bottlenecks.

- Assessment & Secure Data Onboarding: The process begins with a data health check, where we help you identify and understand the quality of your source data. We guide your team on exactly what we need and why, preventing the typical IT logjam.

- Tailored Configuration & Automated Analytics: We configure the platform and our proven RFM models to your business, taking the technical burden off your team.

- Rapid Deployment: Most Revify clients are live and seeing their own data in our dashboards within 1-2 weeks, not months.

- Hands-On Training & Immediate Impact: We ensure your team understands how to use the insights. Our initial diagnostic review is designed to spotlight the biggest quick wins for generating fast, demonstrable ROI.

- Continuous Improvement & Coaching: The journey doesn’t end at deployment. Through ongoing strategy sessions with our RGM experts, we help you evolve your tactics, ensuring you build a lasting, data-driven capability.

Your Invitation to Clarity

Ultimately, the goal of a framework like RFM is to replace guesswork with confidence. It’s about gaining a clear, objective understanding of your customer base so you can make smarter, more deliberate decisions about where to invest your team’s time and your company’s resources. This approach allows you to move beyond reactive problem-solving and begin proactively shaping your growth trajectory. We recognize, however, that moving from the theory presented in an article to practical application is often the biggest hurdle. The data can feel complex, and building a case for a new approach requires a clear path to value.

Take the Next Step

If the challenges and solutions discussed in this guide resonate with you, we invite you to have a conversation with us. This isn’t about a high-pressure sales pitch, but rather a frank discussion to see if our approach is a genuine fit for your business. It’s an opportunity for us to learn about your specific situation and for you to see firsthand how our blend of an intuitive platform and expert guidance truly works. Let’s explore how you can gain the clarity you’re looking for and build a more predictable, profitable path forward.

Connect with our team to discuss your challenges and see if a partnership with Revify is the right next step for your company.