Competitive intelligence analytics has become an increasingly important topic for executives, pricing leaders, and commercial teams. Pricing decisions are under more scrutiny than ever: margins are pressured by inflation and supply chain volatility, customers compare offers more easily, and competitors react faster. In this environment, understanding how your pricing compares to the market feels essential.

At the same time, most small to mid-sized companies face very real constraints. Budgets for large IT transformations are limited. Pricing teams are lean. Data is often fragmented across ERP systems, CRM tools, and spreadsheets. Against this backdrop, the idea of implementing a comprehensive competitive intelligence system that delivers complete and precise market pricing can sound both attractive and unrealistic.

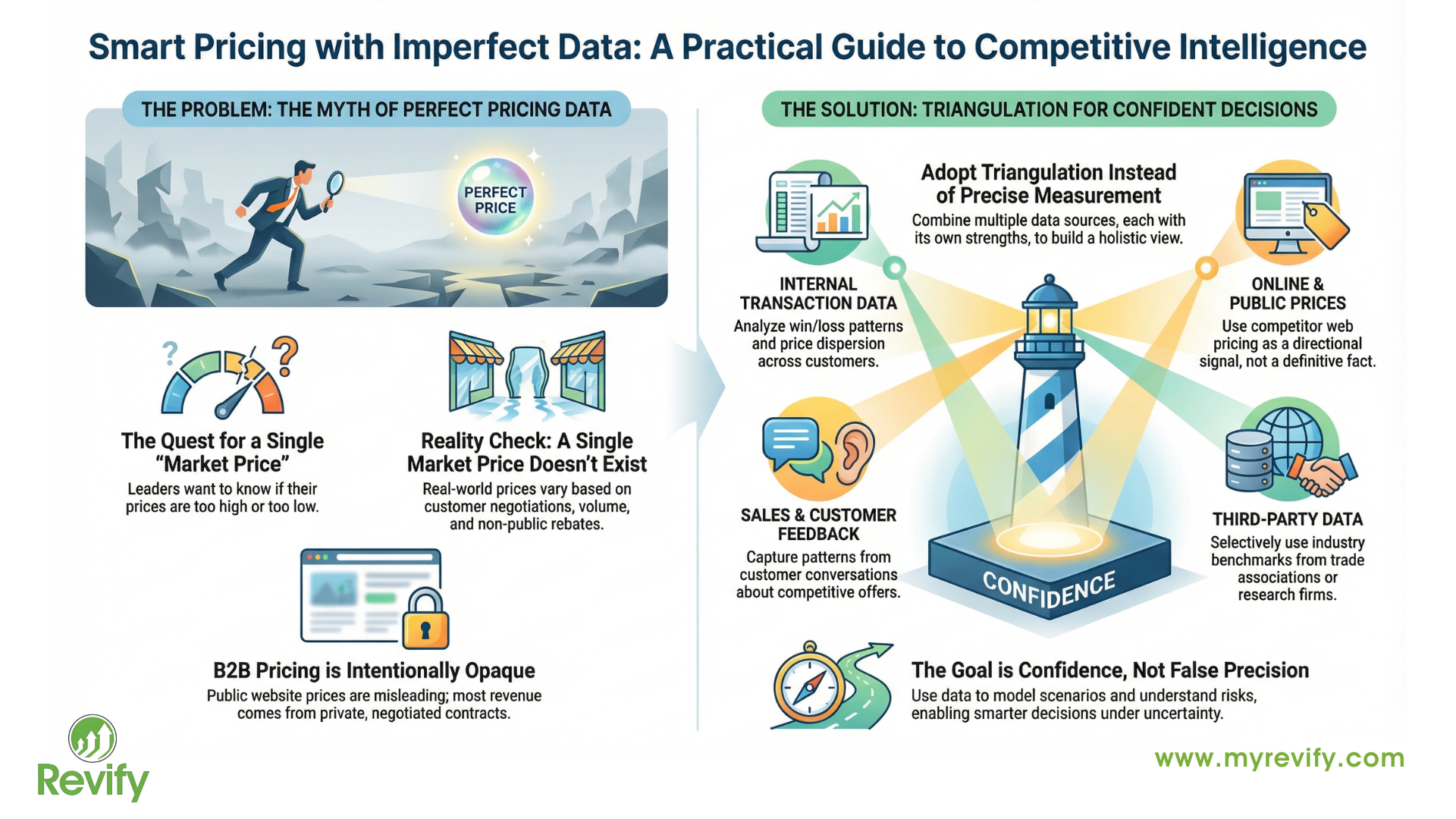

This article takes a pragmatic view. Rather than promising perfect competitive pricing data, it explains how competitive intelligence analytics actually works in practice, why no system can provide a fully complete view of the market, and how companies can still make confident, high-quality pricing decisions using a disciplined, cost-effective approach. Throughout, the focus is on what is realistic and actionable for small and mid-sized organizations—the core audience of Revify Analytics.

