In B2B, customer attrition is rightly called a silent killer of growth. Research from Bain & Company shows that increasing customer retention by just 5% can increase profits by 25% to 95%. Yet, many businesses remain agnostic to closing this growth leakage: according to extensive research by Gallup, in a typical B2B company, a staggering 71% of customers are either indifferent or actively disengaged, leaving them vulnerable to competitors.

While many companies focus on predicting long-term customer defection, they often overlook the more fundamental truth: many customer relationships are doomed from the start. They don’t fade away over years; they become unprofitable or are lost within the first few months because of a broken “commercial onboarding” process—the critical first 90 days where the terms of a new B2B relationship are set.

This leads to a clear, data-supported thesis: For mid-market B2B companies, significant customer attrition is not a long-term retention challenge but an acute failure within the first 90 days of the commercial relationship. The root cause is a reactive, inconsistent approach to initial pricing and account setup that fails to establish a foundation of profitability and mutual value. The only sustainable path forward is to adopt a proactive Revenue Growth Management (RGM) discipline that treats the start of every customer relationship as the strategic inflection point it truly is.

If your customers don’t experience a partnership grounded in clarity and demonstrable value within that initial window, they won’t stick around long enough for your long-term retention models to matter. It’s time to stop trying to predict customer loss and start preventing it from the source.

Dismantling the Status Quo: The Anatomy of a Failed Commercial Onboarding

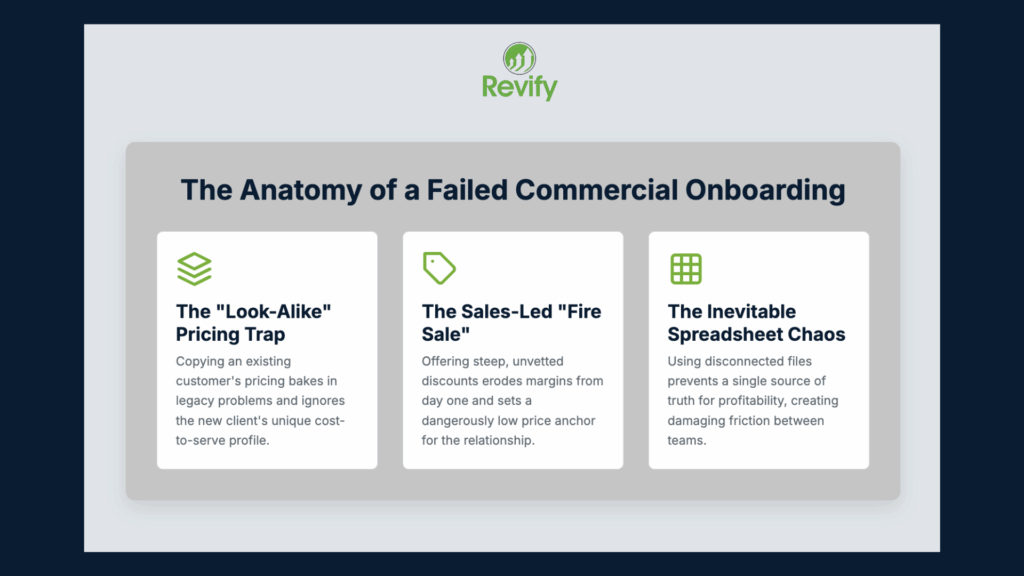

Before we can architect a better way, we must be brutally honest about the current process. This isn’t a theoretical problem; customers feel it acutely. A recent study by Wyzowl found that over 90% of customers feel that the companies they buy from ‘could do better’ when it comes to onboarding. This widespread dissatisfaction stems from three critical breakdowns.

