Picking Up the Thread

You may have already read our recent deep dives about tariff-driven cost shocks, conducted in collaboration with Revology Analytics. First, we dismantled one-size-fits-all price hikes in “Tariff Shockwaves & Margin Erosion,” then mapped four distinct pricing games—Cost, Uniform, Power, and Custom—in “Pricing Strategies to Counter Tariff Impacts.” Those articles established a critical premise: reactive price moves often create more damage than they repair.

Today, we share more best practices. We will outline how mid-market industrial manufacturers and distributors can embed Revenue Growth Management (RGM) into weekly operations without recruiting a battalion of data scientists.

The intent is straightforward: build a repeatable engine so the next duty hike—or freight spike or currency wobble—triggers disciplined analytics rather than panic spreadsheets.

By the time you finish reading, you should have a clear tactical picture of what to tackle during the next two-week sprint and a 90-day roadmap that institutionalises pricing muscle.

Tariff Turbulence: Why the Topic Still Dominates Board Decks

Tariffs were marketed as temporary negotiating levers in 2018. Yet, most of those duties remain embedded in U.S. Customs schedules and metastasize into adjacent Harmonised System codes whenever political rhetoric heats up. Executives who expected a swift rollback now face a durable cost layer that refuses to fade, forcing them to re-engineer price architecture, sourcing, and contractual pass-through clauses. Compounding the pressure, competitors that import nothing use the headlines as cover to reset their list prices, effectively moving the market anchor upward while demanding you re-justify any lagging gaps.

Meanwhile, supply-chain teams shuffle suppliers toward Mexico or Southeast Asia, altering landed costs every six to nine months, which means elasticity curves from last winter are already stale. Customers do not sit idle either; procurement departments accelerate dual-sourcing initiatives, creating new volume volatility that the original tariff models never contemplated. Factor in incremental freight fuel adjustments, energy surcharges, and ESG-driven compliance fees, and you have a perfect recipe for silent pocket-price erosion. Tariffs no longer represent an external nuisance; they are an ongoing stress test of internal pricing governance and analytics readiness.

Here are some examples of macro forces your business is likely experiencing:

| Macro Force | Pressure Channel | Management Implication |

|---|---|---|

| Persistent Tariffs vs. transitory | Direct COGS inflation | Requires permanent and precise cost-tracking mechanism |

| Market-wide price resets | Competitor list price changes | Enforces CPI benchmarking discipline |

| Supplier realignment | Near-shoring cost variations | Mandates quarterly cost rebuilds |

| Customer re-sourcing | Volume volatility | Necessitates dynamic elasticity refresh |

| Innovation spurts | Product substitutes emerge | Demands rapid value-messaging updates |

| Last mile cost-pass through | Freight/energy surcharges | Calls for pocket-price waterfall vigilance |