UNDERSTANDING WHAT COMPETITIVE INTELLIGENCE CAN AND CANNOT DO

When executives ask for competitive intelligence analytics, they are usually looking for clarity. They want to understand whether their prices are too high, too low, or broadly in line with the market. They want to know where they are losing business on price and where they may be leaving margin on the table.

What competitive intelligence cannot provide is a single, definitive answer to the question, “What is the market price?” Pricing is not a static fact. It is the result of customer-specific negotiations, deal structures, volumes, service levels, and timing. Even within one company, two customers buying the same product can pay very different prices.

Competitive intelligence analytics is therefore less about finding one correct number and more about understanding ranges, patterns, and relative positioning. The goal is not perfect accuracy, but informed decision-making.

This distinction is particularly important for smaller organizations. Investing in a large, complex competitive intelligence system that promises exhaustive coverage often leads to disappointment. The system may be expensive, difficult to maintain, and still fail to answer the questions that matter most.

WHY COMPETITIVE PRICING DATA LOOKS SIMPLER IN CPG

In discussions about competitive pricing, the consumer packaged goods (CPG) industry is often cited as an example where competitive data is relatively accessible. In many CPG categories, products are standardized, prices are visible at retail, and scanner data captures transactions across a wide range of outlets.

This level of visibility can be helpful. It allows companies to track price changes, promotional activity, and relative shelf positioning. For certain pricing decisions—especially those focused on consumer perception—this data provides valuable insight.

However, even in CPG, visible prices tell only part of the story. The total economic value of a transaction includes elements that are not publicly observable, such as trade promotion spend, advertising contributions, slotting fees, and logistics arrangements. Two products may sell at the same shelf price while generating very different margins once these factors are considered.

For pricing and revenue management purposes, this distinction matters. Competitive intelligence analytics that focuses only on visible prices risks overlooking the economics that ultimately drive profitability.

THE REALITY OF COMPETITIVE PRICING IN B2B MARKETS

For manufacturers and distributors operating in B2B markets, competitive pricing visibility is significantly more limited. Publicly available prices—such as those shown on competitor websites—typically apply only to a narrow segment of customers.

These prices are most often relevant for:

– Small, transactional buyers

– Spot purchases

– Customers without negotiated agreements

Larger customers, strategic accounts, and contract buyers almost always operate under negotiated pricing structures that include discounts, rebates, and non-price concessions. These arrangements are not visible externally and often differ substantially from published prices.

As a result, website pricing can be misleading if treated as a representation of the broader market. It provides some context, but it does not capture where most revenue and margin are generated.

This is one of the key reasons why no competitive intelligence system can claim to offer a complete view of market pricing in B2B environments.

STRUCTURAL LIMITATIONS OF ANY COMPETITIVE INTELLIGENCE SYSTEM

The limitations of competitive pricing data are not caused by weak tools or insufficient analytics. They are rooted in how markets operate.

Several factors make full visibility impossible:

– Prices vary by customer, volume, and relationship

– Contracts include rebates and incentives that are applied after the transaction

– Service levels and commercial terms affect the true value of a deal

– Competitors intentionally keep pricing opaque to protect their positions

Understanding these limitations helps set realistic expectations. Competitive intelligence analytics should be used to support better decisions, not to eliminate uncertainty entirely.

FROM MEASUREMENT TO TRIANGULATION

High-performing organizations approach competitive intelligence as a process of triangulation rather than precise measurement. They combine multiple sources of information, each with its own strengths and weaknesses, to build a more complete picture.

This approach is especially relevant for small and mid-sized companies. Rather than investing heavily in a single, expensive system, they focus on making better use of the data they already have and selectively adding external inputs where they add the most value.

KEY SOURCES OF COMPETITIVE INTELLIGENCE ANALYTICS

1. SALES QUOTES AND CUSTOMER FEEDBACK

Sales teams are often the first to encounter competitive pricing information. Customers reference alternative offers, provide feedback on price competitiveness, and explain why they chose one supplier over another.