1. The “Look-Alike” Pricing Trap

The first question asked when pricing a new customer is often, “Who are they like?” The sales team, under pressure to deliver a quote quickly, finds a similar existing customer and essentially copies their pricing structure. This approach is a shortcut to failure. It actively bakes legacy problems, past mistakes, and unexamined discounts into a brand-new relationship. More critically, it ignores the unique cost-to-serve profile of the new client. Does this customer require more frequent, smaller deliveries? Do they need specialized support? Are their payment terms slower? By treating them as a clone of an older account, you completely miss the opportunity to price for the reality of the partnership, starting the relationship on uneven footing.

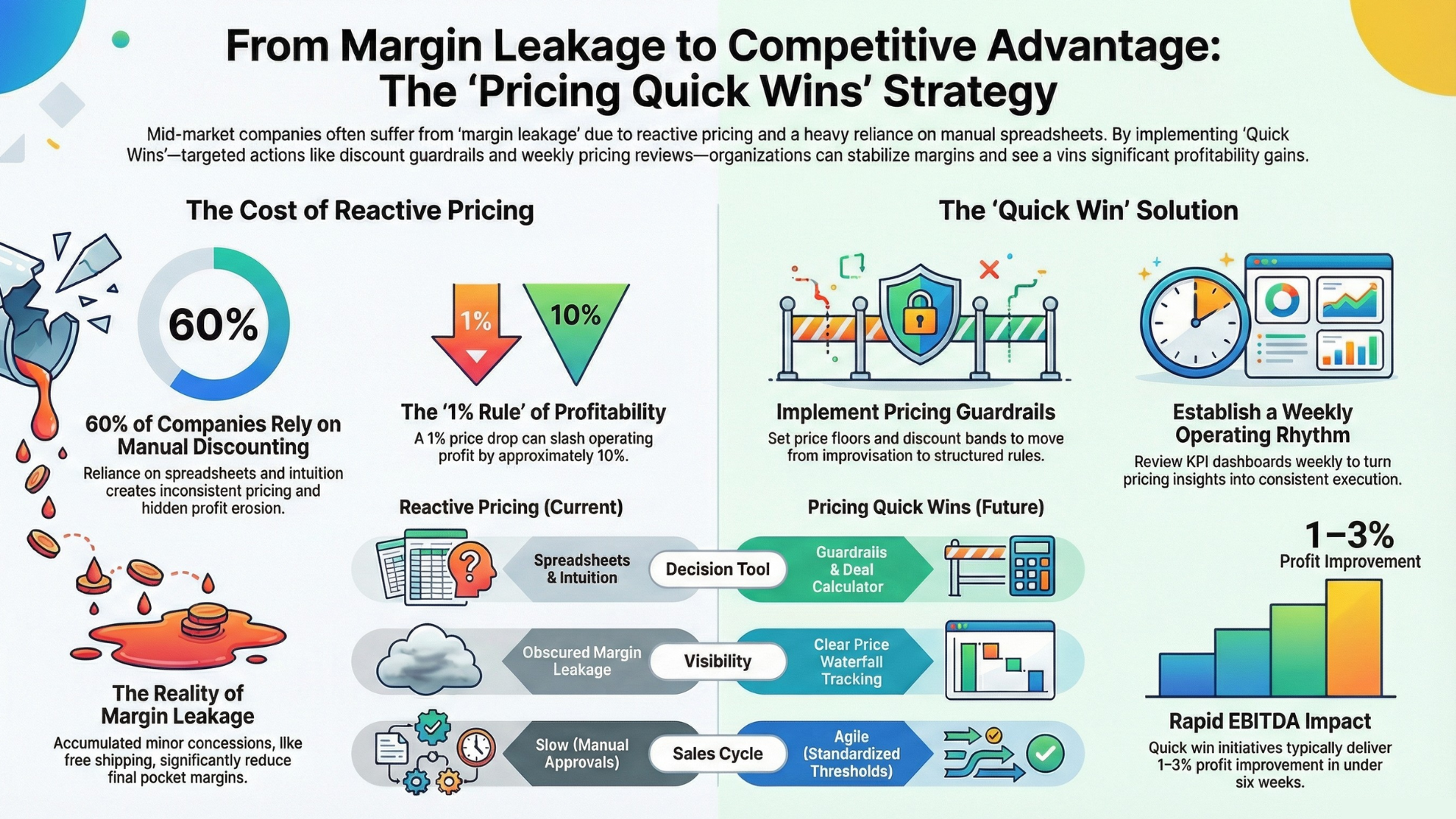

2. The Sales-Led “Fire Sale” to Close

In the trenches of a competitive deal, the primary objective is to get the signature. This often leads to reps offering steep, unvetted introductory discounts—the origin of the “panic discounting” that plagues so many businesses. While it may secure the win, it directly erodes gross margins from the very first invoice. Worse, it sets a dangerously low price anchor, psychologically devaluing your offering from day one. Any future attempt to align the price with the true value delivered will be perceived not as a correction, but as a punitive price hike, creating friction and distrust.

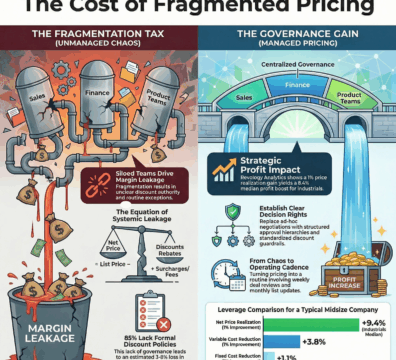

3. The Inevitable Spreadsheet Chaos