Mid-Market Blind Spot: Data-Rich, Insight-Poor

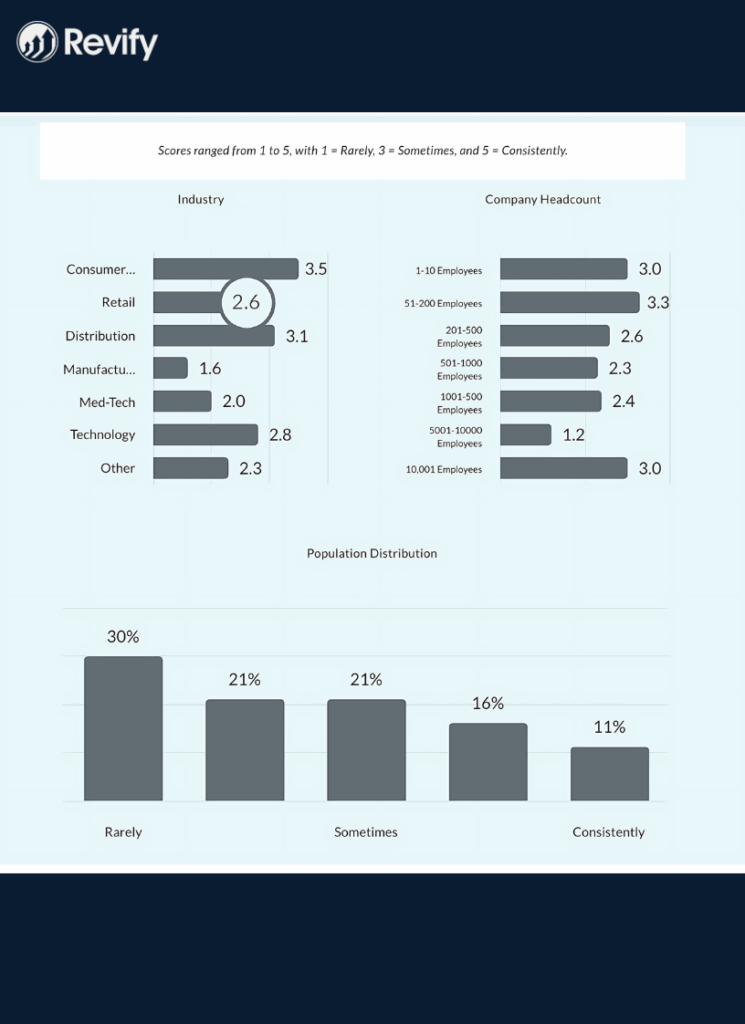

Our Revenue Growth Analytics Maturity Study canvassed one hundred fifty industrial and distribution executives and illuminated a stark statistic: only ten percent rely on predictive analytics for live pricing decisions.

Only 1 out of 10 companies leverage diagnostic and predictive analytics on a consistent basis.

Most participants confessed to weekly spreadsheet gymnastics, episodic consultant engagements, or gut-feel meetings masquerading as strategy sessions.

Large enterprises plaster over data fragmentation with eight-figure data lakes and internal pricing science departments; mid-market operators, by contrast, juggle three ERPs, a legacy CPQ tool, and a CRM that sales stopped updating last Christmas. The finance lead who might champion an advanced optimisation engine usually runs treasury, FP&A, and audit support, leaving little bandwidth for algorithm stewardship. Even if funding surfaced, year-long implementation timelines would collide with quarterly board targets, making the project politically untenable.

The result is a capability gap where leadership knows advanced elasticity models matter but cannot justify the overhead of building and maintaining them.

Revify’s RGM-as-a-Service intervention tackles each friction point head-on—hosted dashboards, automated data ingestion, and embedded advisors—so the first analytical pass arrives within one workweek, not one fiscal year. In short, we provide scientific horsepower at a subscription price aligned with mid-market realities.