While individual data points can be unreliable, patterns emerge when this information is captured consistently and reviewed in aggregate. Over time, companies can identify:

– Typical competitive price ranges

– Segments where price pressure is highest

– Products where pricing is less critical to winning business

For smaller organizations, this source of intelligence is particularly valuable because it requires limited additional investment—only discipline and structure.

2. ONLINE AND PUBLIC PRICING SIGNALS

Where competitors publish prices openly, web-based pricing signals can provide useful context. These prices help establish reference points and track relative movements over time.

The key is to treat this information as directional rather than definitive. Online prices are rarely representative of negotiated deals, but they can still inform pricing discussions when used appropriately.

3. THIRD-PARTY AND INDUSTRY DATA

In some industries, trade associations or research firms provide aggregated pricing benchmarks. These can be useful when methodologies are transparent and coverage is understood.

For small and mid-sized companies, selective use of such data—rather than broad, expensive subscriptions—often delivers the best return.

4. INTERNAL TRANSACTION DATA

Internal data is often the richest and most underutilized source of competitive insight. Transaction history reveals:

– Price dispersion across customers

– Volume response to price changes

– Win and loss patterns

– Differences between list and realized prices

Analyzing this data helps infer where competitors are likely aggressive and where pricing power exists, even without direct observation of competitor prices.

FROM INSIGHT TO DECISION-MAKING

Competitive intelligence analytics only creates value when it supports decisions. Executives and pricing leaders are rarely interested in exhaustive benchmarking. They want to understand where to act and what the impact is likely to be.

Typical questions include:

– Where can we increase prices with limited risk?

– Which customers or segments require defensive pricing?

– Are discounts aligned with actual price sensitivity?

– What is the expected trade-off between volume and margin?

Answering these questions requires combining competitive signals with internal performance data and commercial judgment.

THE ROLE OF SCENARIO THINKING

Rather than asking for a single “correct” price, many organizations are shifting toward scenario-based thinking. This involves evaluating how different pricing actions might play out under realistic assumptions.

Scenario analysis helps decision-makers:

– Compare alternatives

– Understand risks and trade-offs

– Align pricing actions with financial objectives

A competitive analytics system that supports this type of analysis is often more valuable than one that focuses narrowly on external benchmarks.

HOW REVIFY ANALYTICS SUPPORTS PRACTICAL COMPETITIVE INTELLIGENCE

Revify Analytics was designed with these realities in mind. It recognizes that small and mid-sized companies need tools that are powerful but practical—tools that work with existing data and limited resources.

Rather than positioning itself as a system that knows every competitor price, Revify Analytics helps organizations:

– Visualize price dispersion and customer behavior

– Identify patterns in elasticity and sensitivity

– Analyze win and loss outcomes

– Model pricing scenarios quickly

– Prioritize actions where confidence is highest

By focusing on triangulation and decision support, Revify functions as a competitive analytics system that enhances judgment rather than replacing it.

COMPETITIVE INTELLIGENCE AS A CAPABILITY

Successful competitive intelligence is not about installing a single tool. It is about building a repeatable capability that combines data, analytics, and commercial insight.

For smaller organizations, this means:

– Keeping processes simple

– Leveraging existing data sources

– Avoiding large, rigid IT investments

– Focusing on decisions with the highest impact

Technology should support this capability, not complicate it.

CONFIDENCE OVER FALSE PRECISION

In pricing, the goal is not to eliminate uncertainty but to manage it effectively. Decision-makers benefit more from understanding ranges, sensitivities, and likely outcomes than from relying on overly precise but incomplete benchmarks.

Competitive intelligence analytics, when done well, increases confidence by clarifying where data is strong, where it is weak, and what actions are reasonable given that uncertainty.

FINAL THOUGHTS

Competitive intelligence analytics plays a critical role in modern pricing and revenue management. However, it works best when expectations are grounded in reality.

No competitive intelligence system can provide full visibility into every transaction in the market. What companies can do—especially small and mid-sized ones—is adopt a disciplined, pragmatic approach that combines multiple signals and focuses on decision-making.

With the right mindset and tools, imperfect data can still lead to strong outcomes. Platforms like Revify Analytics help organizations turn fragmented information into practical insight, supporting smarter pricing decisions without requiring massive investments in systems or headcount.

To learn more about how Revify Analytics supports practical competitive intelligence and pricing decision-making, visit myrevify.com.