The core operational tool holding this fragile process together is almost always the spreadsheet. This is where profitability goes to die the “death by a thousand cuts.” A discount is tracked on one tab, a rebate on another, freight costs in a separate file, and payment terms in an email chain. This isn’t a niche problem; it’s an epidemic. The Revology Analytics 2025 RGA Maturity Report found that a staggering 51% of companies don’t even have a price waterfall—the foundational tool for tracking every deduction from your list price down to your pocket profit. Without this, there is no single source of truth. Version control becomes a nightmare, creating damaging friction between sales, who believe they delivered a great new account, and finance, who sees a new drain on profitability.

The cumulative effect is a relationship built on a foundation of sand. The customer is “won,” but they may be unprofitable, demanding, and already on a path to defection. The first 90 days have passed, and instead of building a strategic asset, the company has acquired a liability.

The Cultural Cost of a Broken Start

Beyond the financial leakage, a flawed onboarding process inflicts a heavy cultural toll. When a new account immediately underperforms, a toxic internal blame game begins. Finance accuses Sales of giving away the margin. Sales blames Operations for a high cost-to-serve or the pricing team for a lack of flexibility. Customer Service is caught in the middle, dealing with a confused and frustrated new client whose reality doesn’t match the promises made during the sales cycle. This constant friction erodes morale, hinders collaboration, and fosters an environment of siloed thinking where each department optimizes for its own metrics at the expense of overall company profitability and customer health.