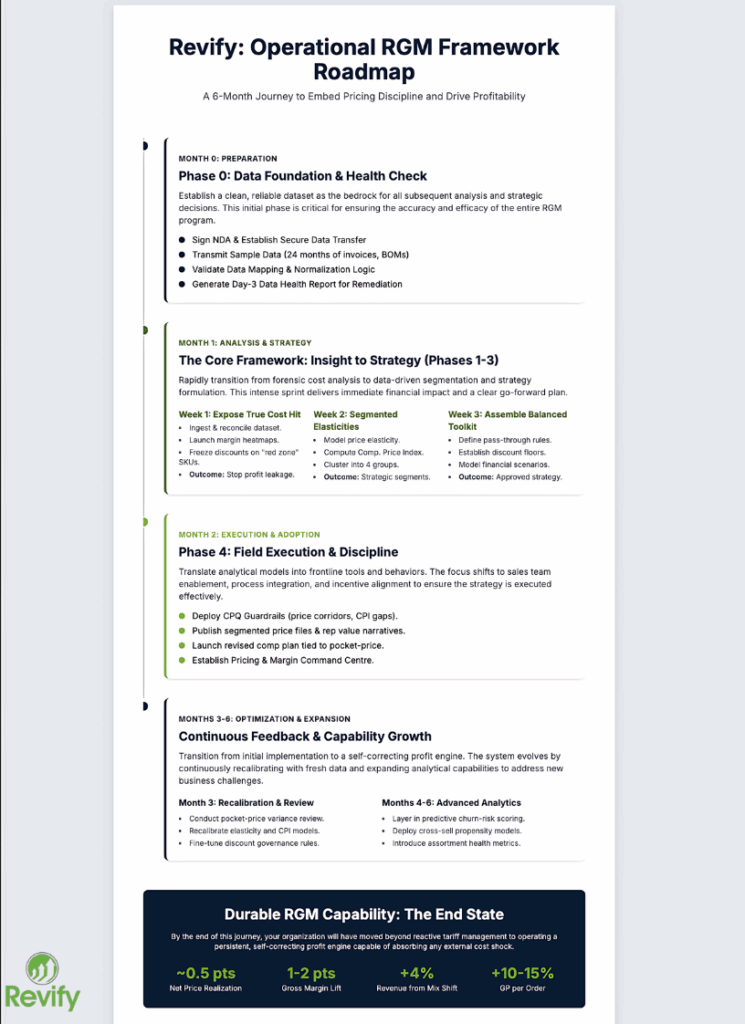

The Revify Four-Phase Framework

Our operational framework retains the skeleton introduced in Shielding Industrial Margins but accelerates tempo and hard-codes feedback loops. Phase 1 interrogates landed-cost changes at SKU resolution, surfacing margin bleeds before they enter P&L flash reports. Phase 2 re-segments customers and products using real elasticity coefficients—not guess-stimates—from which strategic price actions derive. Phase 3 translates analytic insight into a balanced toolkit of pass-through, absorption, discount governance, and assortment calls that align with executive risk appetite. Finally, Phase 4 wires execution guardrails into quoting workflows while feeding real-time price-realisation and discount leakage to leadership, enabling weekly course correction. Together, the phases transform episodic crisis response into a rolling profit-improvement discipline.

Phase 0 – Data Health Check, Cleansing, and Ingestion

Phase 1 — Expose the True Cost Hit (Week 1)

A credible pricing strategy starts with forensic cost clarity, yet many mid-market datasets blend material, duty, freight, and overhead into a single “standard cost” column. During the first five-day sprint, we ingest twenty-four months of invoice lines—SKU, customer, net price, quantity, material cost, and any freight or duty elements coded separately—plus current BOM roll-ups with fresh tariff percentages.

The secure SFTP upload begins Monday morning, automated reconciliation is completed by Tuesday night, and by Friday, leadership is manipulating an interactive heatmap that shades the contribution margin from deep green to blood red. Green zones confirm economic resilience, whereas red zones flag SKUs where margin has collapsed below the cost of capital, and discretionary discounting must halt immediately.

To its shock, one hydraulics distributor I worked with uncovered that twenty-two percent of gross profit derived from castings produced by a single Chinese foundry now paying a twelve-percent duty—information previously hidden inside aggregate “metal parts” spend. Freezing discounts on those SKUs bought the team breathing room worth nearly $700,000 annually while we advanced to segmentation. Visibility drives action.

Phase 2 — From One-Size Hikes to Segmented Elasticities (Week 2)

Uniform price lifts photograph well on PowerPoint but implode at the negotiating table because customers value SKUs—and your competitive gaps—unevenly. Revify’s Product Elasticity engine trains gradient-boosting and random-forest models on two years of transaction lines to estimate own-price and cross-price sensitivity at the customer–SKU grain. Simultaneously, our Price Fine-Tuning module scrapes competitor sheets or syndicated indices to compute a live Competitive Price Index (CPI) for every item.

Overlay customer lifetime value and RFM metrics drawn from Customer Diagnostics; actionable segments materialise quickly. In most industrial portfolios, we uncover four practical clusters:

- Defend & Pass-Through—low-elasticity, value-differentiated SKUs where full duty recovery is feasible.

- Protect Share—commodity lines with punitive elasticity, where partial absorption plus mix guidance avoids volume leakage.

- Upside Mix. Complementary accessories or consumables whose margin accretes when primary items face pressure.

- Trim or Redesign. Long-tail SKUs that devour working capital without earning it back, ripe for engineering changes or exit.

Revify auto-tags each product–customer cell in the quote interface so sales reps immediately recognise which playbook applies. Compare that to the spreadsheet-driven approach, where last-minute “price matrix” emails circulate thirty minutes before month-end. One method builds confidence; the other fuels discount chaos.

A Balanced Toolkit, Not a Hair-Trigger (Week 3)

With segment intelligence in hand, strategy moves from diagnosis to prescription. A single lever rarely suffices; therefore, we assemble a toolkit where each instrument functions under defined conditions. Surgical pass-through embeds calibrated list adjustments into the price book for low-elasticity clusters, ensuring reps quote from an authoritative source rather than personal PDFs. Partial absorption with mix shift preserves headline price points for hyper-elastic items while guided-selling prompts nudge customers toward alternative grades or bundles that recoup margin elsewhere.

Discount governance introduces algorithmic floors, targets, and stretch aspirational prices inside CPQ workflows; sub-floor quotes automatically escalate to a manager with full margin context, curbing silent leakage. Finally, assortment rationalisation identifies SKUs where demand cannot support post-tariff costs and recommends retirement dates, freeing warehouse slots and working capital.