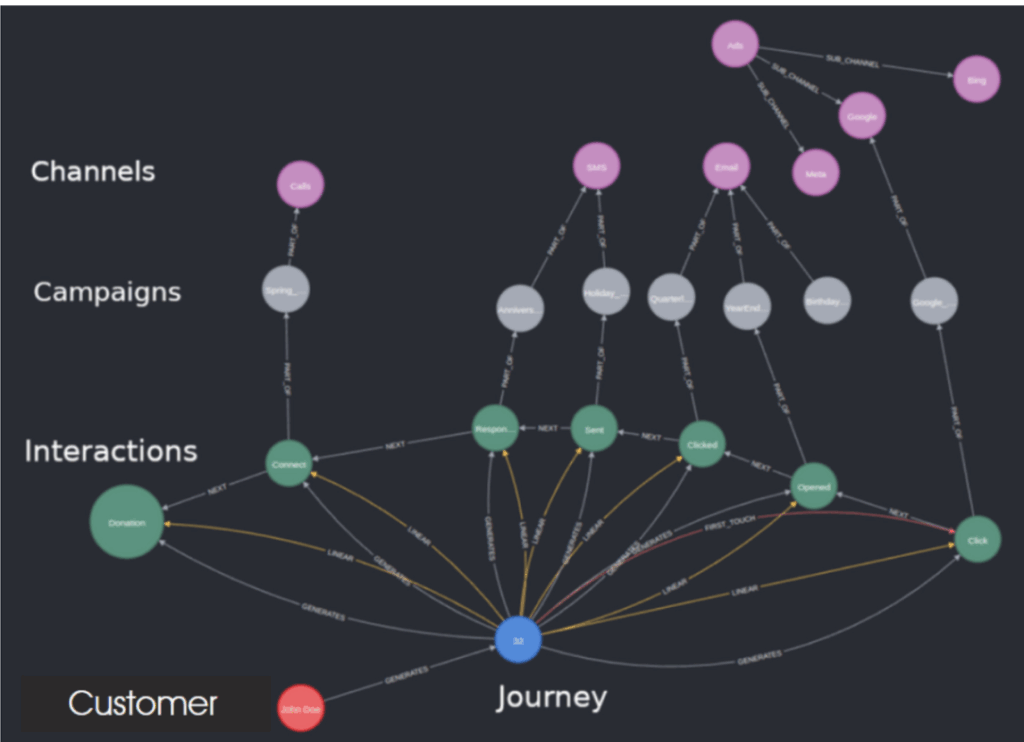

Through the Customer’s Eyes: An Onboarding of Broken Promises

This customer journey graph visualizes the intricate network of interactions, campaigns, and channels that a customer navigates, connecting their starting point to their ultimate actions.

Now, consider this journey from the customer’s perspective. They chose you over your competitors based on a compelling vision of partnership and value. Then the onboarding begins. Their first invoice is confusing, filled with unexpected surcharges or a discount structure that doesn’t match their verbal agreement. When they call for support, they learn the “premium service” they thought they were getting has limitations. The seamless experience promised by the sales team dissolves into a series of transactional headaches. This early disconnect shatters trust. The customer learns that they are not a valued partner but merely a number on a spreadsheet, and they begin mentally composing their exit strategy long before their first contract is up for renewal.

The Superior Methodology: Architecting the First 90 Days with RGM

To escape this cycle, we must reframe onboarding as the strategic implementation of a new commercial relationship. This proactive methodology is the essence of modern RGM, and its value is confirmed by customer sentiment. The same Wyzowl report revealed that 88% of people say they’d be more likely to stay loyal to a business that invests in a high-quality onboarding experience.

This discipline is built on three core principles applied within that critical 90-day window.

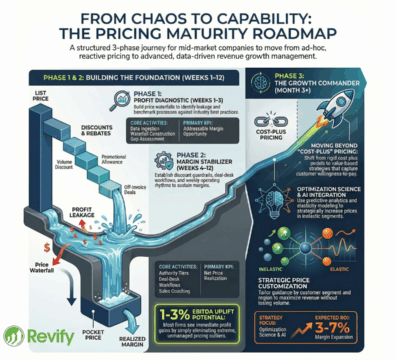

Principle 1: Price for Profitability, Not by Analogy

Instead of asking, “Who is this customer like?” the right question is, “What does a profitable customer in this segment look like, and how does this new customer fit that model?” This requires shifting to a value-based approach grounded in your own data. It means understanding your true cost-to-serve and architecting a price and service structure designed for mutual success. You price not just the product, but the holistic value you provide, ensuring the margin reflects the effort.

Principle 2: Engineer the Pocket Price Waterfall from Day One

A proactive onboarding process doesn’t wait to see what the final margin will be; it engineers the desired margin from the outset. This directly addresses the critical capability gap where half of all companies are flying blind on profitability. It means modeling the entire Pocket Price Waterfall—from the gross invoice price down to the final pocket margin—before the quote is even sent. This visual journey identifies every potential source of price leakage, from off-invoice rebates to freight costs and payment terms, allowing you to build a profitable deal structure by design, not by chance.

Principle 3: Establish a Diagnostic Baseline with Initial Transactions

The first few orders from a new customer are the most valuable data points you will ever receive. They must be treated as a diagnostic tool, not just another set of transactions. Like a doctor establishing a patient’s baseline health metrics, analyzing these first orders provides an immediate, empirical benchmark of the customer’s behavior. Are they ordering the product mix you expected? Is their order frequency aligned with your cost-to-serve model? This analysis allows you to have data-driven conversations and course-correct in weeks, not years, ensuring the relationship stays on its profitable track.

Revify as the Enabler: The RGMaaS Toolkit for a Strong Start

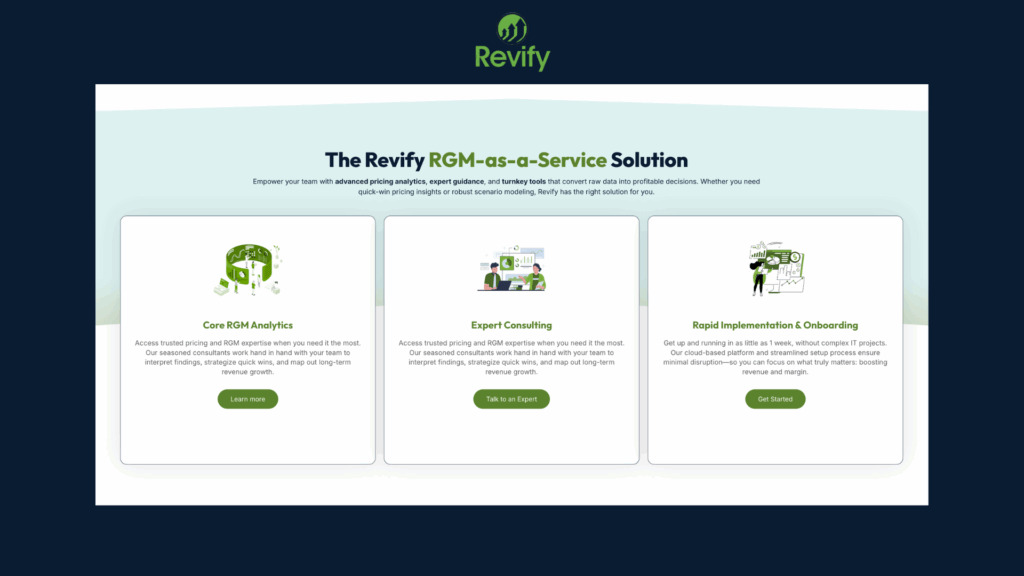

This level of rigor sounds compelling in theory, but for a mid-market team, it can feel out of reach. This is where Revify closes the gap with a combination of a powerful, accessible analytics platform and essential, hands-on expert guidance.

Our Revenue Growth Management as a Service (RGMaaS) model is designed to enable this superior methodology without the cost and complexity of traditional enterprise software.

- To Price for Profitability, our Customer Base Diagnostics module sheds light onthe traits of your most and least profitable customers. It is achieved by analyzing the entire customer base to illuminate the specific attributes and serving costs of the most—and least—profitable accounts. This creates data-backed profiles to guide new customer pricing with precision.

- To Model Upside Opportunities, our platform provides immediate clarity through Net Price Realization visualizations, and our “What-If” Scenario Analysis tool lets your team model the full EBITDA impact of different discount structures before they are offered, including the possible impacts on volume, leveraging AI/ML price elasticity modeling.

- To Establish a Diagnostic Baseline, our platform automatically tracks the profitability and buying patterns of new customers from their very first order, empowering you to have proactive conversations and giving you a proactive view of customers who may be likely to churn.