To illustrate the financial impact, we feed these levers into Revify’s Scenario Analysis sandbox. Finance toggles CPI gaps, elasticity sliders, and competitor reactions; revenue, volume, and gross-profit charts refresh instantly—no brittle macros, no version catastrophes. Table 1 below reproduces the fastener distributor case we dissected in April; the segmented strategy drove $8.6 million incremental revenue and $2.6 million additional gross profit compared with the baseline while barely denting volume. Boards rarely request further justification after seeing outcomes that stark.

| Scenario | Revenue Δ | Gross Profit Δ | Volume Δ |

|---|---|---|---|

| Blanket +20 % | +$2.5 M | +$1.8 M | -9 % |

| Blanket +10 % | +$5.6 M | -$0.2 M | +2 % |

| Segmented | +$8.6 M | +$2.6 M | -2 % |

Phase 4 — Execution Discipline and Continuous Feedback (Weeks 4+)

Brilliant models die in the field unless the quote screen reinforces them. We wire CPQ guardrails that surface CPI gaps, elasticity notes, and approved price corridors beside each line item, nudging reps toward the correct tactic before the first customer objection lands. One-page narrative sheets translate coefficient jargon into conversational value language so sales can anchor discussions on total cost of ownership or supply-risk mitigation instead of apologizing for price.

Regularly refreshed dashboards then track list-to-pocket slippage, rogue discounts, and margin variance by rep, creating transparent coaching fodder. Crucially, we propose shifting ten to fifteen percent of variable compensation from pure volume to pocket-price realisation. Few interventions reshape behaviour that rapidly. All metrics roll into a cloud-hosted Pricing & Margin Command Centre, which looks like a Power BI cockpit but requires zero internal development. Leadership can pivot strategy in days because feedback arrives fresh, complete, and visual.

What Durable RGM Capability Delivers

Tariffs may have triggered the project, yet the capabilities you build persist long after customs schedules stabilise. Decision velocity improves because cost and elasticity updates propagate through dashboards without manual intervention, shortening cycle time from quarter to week and adding roughly half a point to net-price realisation. Predictive precision lifts gross margin one to one-to-two points by steering increases toward defensible pockets of value rather than blanketing the market. Guided cross-sell nudges raise revenue by four percent by shifting the mix toward high-spread accessories that customers already trust you to supply. Finally, incentive realignment boosts representative gross profit per order ten to fifteen percent; pay plans structured around pocket price rather than shipped revenue encourage profitable persistence rather than discount attrition.

Six-Month Roadmap at a Glance

- Month 0. Sign NDA, transmit sample data, validate mapping logic.

- Month 1. Full framework live; first segmented price files and guard-rails published.

- Month 2. Rep value narratives and compensation tweaks go into effect.

- Month 3. Pocket-price variance review; elasticity and CPI tables recalibrated.

- Months 4-6. Layer churn-risk scoring, cross-sell propensity models, and ABC-XYZ assortment health metrics.

By the end of H2 you will no longer say “we’re managing tariffs.” Without descending into margin mayhem, you will run a self-correcting profit engine that absorbs any external cost shock—raw material, freight, energy, wage.

Frequently Asked Reality Checks

We’re under $100 million. Is Revify overkill?

No. The platform scales down to five users; you launch with the two dashboards that matter and bolt on modules as complexity grows.

Our data are messy—really messy.

Join the club. Revify automates ninety percent of normalisation and surfaces the ugliest ten percent in a Day-3 Data Health report, complete with recommended fixes.

What if tariffs vanish next year?

Wonderful. The elasticity and CPI scaffolding still maximize every future price action—fuel, labour, ESG fees—so the ROI persists.

Where to Go Next

Uniform cost-plus mark-ups and knee-jerk cost cuts feel safe, yet history shows they invite unintended volume loss, damaged credibility, and sustained profit leakage. Tariffs will keep stress-testing commercial processes; the winners will be the organisations that embed segmentation, elasticity analytics, and closed-loop execution into their daily rhythm.

Download the companion guide below for the regression formulas, scenario templates, and five-step implementation checklist.

Download: Shielding Industrial Margins—Strategic Pricing in the Age of Tariffs

Ready to see these concepts in action? Join our Early-Access waitlist, and we’ll activate a live Revify sandbox—complete with your data—in as little as two weeks while you still qualify for founding-member pricing.

Every registrant also receives our complimentary white-paper, “Overcoming Growth Headwinds,” so you can start turning analytics into profit before the whole platform even lands in your inbox.