Evidence in Action: A Tale of Two Onboardings

Let’s bring this to life with a common scenario: onboarding a new, promising regional account. The difference between a standard, reactive approach and a proactive, RGM-driven one is stark, not just in numbers, but in the health and future of the entire relationship. The table below illustrates the contrast in thinking and outcomes at each critical stage.

| Decision Point / Action | The Status Quo Approach (The Margin Killer) | The Proactive RGM Approach (The Profit Architect) |

|---|---|---|

| Initial Pricing Strategy | Price is copied from a “look-alike” existing customer. | Pricing is architected based on profitability analysis of the entire customer segment. |

| Discounting & Negotiation | A steep, unvetted 10% upfront discount is offered to close the deal quickly. | The full impact of any discount is modeled. A smaller 3% upfront discount is paired with a 4% volume-based rebate. |

| Data & Visibility | Decisions are based on disconnected spreadsheets and sales team “gut feel.” | A centralized analytics platform provides a single source of truth, including “What-If” scenario modeling. |

| Key Outcome (First 90 Days) | The account runs at a 1% net margin. A low price anchor is set, and the relationship is already unprofitable. | The account runs at a healthy, planned 8% net margin. The relationship is built on a foundation of mutual value. |

| Attrition Risk | High. Any future attempt to correct pricing will be seen as a “take-away,” creating friction and heightening the risk of account loss. | Low. The customer relationship is profitable and sustainable from day one, mitigating reasons for early customer defection. |

| Internal Impact | Creates friction and mistrust between the Sales team (focused on revenue) and the Finance team (focused on profit). | Fosters alignment and a shared objective of profitable growth between Sales, Finance, and Operations. |

As the comparison clearly shows, the status quo approach closes a deal but simultaneously creates a long-term liability. The proactive RGM approach architects a profitable asset from day one.

From a Strong Start to a Lasting Partnership

Getting the first 90 days right does more than prevent early churn; it lays the foundation for long-term growth. When a relationship begins with transparency and mutual profitability, trust is established as the default. This foundation transforms future interactions. Quarterly Business Reviews (QBRs) shift from contentious price justifications to strategic discussions about shared goals. Having a clear, data-driven baseline of the relationship’s health allows you to proactively identify opportunities for value-added services or volume growth. In short, a successful onboarding is the catalyst that turns a new customer into a genuine partner, and ultimately, a powerful advocate for your brand.

Overcoming the Hurdles to Implementation

At this point, logical questions arise from CFOs and Sales Leaders about cost and complexity. This is why Revify’s RGMaaS model is fundamentally different.

- On Complexity & Speed: We are not a traditional enterprise software implementation. Our clients are live and seeing their own data illuminated on our platform in one to two weeks.

- On Cost & ROI: Revify is not an IT capital expenditure; it is a direct investment in EBITDA growth, designed for the mid-market reality.

- On Partnership & Adoption: We are firm believers that technology alone is not enough. Our RGM experts become a hands-on extension of your team, helping to interpret the data, diagnose the issues, and architect the action plan.

The Logical Next Step

Early customer attrition is rarely a mystery. It is a direct, predictable consequence of a broken commercial onboarding process that fails to establish a profitable, value-based partnership from the outset. The question for business leaders isn’t whether you can afford to fix your onboarding process, but whether you can afford the continued cost of ignoring it.

Fixing the commercial onboarding process stops profit leakage and the erosion of your customer base at the source. Once this foundation is secure, leaders can then expand their focus to managing the entire customer lifecycle with the same level of analytical rigor.

To explore how these same RGM principles apply to predicting and preventing the loss of long-term customers, we recommend reading our comprehensive guide on The Role of Pricing & RGM In Managing Customer Churn.

But the journey begins here. It starts with a single, clear view of your business. A professionally managed diagnostic can provide that clarity in under two weeks, using your own data to illuminate precisely where profit is leaking and where opportunities lie—with new and existing customers alike.